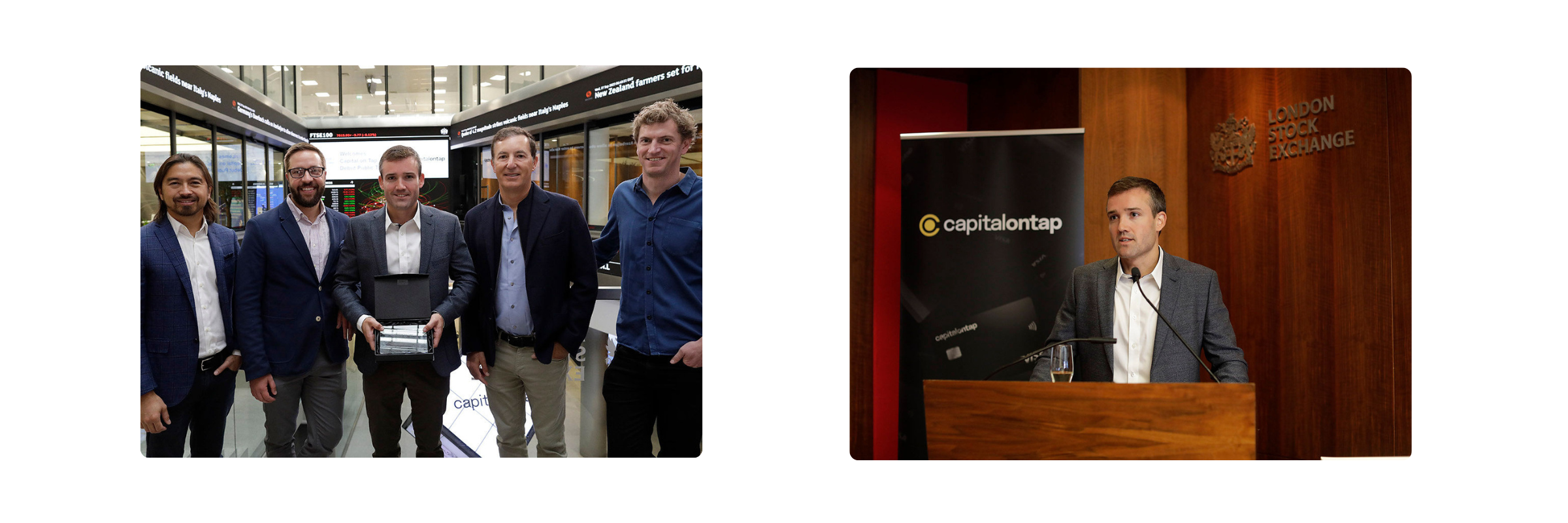

London, 27 September 2023 - Capital on Tap, the FinTech company democratising small business funding, opened the London Stock Exchange market today to celebrate the launch of its groundbreaking £250 million securitisation facility.

The securitisation, called London Cards No.1, is the first of its kind in Europe for business credit cards. It has a total value of £250 million and includes a Loan Note and five Placed tranches of Notes, all listed on the Main Market of the London Stock Exchange. The facility received high credit ratings, with Moody's and DBRS assigning ratings of Aa3/AAA to the Class A Loan Note.

By opening the Market today, Capital on Tap signals its commitment to keep driving innovation and financial inclusion in entrepreneurial finance. This landmark securitisation ushers in a new era of disruptive funding solutions that provide small businesses the freedom to reach their potential.

LSE listing a "major achievement" for Capital on Tap's growth

“Listing the London Cards No.1 securitisation facility on the London Stock Exchange marks a major achievement for Capital on Tap,” said David Luck, Founder and CEO of Capital on Tap. “As a homegrown British fintech born in London, we could not be prouder to celebrate this milestone in the city where our journey began over a decade ago. This deal will support Capital on Tap's ambitious growth plans as we continue our mission of providing innovative funding solutions for small businesses in the UK, US and beyond.”

Dave continued: “The success of this offering demonstrates the confidence investors have in us to disrupt the finance industry through technology. We are honoured to join the prestigious ranks of public companies on the London Stock Exchange. This is a tremendous vote of confidence in Capital on Tap's vision of making entrepreneurial finance more accessible worldwide.”