The ‘London Cards 3’ deal, Europe's largest non-bank credit card securitisation, provides 'rocket fuel' for the small business spend management platform.

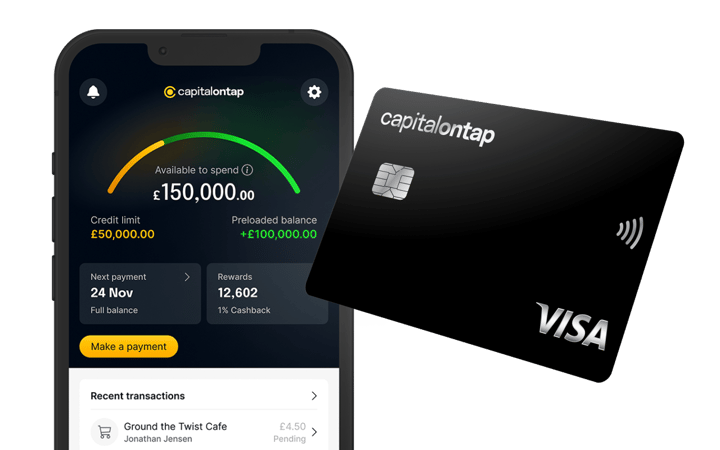

LONDON, 19th November 2025 – Capital on Tap, the all-in-one business credit card and spend management platform, today announced the successful closing of "London Cards 3," its third asset-backed securitisation (ABS)—a £500 million funding package backed by its business credit card receivables.

The deal, which is the largest non-bank credit card ABS ever issued in Europe, provides Capital on Tap with a deep and efficient funding source to accelerate its product development and support for small businesses. This successful transaction comes at a critical time when many traditional lenders are tightening credit access, reinforcing Capital on Tap's role as an essential partner for SMBs.

This landmark transaction achieved a significant milestone for the company, securing investment grade ratings on all bonds issued. This external validation reflects strong investor confidence in the quality and performance of Capital on Tap's assets, which are generated by its portfolio of over 200,000 small business customers. The deal attracted significant demand from a broad range of institutional investors.

"Small businesses are the backbone of our economy, but there may be times when some face challenges and they need additional sources of support. This record-breaking deal isn't just a financial milestone; it's rocket fuel for our mission," said Damian Brychcy, CEO at Capital on Tap. "Achieving investment grade status from our new master trust proves the resilience of our customers and the strength of our platform. This funding allows us to double down on empowering SMBs with the tools and credit they need to thrive."

The transaction was structured and distributed by a syndicate of leading global financial institutions, with BNP Paribas, Citi, Lloyds, Societe Generale, and SMBC Group acting as Joint Lead Managers.

“BNP Paribas is delighted to have supported Capital on Tap on its debut master trust issuance, a landmark transaction which represents an important milestone for the company,” Ghanem Al-Araj, Managing Director, BNP Paribas.

“We are delighted to have acted as Arranger and Joint Lead Manager on Capital on Tap’s inaugural Master Trust issuance. We are proud to have supported our client in executing this successful transaction and look forward to our continued partnership.” Sebastian Walf, EMEA Head of ABS at Citi.

“We are proud to have acted as Joint Lead Manager on this landmark transaction which is a major step forward in Capital on Tap’s funding strategy. The financing will provide scalable, long-term access to capital to support its continued growth and support for forward-thinking SMEs across the UK.” Miray Muminoglu, MD and Head of Securitised Products Group & FI DCM, Lloyds.

“Societe Generale is pleased to have placed London Card 3 with key institutions in what is a milestone for Capital on Tap as well as UK and European markets for a non-bank financial issuer, We look forward to supporting Capital on Tap in its high growth journey to meet the funding and credit needs of UK SMBs.” Florence Coeroli, Head of UK Distribution & Credit Solutions, Societe Generale.

“SMBC Group is proud to support Capital on Tap in this successful £500 million securitisation. This is a landmark transaction, the largest of its kind so far and testament to the strength and the reputation that Capital on Tap has continued to build as a platform and as an issuer in the capital markets.” Fabrizio Baicchi, EMEA Head of Structured Finance (Capital Markets & Advisory) at SMBC Group.

The new master trust provides a more flexible and efficient platform for Capital on Tap to access the capital markets, securing the long-term funding necessary to support its mission of empowering small business owners.

About Capital on Tap

Capital on Tap makes it easy for small businesses to manage their business spending, access funding, and earn cashback, travel, and gift card rewards. Over 200,000 small businesses have spent more than £20 billion on their Capital on Tap Business Credit Cards across the US and UK. The company has achieved remarkable recognition, ranking #1 in the Fintech, Financial Services & Insurance category and #5 overall in the Financial Times' inaugural Europe's Long-Term Growth Champions 2025 list.

© 2025 New Wave Capital Limited (trading as Capital on Tap) is a private limited company incorporated in England and Wales.

Press/Media Contact

Kamilla Fernandes-Pickett, Marketing and Communications Senior Manager, Capital on Tap

kamilla.fernandes@capitalontap.com

https://www.capitalontap.com/