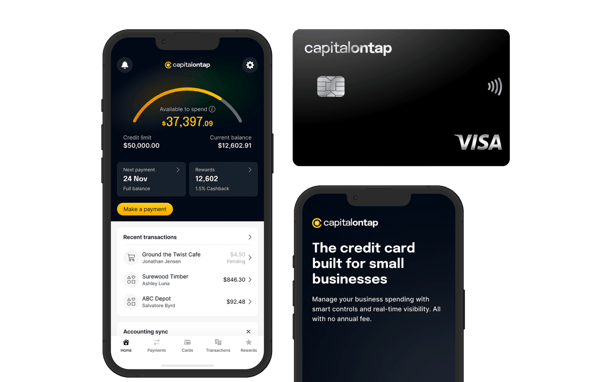

Credit limits up to $50,000

(Based on creditworthiness of applicant)

Gain financial flexibility and supercharge your small business with the Capital on Tap Business Credit Card, issued by WebBank. Unlock accessible capital, higher credit limits, and rewards tailored to you.

A business credit card is a financial tool for businesses. It lets you make purchases on credit, track expenses, and build a separate credit history. This helps with cash flow, separates personal and business expenses, and often gives rewards or benefits for your business.

A company credit card allows authorized people to buy things for the business without waiting for reimbursement. Cardholders, including employees or other authorized users make purchases, but the company pays the bill. It streamlines purchasing, simplifies expense tracking, and ensures smoother cash flow for your business.

A business credit card makes managing your business money easier. It keeps your personal and business expenses separate, helps with cash flow, and builds a good credit history for your business. It also simplifies tracking spending, managing employee expenses, and offers special rewards and benefits.

With higher credit limits, you can make larger purchases and investments, giving you the edge you need to take your business to the next level.

A single, centralized account for employee purchases makes it easy to track spending and removes the need for awkward expense forms and refunds.

Separating your personal and business expenses will help you stay organized and stress-free when it’s time to tackle bookkeeping and taxes.

A business credit card helps bridge cash flow gaps until payments come in. Plus, pay your balance in full by your due date each month, and there’s no interest to pay.

Enjoy a wide range of exclusive perks, from cash back rewards to expense management tools and fraud protection.

A business credit card can establish and improve your score, paving the way for easier financing and greater opportunities for business growth.

Make sure you've got all your personal and business info on hand when you apply.

To complete your application, please have these items ready:

Over 200,000 small business customers have spent more than $25 billion on their Capital on Tap Business Credit Cards, issued by WebBank in the US.

Our customer stories prove why we are the best choice for your business credit card needs.

Business credit cards should only be used to pay for business expenses. This includes things like travel costs, office supplies or paying invoices. By using a business credit card for these everyday expenses, you're not only simplifying your bookkeeping but also potentially earning benefits that can further boost your business's financial health.

Business credit cards offer rewards such as cash back or points on purchases. These can be used to offset expenses or reinvest in your business.

For example, with the Capital on Tap Business Credit Card, issued by WebBank, you earn 1.5% cash back on every purchase and can boost it to 2% cash back by switching to weekly AutoPay. You can use these points to pay off your balance or even purchase gift cards to incentivize employees.

Our goal at Capital on Tap is to empower small business owners by making it easier for them to run their business. A credit card can do just that by helping them optimize their cash flow, simplify their purchasing process, and give them more control over their business payments.

Compare card fees and interest rates to find the most cost-effective option for your business.

Evaluate rewards programs to maximize benefits for your business spending.

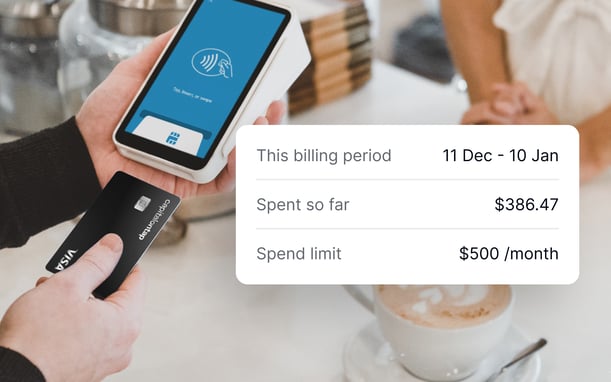

Consider spending limits to ensure they align with your business's purchasing needs.

Look for features that allow you to track expenses and manage finances effectively.

A company credit card may incur costs such as monthly or yearly fees, late payment fees, charges for cash withdrawals, foreign transaction fees, and interest charges on unpaid balances. These fees vary by card issuer and plan.

The Capital on Tap Business Credit Card has no annual or account maintenance fees.

Yes, you can use your personal credit card for business expenses, but it's usually better to use a business credit card. Personal credit cards won't help your business build a good credit history, and they often have lower spending limits. Business credit cards come with special benefits and rewards for business owners. They can also offer features like connecting to accounting software, tracking employee spending, and virtual cards.

