Jump to a section

We have reached a fantastic milestone. We have lent 1 billion pounds directly to small businesses in the UK.

Just a few weeks ago, Capital on Tap hit the incredible milestone of funding over £1,000,000,000 in loans to more than 65,000 UK SMEs. We started Capital on Tap in 2012, with a mission of making it faster and easier for SMEs to obtain working capital. Looking back, I would never have imagined just how many ups and downs there were on the path leading us to where we are today, and I thought that now would be a good opportunity to reflect and share some of the major learnings that got us here.

I still remember the names of the first 20 customers we signed up. In the early days of Capital on Tap, we worked out of a tiny nook of an office in Notting Hill. We were that small SME trying to help other SMEs. There were many difficult lessons learned as we scaled to be one of the biggest non-bank lenders in the country. There were many things we did right, but there were also many things we could have improved upon and, if I could, here is what I would tell my earlier self:

-

Talk to customers more: We underinvested in talking to customers. We really focused on servicing customers, which I hope we’ve done well, but that isn’t the same as talking to them. We didn’t focus on getting out there and talking to our customers face to face. Only when face to face can you really understand the issues your customers are struggling with and how you can help them. We should have been closer to them from Day 1 – it would have saved us a lot of time.

-

Get out early and iterate: We rarely got it right on the first try. It took years of product evolution to figure out how to best serve the SME community. That evolution is ongoing and continues to this day. Don’t expect or strive to get it right on Day 1, better to get something out there and iterate.

-

Go big: We should have swung for the fences more often. Too often we tried something that was 10% or 20% different and got mixed results. All of our biggest wins have been made by making big, ambitious bets (even though some failed!).

While there are many things I wish we had done better, I have never been more optimistic for the future of Capital on Tap. In speaking with a recent customer, I was so happy to hear just how much our product was helping them run their business, and how easy it was to use. These types of conversations with satisfied customers continue to fill me with pride and give me confidence that we are headed on the right path.

Finally, I want to thank our staff, our partners and most importantly, our customers, who have been with us on our journey here. We will continue to execute on our mission of building simple tools for real world businesses to achieve great things.

Do you have feedback on what we can be doing better? We check our feedback inbox on a daily basis at feedback@capitalontap.com.

Check out our journey

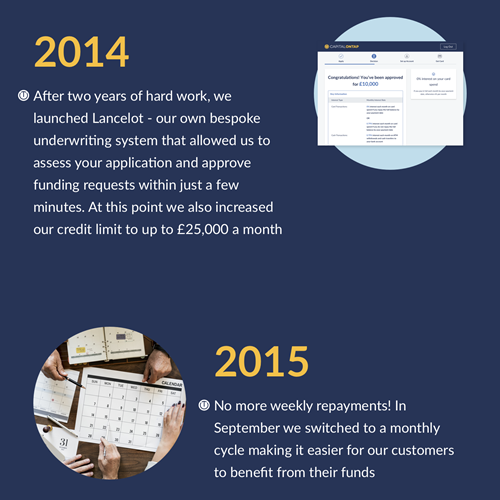

A look back at the last 7 years: