Jump to a section

At Capital on Tap, we know that staying ahead of government policy is key to making running a business easier. Chancellor Rachel Reeves delivered the Autumn Budget 2025, outlining several major changes that will affect your costs, your employees, and your future investment plans.

While the current economic backdrop presents both challenges and opportunities, knowing how to prepare for these changes gives your business a powerful advantage. This guide breaks down the most important announcements so you can plan effectively and keep moving forward with confidence.

Key takeaways

-

National Living Wage rises from April 2026

-

Freeze on Income Tax and National Insurance thresholds extended to 2031

-

Fuel duty cut remains, but set to reverse by end of 2026

-

New Business Rates relief for Retail, Hospitality and Leisure (RHL) from April 2026

-

Apprenticeships for under-25s funded for SMEs

-

Tax rises on dividends, property income and pension contributions

-

New charges for electric vehicles from 2028

For business who employ staff

These changes directly impact your payroll costs, talent acquisition, and employee benefits.

National Living Wage boost

Your business must prepare for a significant rise in mandatory pay rates from April 2026.

|

Age Group |

Hourly Rate from April 2026 |

Rate before April 2026 |

Increase |

|

Aged 21 and over |

£12.71 |

£12.21 |

4.1% |

|

Aged 18–20 |

£10.85 |

£10.00 |

8.5% |

|

Aged 16–17 and Apprentices |

£8.00 |

£7.55 |

5.9% |

A higher living wage means your overall wage bill will grow. As costs rise, it might be worth reviewing your pricing or budgets, especially in tight-margin sectors.

Income Tax and National Insurance thresholds frozen

The freeze on personal tax thresholds will now last until April 2031.

-

As wages rise, more employees (or you, if you’re self-employed) may be pushed into higher tax brackets.

-

This phenomenon—known as fiscal drag—means real take-home pay could remain flat even if gross pay increases.

-

Employers may face pressure to boost gross salaries to help staff maintain take-home pay, raising overall payroll costs.

Cap on pension salary sacrifice

From April 2029, only the first £2,000 of pension contributions made via salary sacrifice will be exempt from National Insurance contributions.

That means any contributions above £2,000 will attract National Insurance contributions for both employer and employee, making pension-based benefits more expensive and potentially less appealing for staff.

For businesses with a physical location

These measures affect the cost of running your premises, whether you own or rent, and property income.

Business rates reform and support

The Autumn Budget introduces permanent changes for high-street businesses.

-

From April 2026, Retail, Hospitality and Leisure (RHL) businesses will benefit from permanently lower business rates multipliers.

-

To help during the 2026 revaluation, a £4.3 billion support package will be available for businesses most affected.

-

This relief is partly funded by a higher tax rate on properties with rateable values of £500,000 or more.

If you operate an RHL business, this is a significant opportunity to reduce overheads, but be ready to act once the new rates kick in.

Property income tax rises

For landlords or businesses earning rental income, tax rates on rental and property income will increase by two percentage points across all bands from April 2027.

That could reduce net yield from property investments—something to reflect in your cash flow planning.

For businesses using vehicles and fuel

Whether you run a fleet, deliver goods, or travel often, these changes affect your operating costs.

Fuel duty freeze extended (temporarily)

Good news for now:

-

The 5p cut on Fuel Duty remains, and the inflation-linked rise is cancelled — until September 2026.

-

But from September to December 2026, the 5p cut will be reversed in stages.

-

Inflation-linked increases resume from April 2027.

Translation: Expect fuel costs to rise again by late 2026. Plan ahead if fuel consumption is a big part of your budget.

Electric vehicle (EV) tax introduced

From April 2028, a mileage-based charge replaces declining fuel duty income:

-

Fully electric cars will be charged 3p per mile.

-

Plug-in hybrids will be charged 1.5p per mile.

For delivery services, taxi firms or businesses running EV fleets, this new charge will impact running costs. It’s a good time to run some cost-benefit calculations comparing EV vs petrol/diesel vehicles under the new rules.

For businesses trading and manufacturing

These policies affect imports, waste management costs, and environmental compliance, especially for importers and businesses that use packaging.

Customs duty on low-value imports

By March 2029 at the latest, the existing exemption threshold (currently £135 or less) for duty on packages imported into the UK will be removed.

That means all imported packages may become subject to customs duty and extra administrative requirements.

If you rely on small value import, e.g. parts, components or low-cost goods, your costs may rise. You’ll need to build in extra margin or pass cost on to customers.

Landfill tax and Plastic Packaging Tax (PPT) increase with inflation

Landfill tax rates will continue to rise with inflation.

