Jump to a section

Although digital wallets have actually existed for over 20 years now, it’s only within the last decade that they have rapidly evolved, revolutionising the way we pay for goods and services.

Digital wallets, also known as e-wallets, refer to mobile apps that store credit or debit card details in one location and allow users to make cashless purchases in-store and online using their phone or a wearable device. They can also be used to store identification documents or digital rewards, tickets, boarding passes and room keys, completely eliminating the need to carry around bulky wallets. Using biometric recognition and data encryption, digital wallets are not only convenient but also give users a greater sense of control and security.

Capital on Tap is the latest UK fintech company to offer its business credit card customers full integration with the most popular digital wallet apps - Google Pay and Apple Pay. With the recent launch, our team has also taken a look at the trends within the digital payment market and the recent evolution of mobile payment apps.

Cash set to be the least common payment method worldwide by 2022

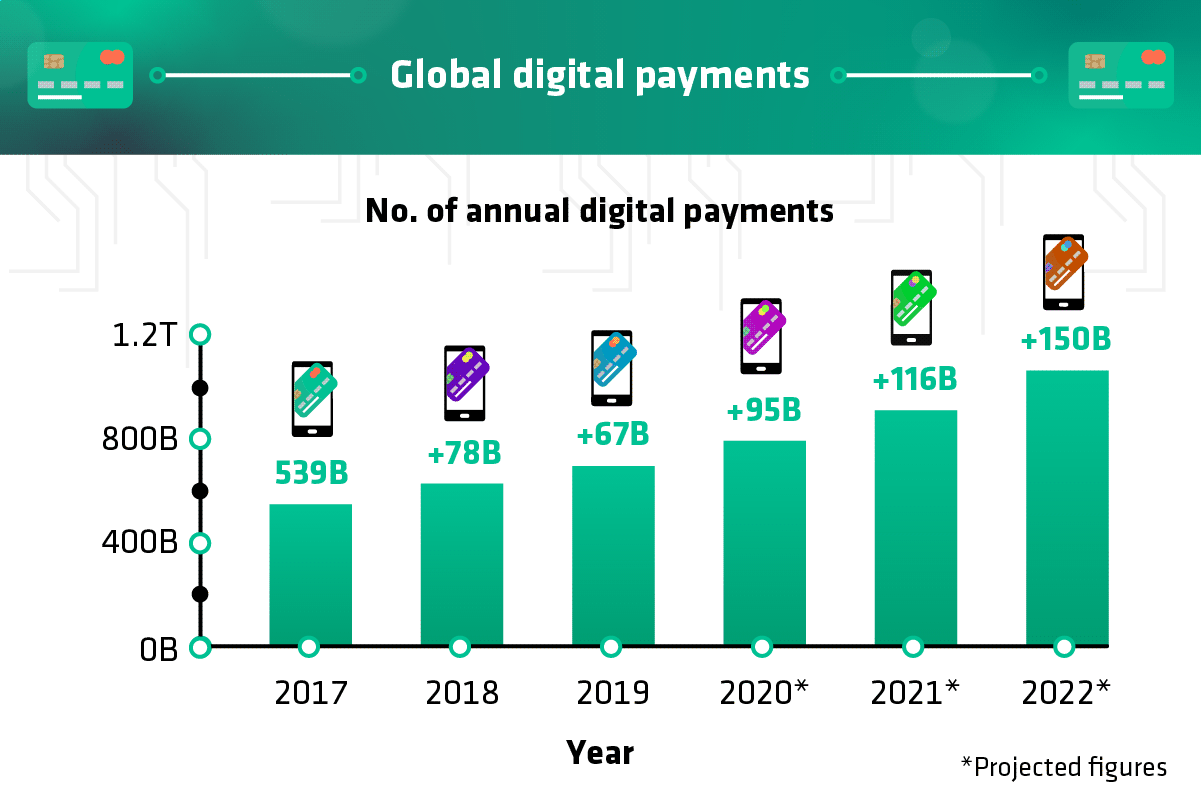

The digital payment market, which includes all consumer transactions made over the internet and on mobile devices, has been on the rise for over a decade. In 2020, there have been over 779 billion digital transactions worldwide and this number is expected to grow at a 13% rate in the coming years.

The above graph shows the number of digital and mobile payments made around the world. Source: https://www.statista.com/statistics/265767/number-of-cashless-transactions-worldwide-by-region/

The growing adoption of digital wallets, ongoing digitalisation of services, increasing demand for smartphones and developments of new technologies like 5G or payment services like Alipay, Google Pay and Apple Pay are some of the key factors behind the rapid increase in digital payments. The global COVID-19 pandemic will undoubtedly accelerate this process even further with people trying to avoid cash transactions and using contactless payments to minimise physical interactions.

