Trusted by over 200,000 businesses

The credit card built for small businesses

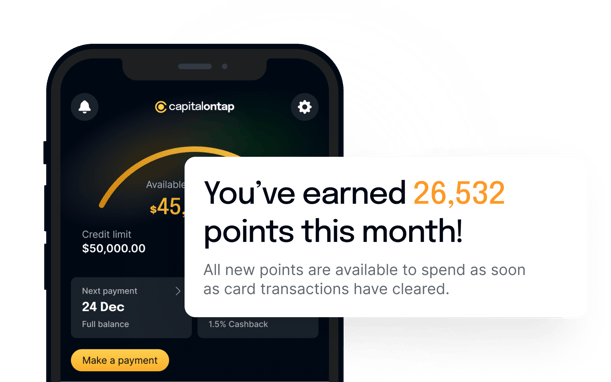

Earn 1.5% cash back on all card purchases. Boost your cash back to 2% by switching to weekly AutoPay. Apply in under 2 minutes.

- Go further with credit limits up to $50,000 (based on creditworthiness)

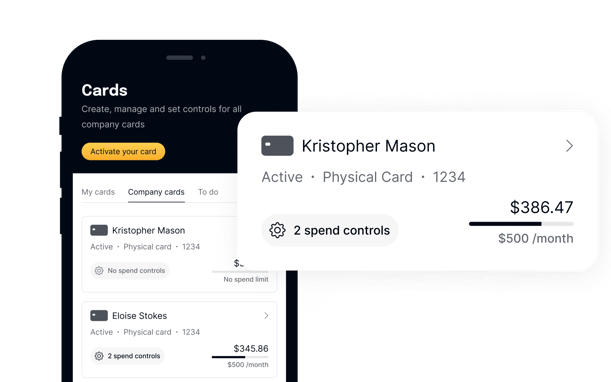

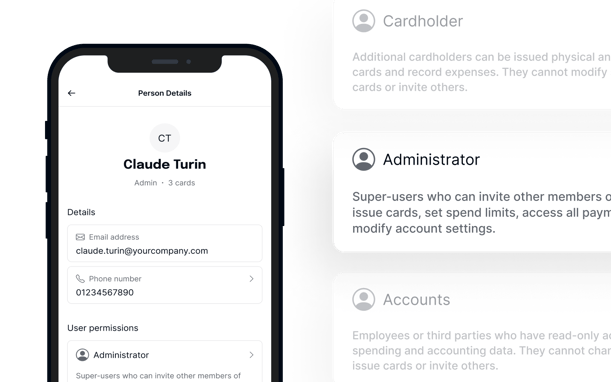

- Free company cards with spend controls

- No annual or FX fees