1% cashback on all card spend

Business employee cards

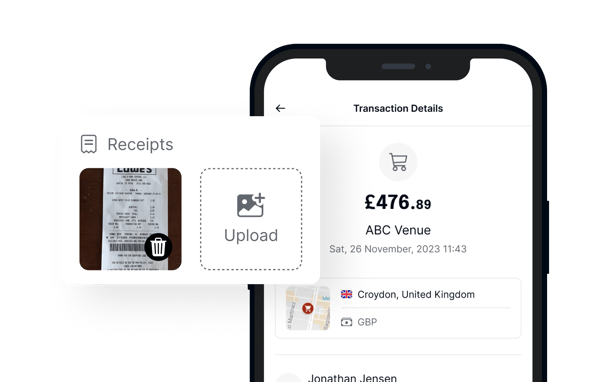

Employee credit cards give your employees the freedom to pay for business expenses while keeping you in control of their spending.

- Unlimited free company cards

- See spending updates in real time

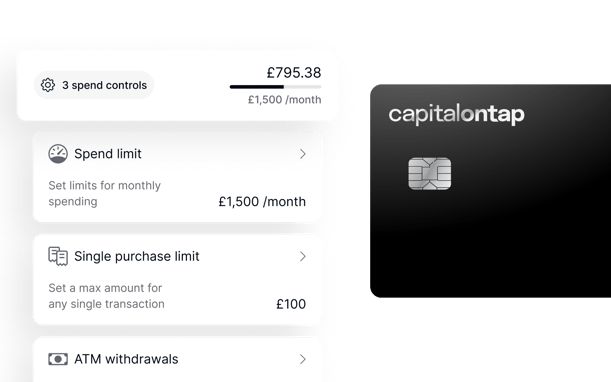

- Set custom limits for each card