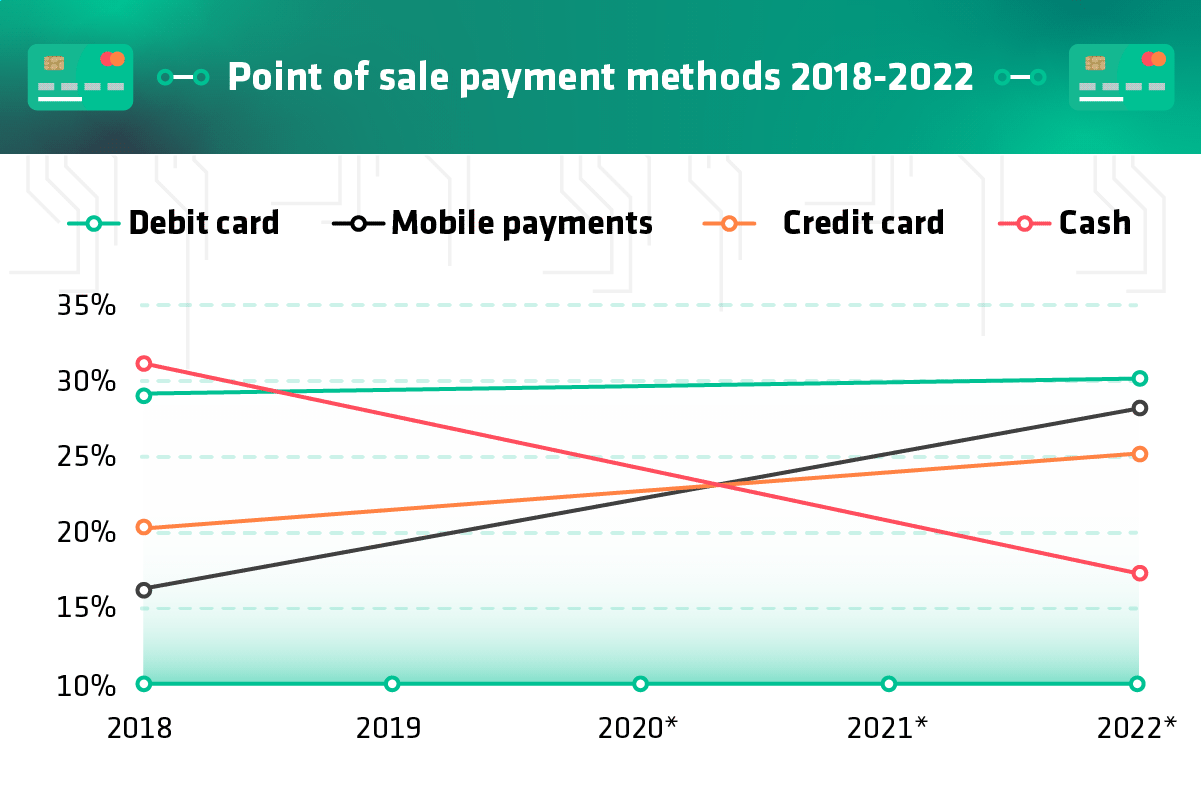

According to the 2019 Mobile Payments Market – Growth, Trends, and Forecast (2020-2025) report by Mordor Intelligence, the most popular payment method in 2020 - debit cards, will retain its’ position for years to come but cash, now the second most common payment method will be overtaken by digital wallets making it the least popular by 2022. The decreasing need for cash suggests that the cashless economy may be coming sooner than we think.

The above chart shows the global share of point of sale payment methods from 2018-2022. Source: https://worldpaymentsreport.com/wp-content/uploads/sites/5/2018/10/World-Payments-Report-2018.pdf

A quarter of Europe’s digital payments originate from the UK

The rise in digital payments has also been very pronounced in the UK. According to data published by BuyShares, the UK is the largest digital payment market in Europe, accounting for 25% of the region’s total digital transaction value (just over 164 billion USD) followed closely by Germany, France and Italy.

