Jump to a section

Whether it’s a groundbreaking product idea or the appeal of escaping the traditional 9 to 5, the dream of launching a business is one that resonates with many. In fact, our recent survey shows that 61% of Brits have considered starting their own venture, with nearly two-thirds thinking about it on a regular basis. But if the entrepreneurial spirit is so widespread, why do so few people actually take the leap?

To find out, we surveyed over 1,000 people across the UK to uncover which types of businesses create the foundations for the most dreams, and what’s standing in the way of them becoming a reality.

We also explored what people think it costs to start a business versus the real numbers, with expert insights from Hugh Acland, Chief Commercial Officer at Capital on Tap, to break down actual startup costs and share practical financial tips. To turn ambition into action, we’ve also included expert advice on taking those crucial first steps, making the dream of starting a business more achievable than ever.

The reasons people dream of starting a business

While people will want to start their own business for many different reasons, there seem to be three key themes motivating them: freedom, money, and passion.

|

Rank |

Reason |

% of people stating this as the reason to start a business |

|

1 |

Being my own boss |

47% |

|

2 |

Flexible working hours |

38% |

|

3 |

Better work/life balance |

32% |

|

4 |

Financial independence |

31% |

|

5 |

Turning a hobby into a career |

25% |

|

6 |

Working from anywhere |

24% |

|

7 |

Building something meaningful |

21% |

|

8 |

Creating something for my faily |

18% |

|

9 |

Passion for an industry or idea |

18% |

|

10 |

Desire for unlimited earning potential |

17% |

The top motivator behind wanting to start a business for aspiring entrepreneurs in the UK is the freedom that comes with being their own boss. Nearly half (47%) of respondents cited this as a main reason for wanting to start a business. For many, the idea of breaking free from rigid corporate structures and taking control of their own career path is incredibly appealing. It’s not just about professional autonomy, but about crafting a lifestyle that aligns with personal values and priorities.

Closely tied to this desire for independence is the appeal of flexible hours (38%) and achieving a better work-life balance (32%). The ability to set your own schedule and create boundaries that suit your life is especially important to those aged 45 to 54, with 43% of people within this age group suggesting that work-life balance is a major motivator. For many, starting a business isn’t just about professional ambition - it’s about reclaiming time, energy, and quality of life.

Although financial rewards are certainly a consideration, it's the pursuit of financial independence, the freedom to earn on one’s own terms and build long-term security, that drives nearly a third of aspiring founders.

Many also wish to transform their hobby into full-time careers - a goal that motivates one in four prospective business owners (25%). This ambition is particularly strong among women (30%) compared to men (20%), as is the drive to pursue a business idea that they feel truly passionate about. For these individuals, purpose and personal fulfilment are key.

The business ideas behind the dreams

|

Rank |

Type of business |

% of people stating this as the business they would most like to start |

|

1 |

Café, restaurant, or food truck |

20% |

|

2 |

Online retail (e.g. clothing, accessories, niche products) |

16% |

|

3 |

Airbnb hosting or short-term property rental |

10% |

|

4 |

Technology |

9% |

|

5 |

Speciality shops focusing on specific products (e.g., books, fashion, electronics, gifts) |

9% |

|

6 |

Independent shops offering unique or local products |

8% |

|

7 |

Digital marketing or content creation |

8% |

|

8 |

Tutoring or education services |

8% |

|

9 |

Creative agency or freelance service (design, writing, photography) |

8% |

|

10 |

Consultancy or coaching |

7% |

When asked what type of business they would most like to start, one in five Brits said they dream of opening their own cafe, restaurant, or food truck, making it the UK’s most popular business ambition. From trendy street food vans to cosy coffee spots or elegant dining spaces, the appeal lies in creating a place that reflects personal taste while bringing people together. It’s a hands-on, heart-led venture where aspiring owners can shape menus, curate atmospheres, and foster loyal communities.

Women, in particular, are drawn to the idea of turning culinary passion into a career, with nearly a quarter listing food businesses as their dream, compared to just 17% of men. In Preston, the foodie flame burns even brighter, with a remarkable 50% of locals selecting this as their top choice.

Another passion-driven path is online retail, the second most desired type of business to start, with 16% of Brits naming it their dream venture. Online stores allow aspiring entrepreneurs to align their business with personal interests - from fashion and home decor to niche hobbies - while still enjoying the flexibility and autonomy that come with digital platforms. This option is especially popular among 25–34 year olds, with nearly a quarter (24%) in this age group envisioning an e-commerce venture as their ideal path to self-employment.

One in ten Brits would choose Airbnb hosting and short-term property rentals as their preferred business idea.

