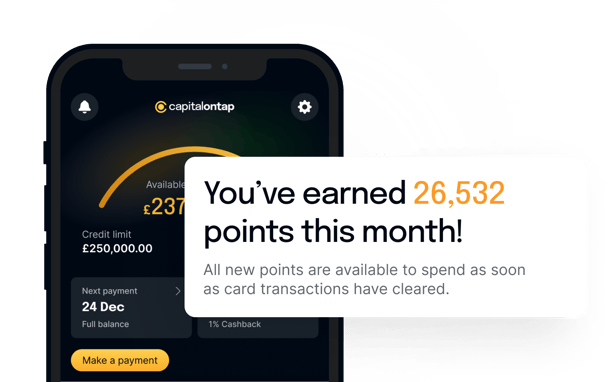

Exclusive offers for your small business

Built for small businesses, packed with benefits

Handpicked business credit card benefits for small business owners—from integrated accounting to unlimited employee cards.

- No annual, FX, or ATM fees

- 24/7 UK-based customer service

- Up to 42 days interest-free on card spend