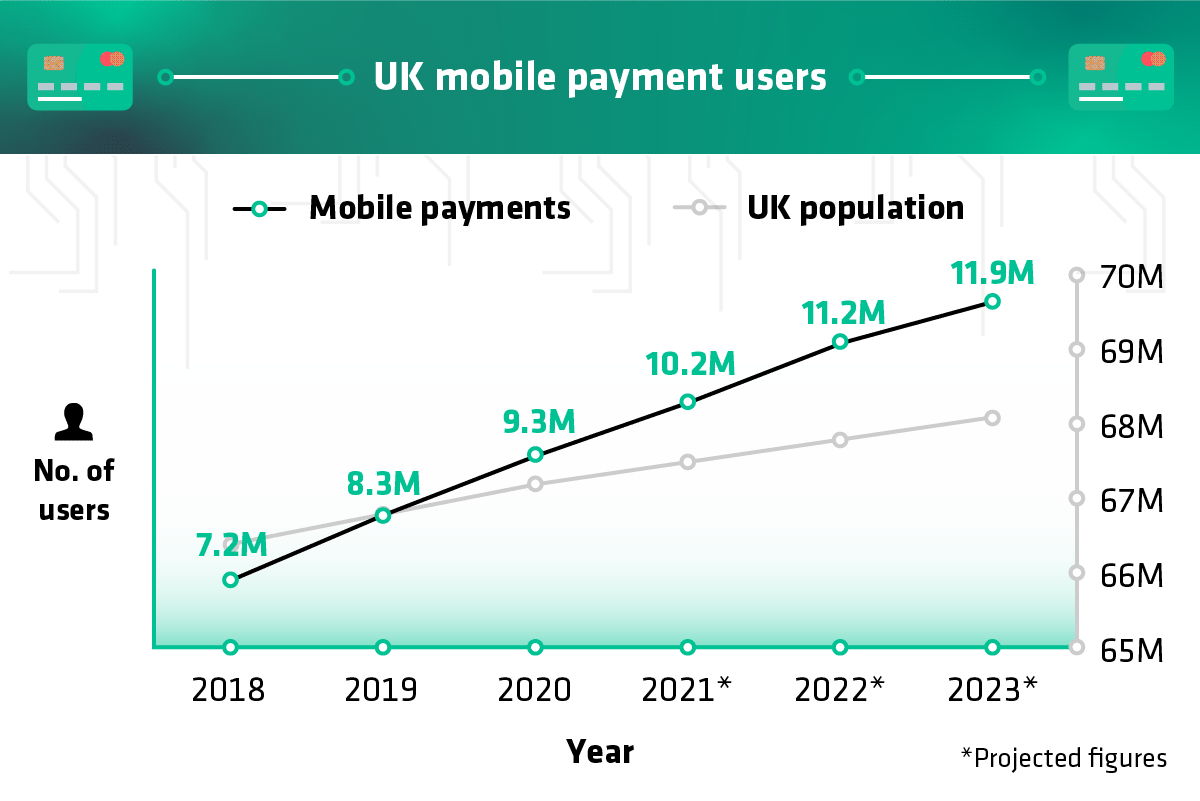

Statista 2020 Fintech report revealed that in 2019 over 81% of UK’s citizens were using some form of online payments which is the highest share globally. There’s also been a marked increase in the number of mobile payment app users - every year digital wallet apps gain nearly a million new users in the UK. By 2023, there will be nearly 12 million people in the UK whose primary payment method is through their phones.

The graph above shows the number of UK mobile payment users from2018, with projected figures made for 2021, 2022 and 2023. Source: https://www.emarketer.com/content/uk-mobile-payment-users-2019

