2012

Capital on Tap is founded in London by CEO David Luck with the mission of providing small businesses with access to funding.

2013

As a provider of fixed-term loans for small businesses, we proudly lent to our first customer!

2014

We launched a bespoke underwriting system, allowing for quick applications and funding approvals.

2015

No more weekly repayments! We switched to monthly repayment cycles to make it easier for customers to access funds.

2016

We were absolutely thrilled to release the first version of the Capital on Tap business credit card!

2017

No fees? You got it! We removed all fees across our product portfolio and increased our credit limits to £50,000.

2018

We’ve lent £500 million to our customers! We also launched rewards, giving our customers the ability to earn points and cashback.

2019

The first version of our app was developed and we hit a huge milestone of having lent £1 billion to small businesses.

2020

We set up integrations with a wide range of accounting software providers and enabled Apple Pay to all customers.

2021

We set our sights across the pond and launched the Capital on Tap Business Credit Card in the US in partnership with WebBank!

2022

We celebrated our 10th birthday with a new look and hit over £4 billion worth of funding to more than 200,000 customers.

2023

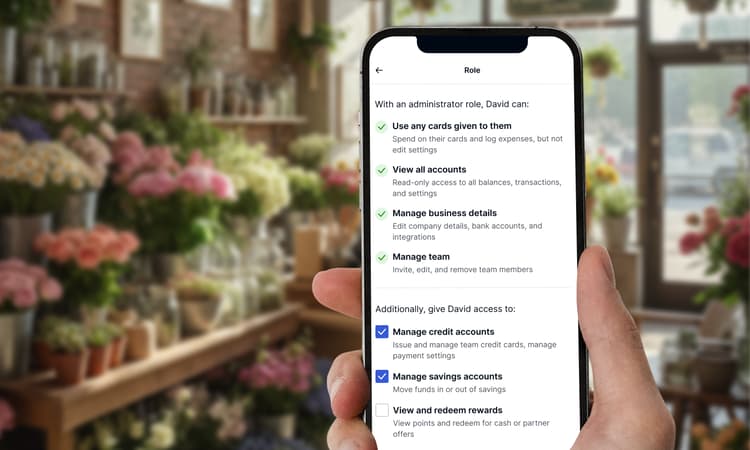

We introduced our Team Management feature and launched our groundbreaking inaugural public securitisation facility, London Cards No.1.

2024

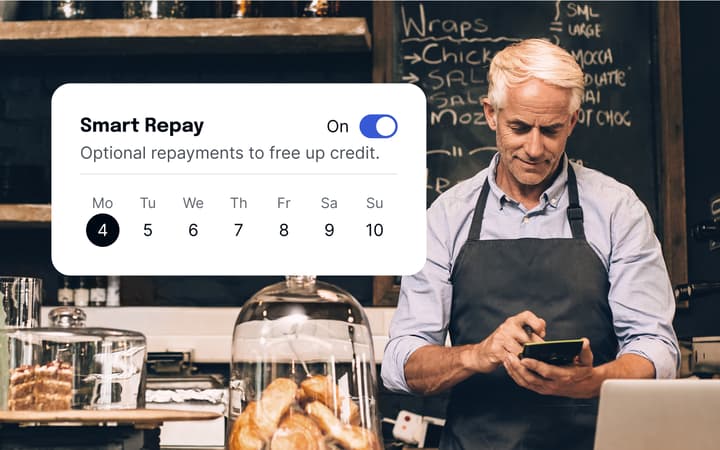

Our founder Dave became Executive Chairman, whilst Damian took the mantle as CEO! Plus, we hit £10 billion worth of funding to customers and launched Preloading.

2025

We launched our business savings account, powered by ClearBank, and hit over £20 billion worth of funding to customers!