We're excited to announce that the British Business Bank has accredited Capital on Tap as an official lender of the Government’s Coronavirus Business Interruption Loan Scheme (CBILS). This will allow us to provide SMEs with funds, crucial to surviving through the COVID-19 crisis.

What is the Coronavirus Business Interruption Loan Scheme?

The Coronavirus Business Interruption Loan Scheme (CBILS) managed by the government-owned British Business Bank, provides financial support to UK small businesses that are losing revenue and cash flow as a result of the global pandemic.

Lending under CBILS is partially guaranteed by the government, which allows small business lenders, like Capital on Tap, to lend to businesses that might not have previously been eligible for a loan, due to the effect COVID-19 has had on their business.

In addition to the guarantee to the lender, the government will also pay any interest or fees charged in the first year, so small businesses can benefit from no upfront costs and lower initial repayments. The scheme is currently delivered through British Business Bank accredited lenders & partners.

What does borrowing under CBILS through Capital on Tap look like?

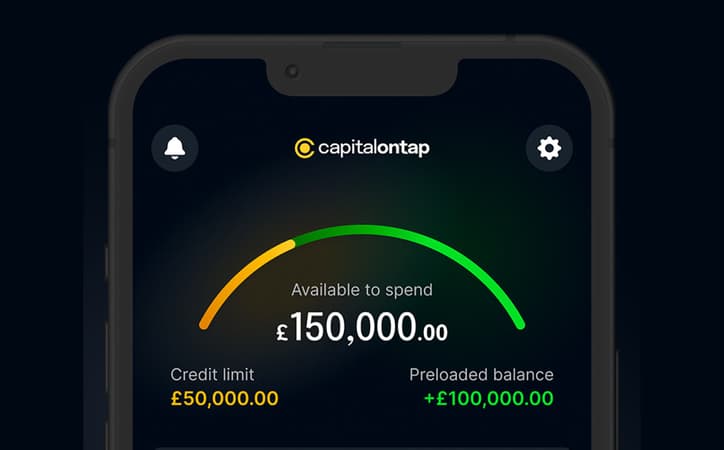

Capital on Tap is accredited by the British Business Bank to lend from £50,001 up to £100,000 through our revolving credit facility. The APRs will range from 9.9% to 14.9% and any interest charged in the first 12 months will be paid for by the government as a 'Business Interruption Payment'. Please remember that your business still remains responsible for repaying 100% of the debt.

Applying for CBILS is simple - you will have to fill in our short application form answering pertinent questions about your business. Just like in our day-to-day operations, your application will be processed quickly which means you will hear about your approval and have access to funds in 1 business day if approved. Applications are now closed.

*The Coronavirus Business Interruption Loan Scheme (CBILS) is managed by the British Business Bank on behalf of, and with the financial backing of the Secretary of State for Business, Energy and Industrial Strategy (BEIS). British Business Bank plc is wholly owned by HM Government and is not authorised or regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA). Full details on CBILS and the list of participating CBILS lenders can be found on the British Business Bank website at: www.british-business-bank.co.uk/CBILS