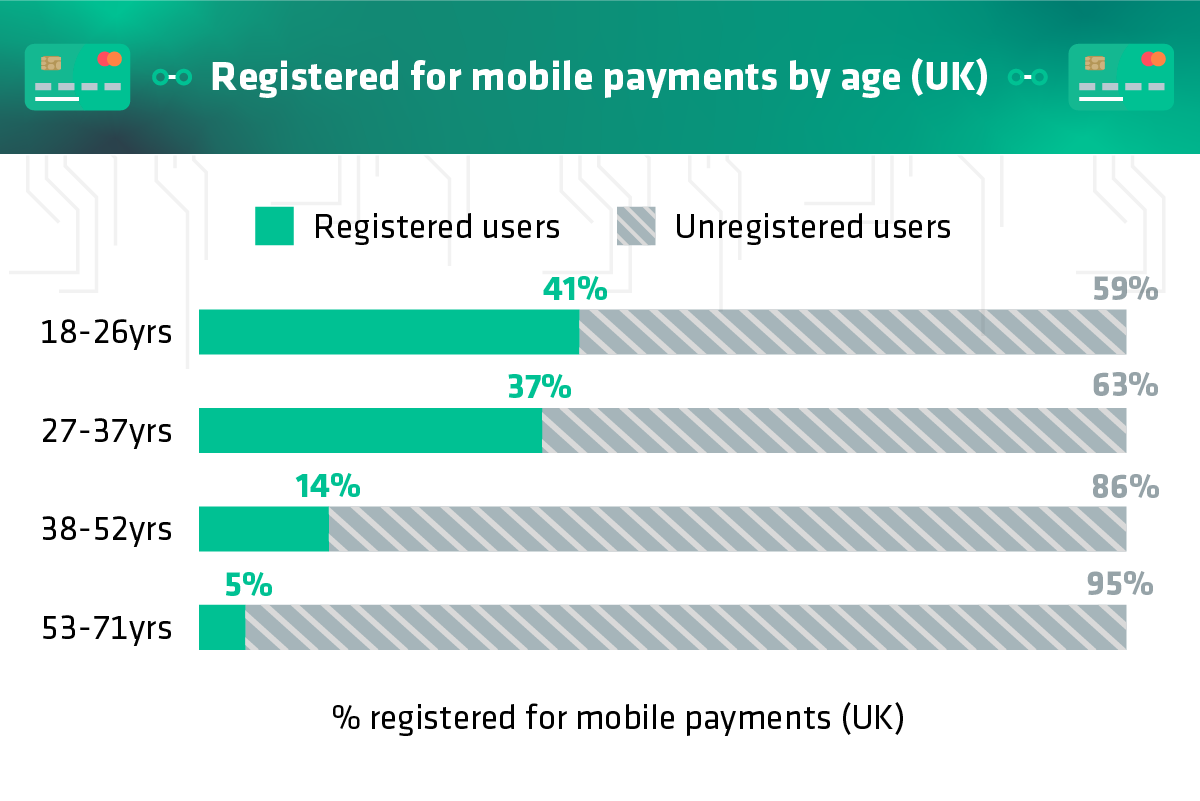

It comes as no surprise that the growing popularity of mobile payments in the UK is largely driven by younger generations. 38% of 27-37-year-olds have registered for a mobile payment system, with the figure rising to 41% with 18-26-year-olds.

The above graph shows the percentage breakdown of age groups who have registered for a mobile payment provider. Source: https://www.statista.com/statistics/1031465/consumers-who-use-mobile-apps-for-payments-in-the-uk-by-age/

12% of the worldwide population is estimated to regularly use digital wallet apps