Some business ideas show clear gender divides, particularly in traditionally male-dominated fields like trades and tech. While 10% of men dream of launching a trade business, such as plumbing, carpentry, or electrics, only 1% of women share this desire. The tech sector shows a similar gap: 15% of men would like to start a tech company, compared to just 3% of women. These differences suggest that while the dream of entrepreneurship is widespread, certain industries still reflect long-standing perceptions around gender and profession.

At the other end of the spectrum, the automotive industry holds the least interest overall, with just 4% of Brits naming it as their business of choice. However, in Nottingham and Belfast, a surprising 20% of respondents would choose to launch a business in the automotive space, potentially reflecting local demand or market opportunities.

And perhaps the most telling stat of all: just 1% of people said they don’t want to start a business. This overwhelming interest highlights the strength of the entrepreneurial spirit across the UK.

The biggest barriers to starting a business in the UK

So, with the motivation high and business dreams clearly defined, what is stopping people from making their dreams a reality?

|

Rank |

Reason |

% of people stating this as their business barrier |

|

1 |

Lack of startup funds |

36% |

|

2 |

Fear of failure |

29% |

|

3 |

Not knowing where to start |

24% |

|

4 |

Uncertainty about profitability |

23% |

|

5 |

Afraid of leaving a stable income |

22% |

|

6 |

Lack of confidence or self-belief |

22% |

|

7 |

Concerns about economic instability |

19% |

|

8 |

Lack of a clear business idea |

18% |

|

9 |

Lack of market knowledge |

17% |

|

10 |

Lack of time |

15% |

Financial barriers

A significant obstacle to entrepreneurship in the UK is the lack of startup capital, with 36% of Brits citing financial constraints as the primary reason for not launching a business. This challenge is even more pronounced among women, where 40% identify funding as their main hurdle, a reflection of persistent issues like the gender pay gap and unequal access to financing opportunities.

The disparity becomes more evident when examining venture capital investments. In 2023, all-female founder teams secured only 8.2% of equity deals, amounting to £232 million, while all-male teams closed 1,413 deals worth £6.5 billion. This stark contrast underscores the systemic biases within the investment landscape.

Regionally, the issue is exacerbated in areas like Bath and Nottingham, where 71% and 70% of aspiring entrepreneurs, respectively, report finances as their primary obstacle. This suggests that, beyond national trends, local economies are also grappling with significant gender-based funding disparities.

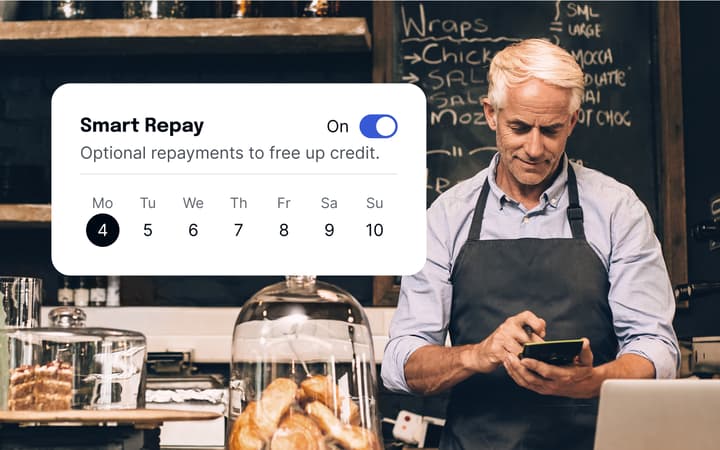

Hugh at Capital on Tap suggests, “While the idea of raising capital may seem daunting, there are a variety of ways to access funding, such as government-backed start-up loans, crowdfunding, and angel investors. Once your business is up and running, opening a dedicated business savings account can be a smart way to manage and grow your finances. It allows you to earn interest on idle cash, build up reserves for future investment, and keep your business finances organised and separate from personal spending. Even small, regular contributions can accumulate over time, creating a financial cushion that supports long-term growth.”

In the current economic climate, it is no surprise that 22% of people are worried about giving up a stable income to start their own venture. This concern peaks among those aged 45–54 (33%), where financial responsibilities like mortgages, childcare, or nearing retirement may weigh heavily on decision-making.

Hugh adds, “Before leaving your current job, it is ideal to create an emergency fund that covers several months of your personal expenses that can act as a buffer during times of low or uncertain income. Alternatively, beginning your business as a side-hustle as a way to test the waters can be a less risky choice, with the option to make it your full-time job later down the line.”

Psychological barriers

Beyond finances, emotional and psychological barriers play a powerful role. Fear of failure (29%) and lack of self-belief (22%) are both named as key reasons why people don’t pursue their business ambitions. These concerns are particularly strong among women, with 27% citing low self-confidence as a barrier compared to 17% of men.

Hugh notes, “Fear of failure is natural, but it is often rooted in unrealistic expectations. Starting with small, achievable goals is important in helping you remain motivated.”

