Offer

As a Capital on Tap customer, you will automatically receive 10% cashback, up to a maximum of £10, when you subscribe to or spend with The Telegraph.

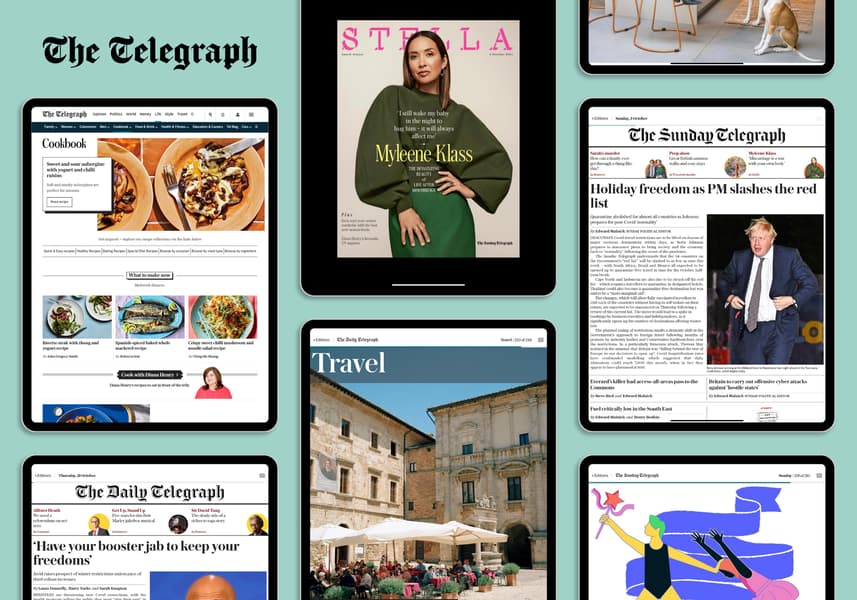

The Telegraph provides the definitive take on today's biggest talking points, offering live news updates, free-thinking opinions, and in-depth analysis from some of the world's most trusted journalists. You'll also gain access to expert guides and useful tools to help you make informed decisions—whether it's managing your money, planning your next holiday, or simply navigating daily life.

Steps to redeem

Simply use your Capital on Tap Business Credit Card when making your subscription purchase directly with The Telegraph, and your cashback will be credited to your account automatically.

Additional Supporting Information

-

These Offer Terms (including the Offer description above) set out the key terms of our Telegraph Offer. Please make sure you read these together with our General Offer Terms, which contain important additional terms, including information about when statement credits or points can be reversed or lost.

-

Statement credits will be awarded for eligible transactions using your Card during the Offer period, as explained above and within these Offer Terms and General Terms. A statement credit or points credit should appear on your Card Account statement within 30 days from the date you made an eligible transaction, but in some instances could take longer.

-

You can report missing cashback or statement credits by contacting us via email, phone or chat. Capital on Tap will then take the appropriate steps to resolve your request within a reasonable timeframe.

-

You must be opted into receiving Rewards and Promotions notifications by email in order to participate in any offer and be awarded any statement credits or rewards points (as applicable).

-

By spending at The Telegraph on your card, you agree to all our Offer Terms.

-

The Telegraph terms and conditions apply.

-

Book and pay by the Offer end date.

-

Offer only applies to spend made in Great British Pound (GBP) using a Capital on Tap card.

-

Spend must be billed to your card account by 30/9/2025, to be eligible for this Offer. If The Telegraph does not charge your card during this period, you may not be eligible for this Offer.

-

The maximum benefit you may receive under this Offer, whether awarded as cashback or points, is capped at an amount equivalent to £10 in total value. This cap applies per eligible card account for the duration of the Offer period.

-

You are automatically enrolled in this Offer and may spend on any physical or virtual card on your account.

-

Some payments made through certain “payment facilitators” will not be eligible and will not count towards your spend for the purposes of the Offer. A payment facilitator is an intermediary that accepts payments on behalf of the seller of the goods/services. Payment facilitators can include some online payment platforms/marketplaces, and entities that provide certain card acceptance products (such as mobile card readers) to sellers of goods/services.

-

If the merchant offers an alternative way to make a payment, such as through a third-party payment facilitator which is not eligible under this Offer, this spend will not be eligible for statement credits and will be excluded from the Offer.

-

Transactions that are subsequently cancelled or refunded will not count towards your spend for the purposes of the Offer.

-

By making a qualifying purchase, you acknowledge that to enable you to redeem the Offer, Capital on Tap may share certain transaction data and account identifiers with the merchant to reconcile and assess the Offer. For more information about how we share your information with the merchant, please review our Privacy Policy.

-

We will use your personal information such as name, email address, account details and transaction information to manage your participation in the Offer and to track your spend. Please see our Privacy Policy for details of how we use your personal information.