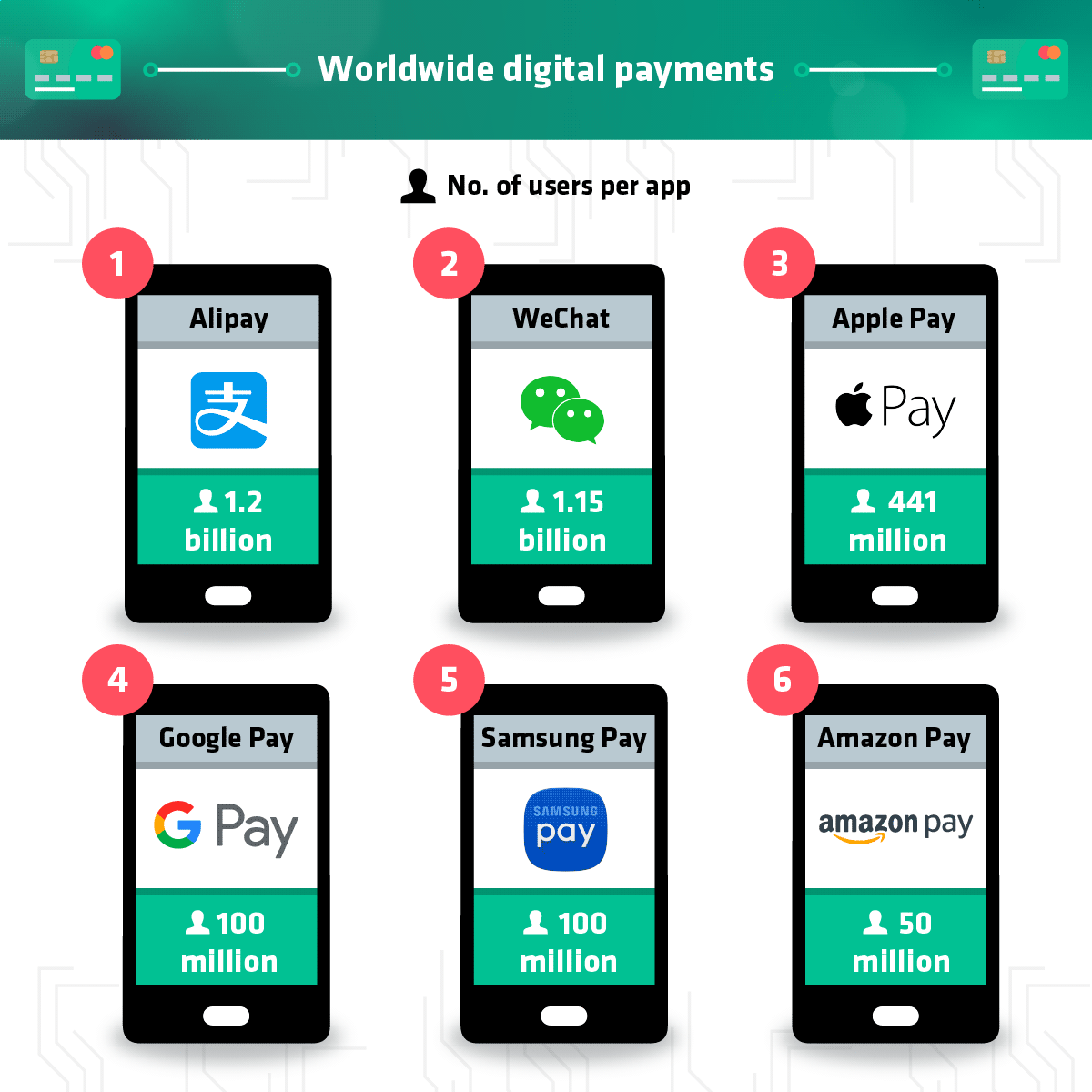

Recent years have seen a huge development in mobile payment apps. From long-established apps like PayPal, to more recent ones like Google Pay, Apple Pay or Samsung Pay to local players like Alipay or WeChat, users now have a whole array of payment apps helping them to make purchases online or via their devices in a seamless and secure way.

Mobile payment apps are estimated to have almost 1 billion daily active users which accounts for 12% of the global population. This number is expected to increase to over 1.3 billion in the next 3 years. The growing popularity is especially seen in China where the two local mobile payment app players - AliPay and WeChat have over 1 billion registered users each. Current estimates are that 47% of all smartphone users in China are regularly using digital wallet apps making it the world’s leader in the highest adoption of mobile payments.

The above data shows the number of users per digital payment app across the world in 2020. Sources: https://www.merchantsavvy.co.uk/mobile-payment-stats-trends/ and https://www.statista.com/statistics/722213/user-base-of-leading-digital-wallets-nfc/

Outside of China, Apple Pay, Google Pay, Amazon Pay and Samsung Pay are the top providers globally with the total number of 691 million users worldwide. The growing popularity of mobile payment apps in Europe has put two European countries - Norway and the UK as the world’s leaders for digital wallet adoption. With 42% and 24% of their population using digital wallets, Norway and the UK may be the first countries in the region heading towards the cashless economy model.

Rank |

Country |

% of the population using mobile and digital wallets |

1 |

China |

47% |

2 |

Norway |

42% |

3 |

UK |

24% |

4 |

Japan |

20% |

5 |

Australia |

19% |

6 |

Colombia |

19% |

7 |

United States |

17% |

8 |

Singapore |

17% |

9 |

Canada |

16% |

10 |

Austria |

16% |

The above data shows the top 10 countries with the highest % utilisation of digital wallets amongst smartphone users. Source: https://www.researchandmarkets.com/

