Trusted by over 200,000 businesses

The credit card built for small businesses

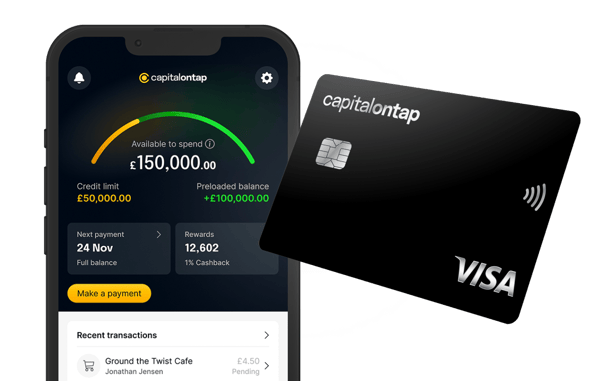

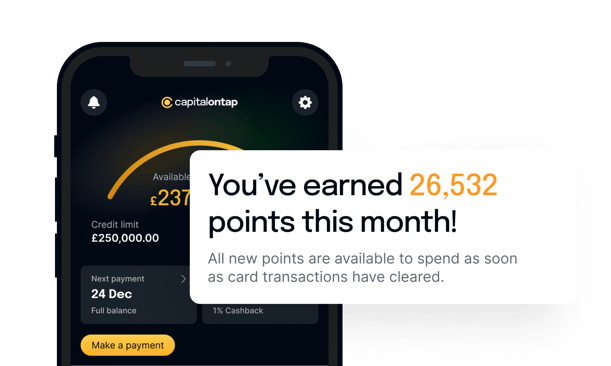

Get uncapped 1% cashback on all card spending. Redeem for cash, gift cards, or against your balance. Apply and get a decision in 2 minutes.

- Go further with credit limits up to £250,000

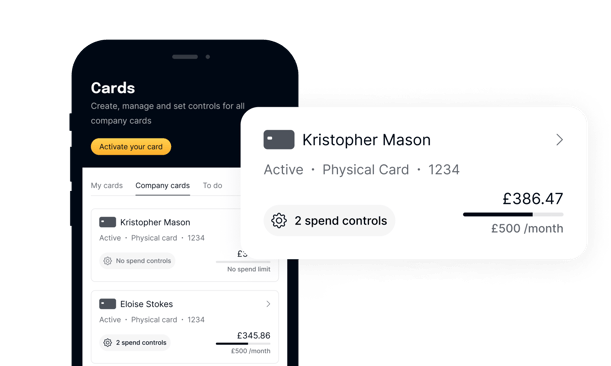

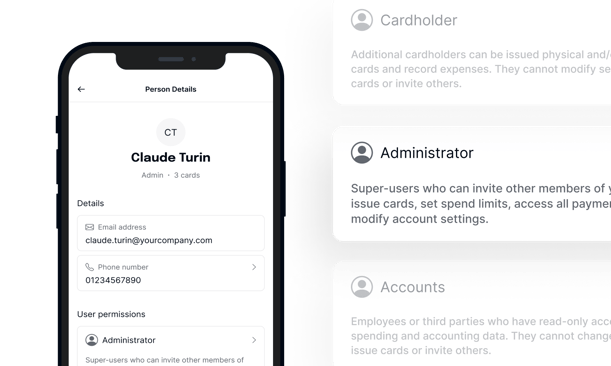

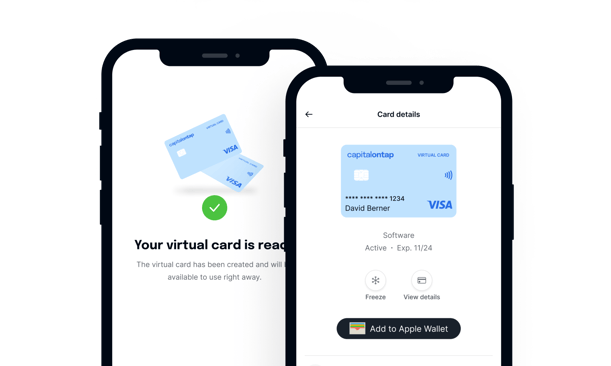

- Free company cards with spend controls

- No annual, FX or ATM fees