Jump to a section

For small business owners, staying on top of tax changes can feel like a full-time job. With HMRC's ambitious Transformation Roadmap, it's more important than ever to understand what's coming.

The goal of the roadmap is to create a more modern, efficient, and digital-first tax system by 2030. For you, this means adapting to some big changes, but it's designed to make managing your tax affairs simpler in the long run.

In this guide, we'll walk you through the key changes outlined in the HMRC Transformation Roadmap and what they mean for your business, so you can stay ahead of the curve.

Key takeaways for your business

Here are the most important things you need to know about the HMRC Transformation Roadmap:

-

The biggest change is the move towards a digital-first tax system by 2030, with more online services and a new app.

-

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) will be rolled out in phases, starting with those who have a qualifying income over £50,000 from April 2026.

-

You'll need to use compatible software for digital record-keeping and quarterly updates, replacing the single annual tax return.

-

HMRC is focusing on a better online experience with features like pre-populated tax forms and automated alerts to help you avoid mistakes.

What is the HMRC Transformation Roadmap?

The HMRC Transformation Roadmap is a plan to modernise the entire UK tax and customs system. It's a long-term vision with three main priorities:

-

Improving day-to-day performance and the overall customer experience.

-

Closing the tax gap (the difference between the tax that should be paid and what is actually collected).

-

Reforming and modernising tax and customs administration.

For small businesses, the biggest takeaway is the move towards a digital-first approach. HMRC's goal is to have at least 90% of all customer interactions happen digitally by 2030. This means more online services, an improved app, and a greater use of technology like AI to help you get things right the first time.

How will this affect your business?

The changes are designed to simplify things, but they do require you to adapt. Here’s a summary of the most important things for small business owners to be aware of:

Making Tax Digital for Income Tax Self Assessment (MTD for ITSA)

This is a major part of the roadmap, and it will change how sole traders and landlords with self-employed or property income report their earnings. Instead of a single annual tax return, you'll need to use compatible software to keep digital records and send quarterly updates to HMRC.

Here's the current timeline for when you might need to start:

-

From April 2026: MTD for ITSA will be mandatory for those with a qualifying income of over £50,000.

-

From April 2027: This will extend to those with a qualifying income of over £30,000.

-

From April 2028: HMRC plans to extend this to those with a qualifying income of over £20,000.

This is a significant shift, but it also means you'll have a clearer, more regular view of your tax liabilities, which can help with your financial planning.

What to expect from a better online experience

HMRC is investing heavily in its digital platforms. This includes improvements to the HMRC app and online tax accounts. Some of the new features you can expect include:

-

More personalised services: New systems will give HMRC a more real-time view of your tax affairs, allowing for better, more targeted support.

-

Simplified processes: Things like registering and de-registering for Self Assessment will become easier.

-

Automated nudges: HMRC will use AI to provide automated alerts and reminders to help you pay what you owe on time and reduce errors.

-

Pre-populated data: Your tax returns will automatically be populated with some data, like Child Benefit information, to save you time.

Tighter focus on compliance

HMRC's roadmap includes a strong focus on closing the tax gap. This means they will be using more data and advanced technology to identify potential compliance risks and prevent errors before they happen. They are also investing in more compliance officers to tackle serious cases of tax evasion.

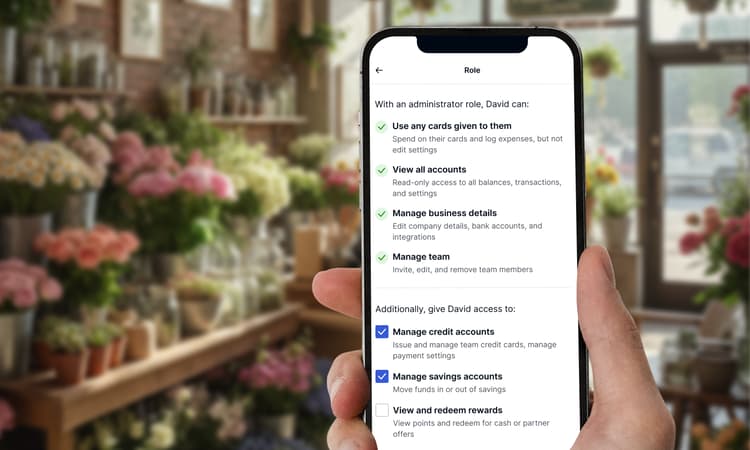

For most small businesses, this is a good thing! It means a fairer system for everyone. It also highlights the importance of keeping accurate digital records, which is a key part of the new MTD for ITSA rules. Having clear records of your business expenses is crucial, and a tool like the Capital on Tap Business Credit Card can help streamline this process by consolidating all your spending in one place with a clear statement every month.

How to prepare your business now

The shift to digital doesn't have to be daunting. Here are three steps you can take today to get ready:

-

Assess your MTD timeline: Review your annual income to determine which deadline applies to you.

-

Explore compatible software: Research accounting software that is MTD-compatible and fits your business needs.

-

Digitise your record-keeping: Don't wait for the deadline. Start keeping digital records of all income and expenses now to make the transition smoother.

The bottom line

The HMRC Transformation Roadmap is a big change, but it's one that can ultimately help small businesses become more efficient. By moving towards a digital-first system, HMRC aims to make tax administration simpler, more accurate, and less time-consuming.

Staying informed about the MTD for ITSA deadlines and preparing to use digital record-keeping software is the best way to get ready. The goal is to move from a yearly rush to a smoother, more continuous process, giving you more time back to focus on what you do best: running your business!

This does not constitute financial or tax advice. If you want to understand these changes in detail, contact your financial advisor or accountant.