Jump to a section

The government has launched a new plan called "Backing your business" with one main goal: to make the UK the best place to start and grow a business. This strategy focuses on boosting the growth and productivity of small and medium-sized enterprises (SMEs) across the country, aiming to create an environment where these businesses can thrive.

This initiative is a comprehensive strategy that touches on many different areas of running a business, from cash flow to training. So, what does this plan include, and how could these new measures help you and your business? Let's take a closer look at the five key areas the plan covers.

New rules to fix late payments and cut red tape

A key focus of this initiative is improving the everyday environment for businesses. The government is directly addressing the ongoing issue of late payments, with new legislation on the way that will give the UK the strongest legal framework on late payments in the G7. The goal is to put a stop to late payments, which are estimated to cost the UK economy billions each year.

The government also aims to make things simpler and more affordable for businesses, with the following key initiatives:

-

Cutting the administrative costs of regulation by 25%, saving you time and money.

-

Modernising the tax and customs system with new technology.

-

Accelerating planning for infrastructure projects.

-

Helping businesses with the transition to net zero, providing advice and training to help you reduce energy costs.

Unlocking more finance and support for growth

Access to finance is a critical hurdle for many small businesses, and this plan includes several measures to help. The Start-up Loans program is being expanded to offer funding and mentoring to 69,000 new businesses. The government is also committing to the British Business Bank’s Growth Guarantee Scheme for the long term, which is designed to help smaller businesses invest and grow.

To support your business’s financial needs, the plan includes a number of key actions:

-

A new £340 million fund to boost the availability of early-stage equity finance for innovative businesses.

-

Working with private lenders on the use of Personal Guarantees to ensure they are fair and transparent.

-

Expanding the capacity of the ENABLE programme to unlock more finance options for small businesses.

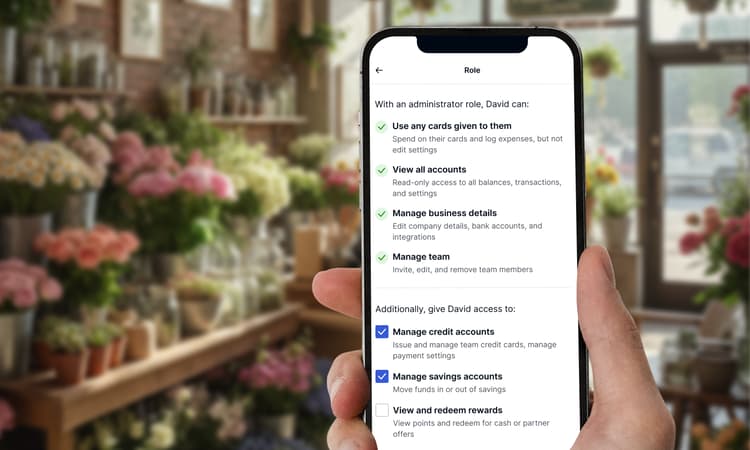

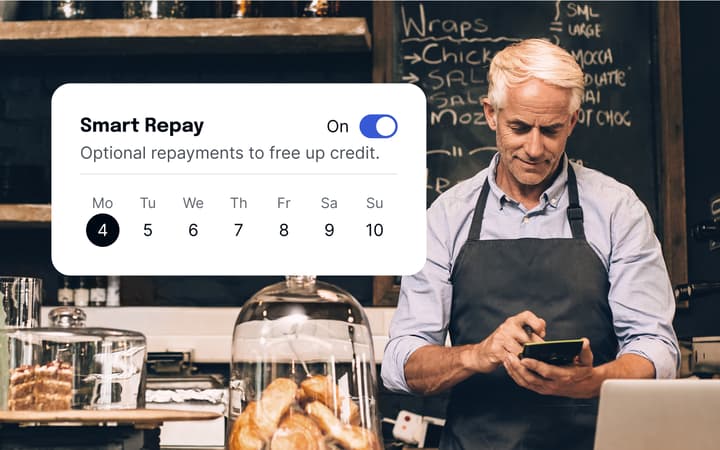

While these government schemes provide a great foundation for long-term support, managing day-to-day spending and cash flow is equally important.The Capital on Tap Business Credit Card can complement your business's financial strategy. Our unlimited 1% cashback means you’re earning rewards on every pound you spend, giving your business a valuable boost while you focus on growth.

Helping high street businesses thrive

The government's strategy for the everyday economy is all about supporting local high streets. New measures include creating a pro-growth national approach to licensing to support al fresco dining and late-night venues. The plan also commits to permanently lower business rates multipliers for high street retail, hospitality, and leisure properties with a rateable value below £500,000, starting in April 2026.

To make running a business on the high street fairer, the government plans to take the following steps:

-

Banning Upward Only Rent Review clauses in commercial leases.

-

Championing High Street Rental Auctions to bring empty properties back into use.

-

Creating safer places to do business by putting more police on the streets to tackle issues like shoplifting and tool theft.

Future-proofing your business with new skills and tech

Another core element of the plan is recognising the importance of skills and technology for future business success. The government is backing a number of initiatives to help businesses adopt new tech and improve their skills, including:

-

Launching new pilots and expanding the Made Smarter Adoption programme to help businesses with digital adoption.

-

Providing leadership training and a new industry-led Business Mentoring Council for business leaders.

-

Supporting the next generation of entrepreneurs by promoting enterprise education and launching a new "Youth Entrepreneur" category of the King’s Awards for Enterprise.

-

Investing £1.2 billion per year in the skills and apprenticeships system to ensure the needs of smaller firms are met.

Opening up new opportunities at home and abroad

Finally, the government's plan focuses on making it easier for small businesses to find support, export, and win government contracts. New services are being created and existing ones are being expanded to open up more opportunities:

-

A new Business Growth Service to act as a central hub for advice.

-

Expanding UK Export Finance’s capacity to help more small firms win business overseas.

-

Making it easier for small businesses to win government contracts by making them a national priority in the new procurement system.

-

Helping firms innovate by providing guidance on leveraging intellectual property.

The bottom line

The UK government's "Backing your business" plan outlines a series of measures designed to support small and medium-sized enterprises. From new rules on late payments and a commitment to lower business rates to expanded funding schemes, the strategy is a broad attempt to foster a more supportive environment. By understanding these key policies, you can explore potential opportunities and resources that could help your business grow and succeed.

Ready to take control of your business finances? The Capital on Tap Business Credit Card offers unlimited 1% cashback, helping you manage spending and put money back into your business. Learn more and get started today.