PPT rates for 2026/27 will increase in line with the Consumer Price Index (CPI).

If your manufacturing or retail operations use significant packaging or generate waste, expect higher disposal and packaging costs. It could be a good time to review packaging strategies or consider more sustainable options where possible.

Investment and other key announcements

A handful of additional measures could shape your long-term business strategy, especially if you draw on dividends, invest in machinery or plan to hire young talent.

Dividend income tax rises

From April 2026, tax rates on dividend income will increase by two percentage points.

If you take profits from your business via dividends, this change will reduce net income, something to factor into future cash flow or personal planning.

Corporation tax and capital allowances

The main rate of Corporation Tax remains at 25%.

On the other hand, the Writing Down Allowance for plant and machinery drops from 18% to 14% from April 2026.

This reduces the pace at which you can deduct machinery or equipment costs — affecting your capital investment return. If you plan to buy equipment, consider the timing carefully.

Funding for under 25s training

One bright spot: SMEs hiring under-25s will benefit from fully funded apprenticeships.

This removes a major cost barrier to hiring and training younger workers — and gives you more flexibility to invest in talent without heavy upfront costs.

The 'Milkshake Tax' extended

The existing sugar tax (Sugar Levy) is being expanded to cover more products.

-

The tax is being extended to include mass-produced and imported milkshakes and lattes.

-

The threshold for the tax is being reduced from 5g to 4.5g of sugar per 100ml.

If your business sells drinks or overlaps with the hospitality sector, this might affect pricing, product formulation, or supplier contracts.

The bottom line

The Autumn Budget 2025 presents a mixed financial picture for UK small businesses.

On one hand, the rising National Living Wage and the pressure from the extended tax threshold freeze mean higher costs for many employers. For business owners, higher tax rates on dividends and property income—along with reduced write-offs for machinery—mean you may need a stronger return to stay financially steady.

On the other hand, targeted reliefs deliver meaningful support where it matters: permanently lower Business Rates for RHL sectors, fully funded apprenticeships for under-25s, and a temporary fuel duty cut.

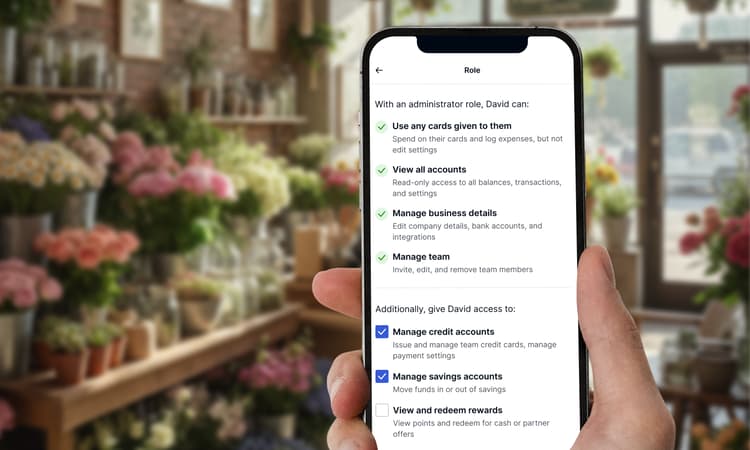

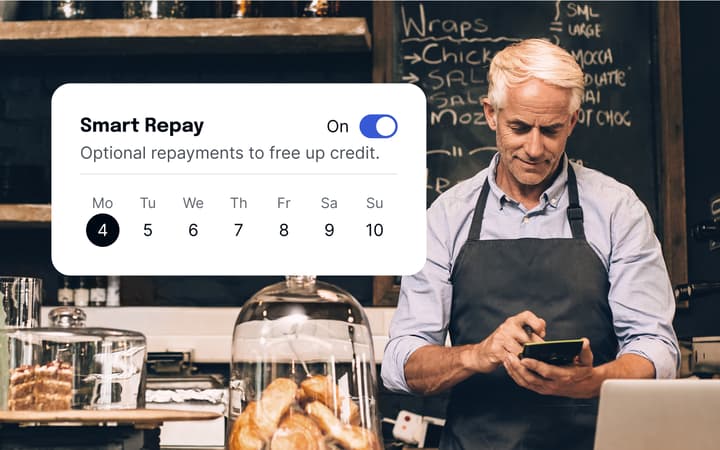

By understanding these changes now, you can adjust your budgets, rethink hiring or investment plans, and make informed choices to help your business stay confident and resilient. Tools like a business credit card can provide flexibility for day-to-day payments and help manage operational costs as you adapt to these changes.

This does not constitute financial or tax advice. If you want to understand these changes in detail, contact your financial advisor or accountant.