Knowledge barriers

For 24% of would-be entrepreneurs, the challenge isn’t fear or finances - it’s a lack of direction. Not knowing where to start is a surprisingly common hurdle, especially for women (30%) compared to men (19%). This could point to a broader lack of support systems for women in business or a gap in access to resources and role models.

Hugh suggests, “If you’re feeling stuck, the best place to start is with a business plan - outline your idea, target audience, and how you’ll make money. Looking out for information and support through local workshops, online courses, or learning from other entrepreneurs will also help you to gain knowledge.”

Expectations versus reality: How much does starting a business actually cost?

With finances often cited as the biggest barrier to starting a business, we set out to uncover how much Brits think it costs to launch their dream venture, and how that stacks up against the real-life experiences of those who’ve actually done it.

According to our survey, most Brits (16%) thought it would cost under £5,000 to set up their business. That aligns with reality, as the majority of entrepreneurs we surveyed said it costs about that much to establish their company.

However, expectations vary significantly by the industry. For instance, 34% of Brits believed it would cost under £5,000 to start a tutoring business—a figure not too far off the actual average reported by entrepreneurs, which was £8,599, suggesting a slight underestimation.

In contrast, 26% of respondents estimated that launching a technology business would cost around £50,000. In reality, entrepreneurs in this sector reported an average startup cost of £24,757, almost half the predicted amount, highlighting a notable gap between perception and reality.

These differences become even more pronounced at the regional level. In Manchester, for example, the most common estimate on for to starting a business was £15,000–£19,999.Yet in practice, 28% of local entrepreneurs spent under £5,000, while22% reported startup costs of £50,000 or more, a significant gap variation that could leave many underprepared.

In the capital, expectations are more closely aligned with reality. The largest group of London respondents (19%) estimated it would cost £50,000 or more to launch their venture, and that mirrors actual experience, as the most common startup cost reported by London entrepreneurs was also £50,000 or more.

This trend continues across other budget brackets: 13% of Londoners predicted it would cost under £5,000, and 19% of local entrepreneurs said they spent that amount. While startup costs and expectations vary across the UK, Londoners appear to be the most in tune with the financial realities of launching a business.

The reality is that there is no universal answer to how much it costs to start a business in the UK; it depends on location and industry. However, having a clear-eyed understanding of potential expenses is essential. In some cities, expectations are already in line with reality. In others, underestimating costs could create real obstacles. The better prepared entrepreneurs are, the greater their chances of turning ambition into lasting success.

How to make your dream business a reality

Hugh shares actionable steps to launch a business and turn your dreams into reality.

Start with your ‘why’

Define the deeper reason behind your business idea. A strong sense of purpose will keep you focused and resilient when challenges arise.

Write a simple business plan

Often, people get tied down by thinking they need a 30-page document to start out, but this isn’t always practical. Having just a clear outline of your idea, audience, goals, and finances is enough. It’s your roadmap to stay on track.

Take one step at a time

Break your big vision into manageable tasks. Whether it's registering your business or setting up a website, progress happens step by step.

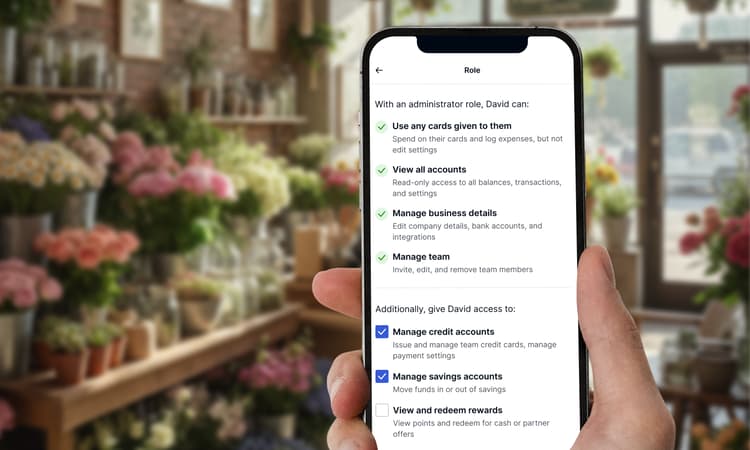

Separate personal and business finances

Open a business account and keep your spending organised. This makes budgeting, taxes, and funding far easier as you grow. A business credit card can help manage cash flow and build your credit profile, just make sure to stay on top of payments and spending limits.

Build a support network

Don’t do it completely alone. Connect with other entrepreneurs, join business communities, and seek advice from mentors who’ve walked the path before you.

Progress beats perfection

Don’t wait for the “perfect” time to launch. Start small, stay consistent, and refine as you go. Momentum is your most valuable asset.

Sources and Methodology

All data was taken from a survey of 1,000 British adults. The survey was conducted in April 2025.