Read our customer storiesIt can be used most anywhere! I keep everything on autopay because you can have so many bills and if you forget one, that’s the thing that will drop your credit.

The application process for a business credit card differs by provider. You'll need to provide personal and business details such as your business's legal name, monthly turnover, and address.

A business credit card works the same way as your personal credit card but instead of being issued to you for your everyday household needs, it is issued to your company for business related expenditures only. A business credit card helps finance short-term needs, boosting your company’s purchasing power. Business credit cards can also be issued to your staff in charge of business expenses, with spending restrictions and thorough transaction histories.

It can take anywhere from a few minutes to a few weeks to get a business credit card.

Once approved and account set up is complete, the Capital on Tap Business Credit Card physical card should arrive in just 4 business days and virtual cards are available for convenient spending.

A personal guaranty is a legally enforceable agreement that holds you personally accountable for paying off your business credit card debt. By giving a personal guaranty, you agree to take on personal liability for the debt if the company is unable to make payments. As business credit cards are a type of unsecured finance, most providers will require this

type of agreement.

Yes, many business credit cards, including Capital on Tap, require a personal guaranty.

Small business credit cards typically offer lower interest rates, higher credit limits, and more flexible terms compared to corporate cards. When it comes to rewards, small business credit card holders earn them personally, while corporate card rewards are earned by the business. With a small business credit card, the primary cardholder is responsible for any debt and fees incurred, while with a corporate card, the company is responsible for all expenses. Additionally, corporate cards require the balance to be paid in full each month, while small business credit cards allow carrying a balance.

In most cases to qualify for a business credit card, you must own a business. To apply for a Capital on Tap Business Credit Card, you will need to provide your Tax Identification Number (also known as your Employee Identification Number, or EIN), as well as some personal and business details including your business's legal name, your monthly revenue, and your business address.

A personal guaranty is required for most business credit cards, so defaulting on a business credit card could make you personally liable for the debt and could negatively impact your personal credit score.

In most cases, yes, you need an Employer Identification Number, also known as a Tax ID Number, to qualify for a small business credit card.

Business credit scores range from 0 to 100, while personal credit scores range from 300 to 850. Most business lenders consider a business credit score at or above 75 as “good”.

A poor business credit score may still qualify for a business credit card with a personal guaranty, if you have good personal credit.

The cost of a business credit card can vary greatly, ranging from zero to several hundred dollars. While annual fees are one aspect to consider, there are other potential costs to keep in mind, such as foreign exchange fees, ATM fees, and interest rates.

The Capital on Tap Business Credit Card offers attractive benefits with no annual fees, foreign exchange fees, or US ATM fees, and low variable APRs (APRs range 17.49% - 57.49%) make it an affordable option for businesses.

Yes, business credit cards are a great way to build credit, and there are a few key ways that they do this. One is by reporting the card activity to business credit bureaus. This helps build a credit history and establishes the business’ credit risk. Additionally, using the business credit card responsibly can help improve the company's overall credit score. Finally, paying off the balance in full each month demonstrates financial responsibility and can help boost the business's creditworthiness.

The APR (annual percentage rate) on a business credit card can vary depending on the card issuer and your creditworthiness. Generally, business credit cards tend to have higher APRs than personal credit cards. It's important to read the terms and conditions carefully before applying for a business credit card.

Yes. Add unlimited employee cards to your Capital on Tap Business Credit Card account, and set individual spending limits on each card from the Cards page on your portal.

Business credit cards typically provide some level of protection for purchases that are faulty, broken, or not received.

However, it's important to note that not all business cards offer such protections since they are not personal credit cards. While some business credit cards may provide safeguards against fraud, unauthorized use, and other potential issues, the availability of these protections ultimately is at the discretion of the credit card issuer and can vary considerably.

Before taking out a business credit card, you should read through the card agreement and any other legal documents provided. This will help you understand the level of protection provided by the card and any potential liability you may have in case you experience issues with your purchases.

Many business credit cards protect you against any losses due to fraud, stolen or misuse of credit cards.

Yes, the majority of business credit cards can be used abroad.

Use your Capital on Tap Business Credit Card almost anywhere in the world. We don’t charge foreign exchange fees on any purchases made outside the US.

Yes, with your Capital on Tap Business Credit Cards for employees, you maintain full visibility and spending control. You control how much each employee spends per billing period, or per single transaction.

Yes, any size business can have a business credit card to make purchases, manage expenses, and pay bills. Small business owners can apply for a business credit card and enjoy benefits such as cashback rewards, exclusive discounts, and expense tracking features.

Sole proprietors do not qualify for a Capital on Tap Business Credit Card.

Page last reviewed on 19 June 2024