London, 31st July 2023 - Capital on Tap, a leading global FinTech, is excited to unveil its inaugural public securitisation facility London Cards No.1. The facility, which successfully priced on 5th June and settled on 20th June, marks a significant milestone in the company's growth strategy.

This UK business credit card securitisation has a value of £250 million and is the first European securitisation in its asset class. The deal includes a Loan Note and five Placed tranches of Notes which were listed on the London Stock Exchange. Moody's and DBRS rated the facility applying ratings of Aa3/AAA to the Class A Loan Note.

Capital on Tap is delighted to have attracted the participation of seven investors across six tranches, further underscoring the market's confidence in the company. As the originator of this pioneering securitisation facility, Capital on Tap is poised to redefine the landscape of business financing.

HSBC and BNP Paribas, renowned global financial institutions, have been appointed as co-arrangers and joint lead managers for this landmark deal. Their expertise and extensive network have contributed to the successful execution of the securitisation facility, further solidifying Capital on Tap's position as an industry leader.

Alan Hart, CFO at Capital on Tap commented, “London Cards No.1 reflects our unwavering commitment to financial innovation and continuous growth. The partnership with BNP Paribas and HSBC, coupled with the robust participation from investors, underscores the trust and confidence placed in our company. We are confident that this significant achievement will establish new benchmarks within the industry, solidifying our position as a prominent leader in the market."

John Millward, Managing Director at HSBC said, “We are delighted to have supported Capital on Tap in its inaugural ABS transaction, placed with a range of institutional investors. This landmark transaction opens up an additional, diversified channel of funding to support the business in its next phase of growth, as well as being the first transaction of its kind in the European ABS market”.

Simon Jones, Head of Securitised Products at BNP Paribas said, “We are thrilled to partner with Capital on Tap, in further growing and diversifying their funding mix into the public European securitisation market. We believe the solid demand witnessed across tranches, on what is a new asset class from an inaugural issuer, accentuates the strength of the transaction and their platform.”

This securitisation facility represents a pivotal moment in Capital on Tap's journey. Having closed multiple funding facilities, totaling over £1 billion since June 2021, this facility marks a significant step forward in enhancing the company's product offerings and bolstering its position as a leading provider of financial solutions for small businesses.

About Capital on Tap

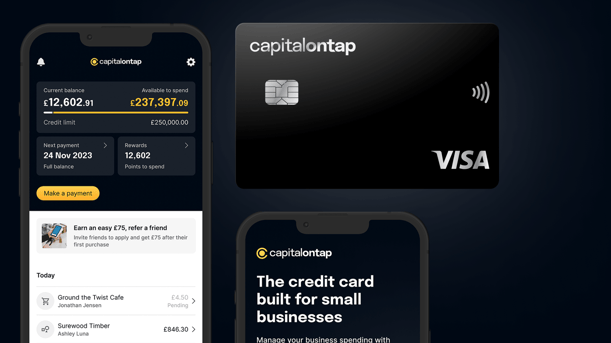

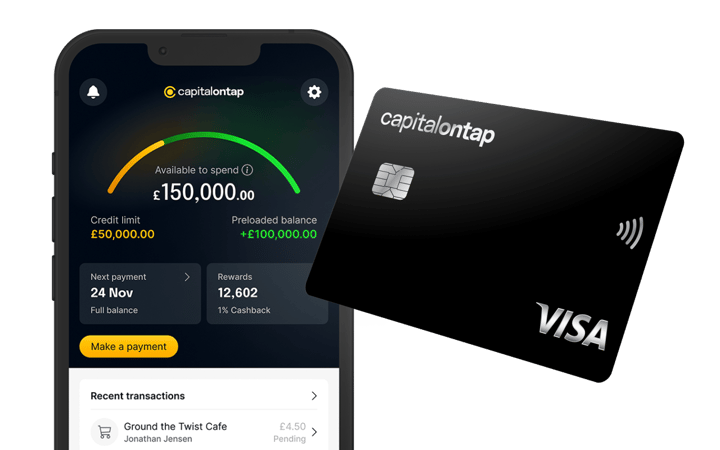

Capital on Tap makes it easy for small businesses to manage their business spending, access funding, and earn cash back, travel, and gift card rewards. Over 200,000 small businesses have spent more than £8 billion on their Capital on Tap Business Credit Cards across the US and UK. They were recently recognised by The Sunday Times and the Financial Times as one of Britain and Europe’s fastest growing businesses, respectively.

About HSBC Holdings plc

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 62 countries and territories in its geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa. With assets of US$2,967bn at 31 December 2022, HSBC is one of the world’s largest banking and financial services organisations.

About BNP Paribas

BNP Paribas is the European Union’s leading bank and key player in international banking. It operates in 65 countries and has nearly 185,000 employees, including more than 145,000 in Europe. The Group has key positions in its three main fields of activity: Commercial, Personal Banking & Services for the Group’s commercial & personal banking and several specialised businesses including BNP Paribas Personal Finance and Arval; Investment & Protection Services for savings, investment and protection solutions; and Corporate & Institutional Banking, focused on corporate and institutional clients. Based on its strong diversified and integrated model, the Group helps all its clients (individuals, community associations, entrepreneurs, SMEs, corporates and institutional clients) to realise their projects through solutions spanning financing, investment, savings and protection insurance. In Europe, BNP Paribas has four domestic markets: Belgium, France, Italy and Luxembourg. The Group is rolling out its integrated commercial & personal banking model across several Mediterranean countries, Turkey, and Eastern Europe. As a key player in international banking, the Group has leading platforms and business lines in Europe, a strong presence in the Americas as well as a solid and fast-growing business in Asia-Pacific. BNP Paribas has implemented a Corporate Social Responsibility approach in all its activities, enabling it to contribute to the construction of a sustainable future, while ensuring the Group's performance and stability.

- ENDS -

Press/Media Contact

Holly Woodward

holly.woodward@capitalontap.com