Zero monthly fees

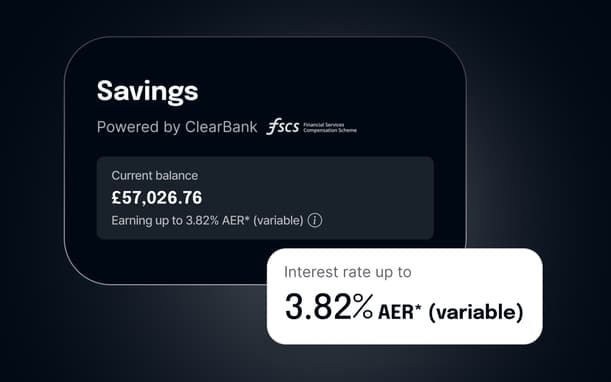

Up to 3.82% AER* (variable) Instant Savings account

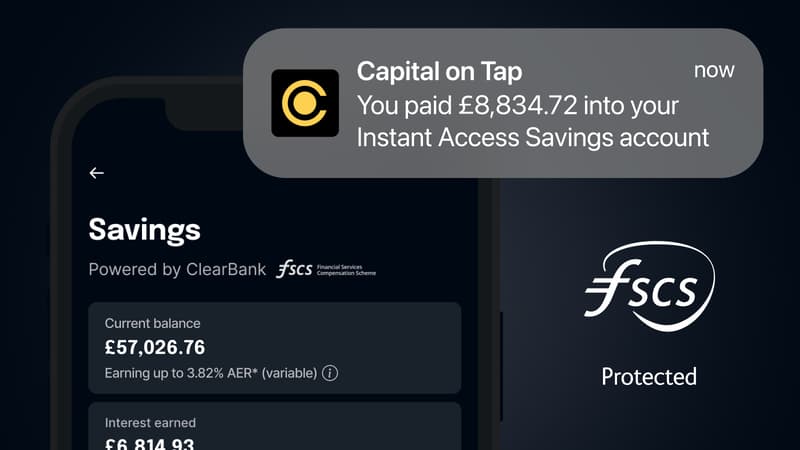

Boost your financial stability and supercharge your business growth with the Capital on Tap Instant Savings account, powered by ClearBank.

- Earn up to 3.82% AER* (variable) for new customers**

- Instant access to your funds with no withdrawal penalties

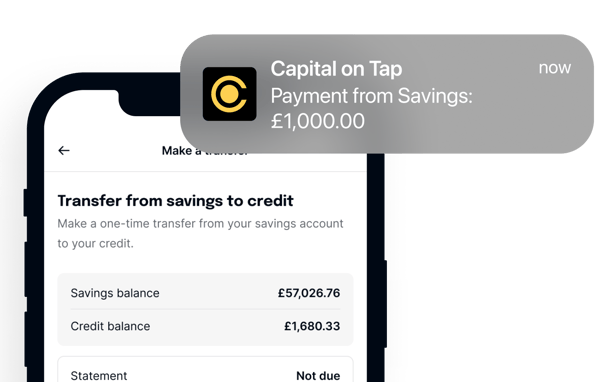

- Pay your credit balance from your savings

- FSCS protection up to £120,000 on eligible deposits