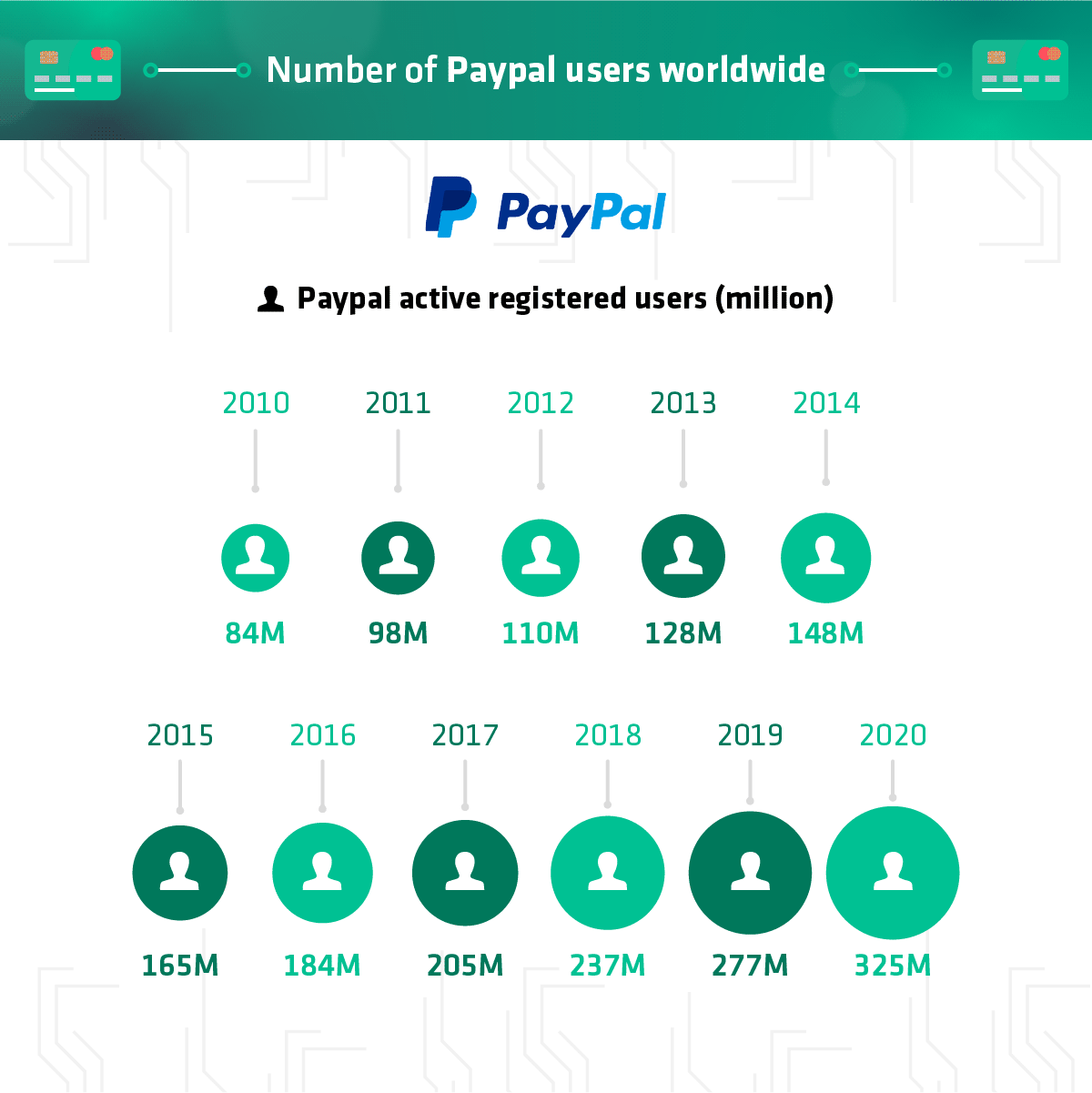

PayPal active users have quadrupled in the last 10 years

With a slightly different business model and designed specifically for online transactions is PayPal - one of the first digital wallet providers. PayPal is an American international e-commerce service that enables companies and individuals to send money and to accept payments without revealing any financial details. PayPal was established in 1998, long before our smartphones could double as a wallet and unlike most of the mobile apps, PayPal isn’t restricted to a specific device. Despite the rising competition from the more recent digital wallet apps, PayPal - that now supports online as well as mobile transactions - still has the biggest market share from all payment apps and its user base continues to grow each year.

Our research shows that in 10 years, the company has seen a quadruple rise in its number of users, totalling over 325 million in 2020 and continuing to be a top choice of payment method when purchasing goods online.

The above data shows the number of registered PayPal users from 2010 to 2020. Source: https://www.statista.com/statistics/218493/paypals-total-active-registered-accounts-from-2010/

Sources and Methodology:

https://www.statista.com/statistics/557959/global-mobile-proximity-payment-users/

https://www.merchantsavvy.co.uk/mobile-payment-stats-trends/

https://www.emarketer.com/content/uk-mobile-payment-users-2019

https://www.ons.gov.uk/peoplepopulationandcommunity

https://merchantmachine.co.uk/digital-wallet/

https://www.statista.com/statistics/277841/paypals-total-payment-volume/