One year after expanding beyond credit, the fintech leader cements its status as a full-service financial hub for UK SMEs.

LONDON, UK – January 28, 2026 – Capital on Tap, the all-in-one spend management platform for businesses, announced that it has surpassed £1 billion in total deposits within its Capital on Tap Instant Savings account, powered by ClearBank. This significant milestone was achieved just 12 months after the product was first introduced to the UK market.

The achievement marks a pivotal moment in the company’s evolution. Following 14 years of empowering small and medium-sized enterprises (SMEs) through its market-leading business credit cards, Capital on Tap’s strategic move into savings accounts addresses a critical gap in the market: the need for high-yield returns coupled with the immediate liquidity required to run a business.

“Reaching £1 billion in savings balances in a single year is a clear signal that small business owners are tired of their idle cash sitting dormant in low-interest high-street accounts,” said Damian Brychcy, CEO at Capital on Tap. “Our mission has always been to provide SMEs with the tools they need to thrive. By partnering with ClearBank to offer a secure, high-yield, and truly instant savings product, we’ve empowered business owners to make their hard-earned capital work just as hard as they do.”

The Capital on Tap Instant Savings account offers a tailored proposition designed for the diverse community of UK business owners:

-

Competitive Returns: Consistently offering some of the UK’s most competitive AER (variable) interest-earning rates for business savings.

-

True Liquidity: Instant access with no withdrawal penalties, ensuring businesses maintain the agility to respond to immediate opportunities or challenges.

-

Deposit Protection: Deposits are held by ClearBank, a UK-regulated bank, with eligible deposits protected by the Financial Services Compensation Scheme (FSCS) up to £120,000.

-

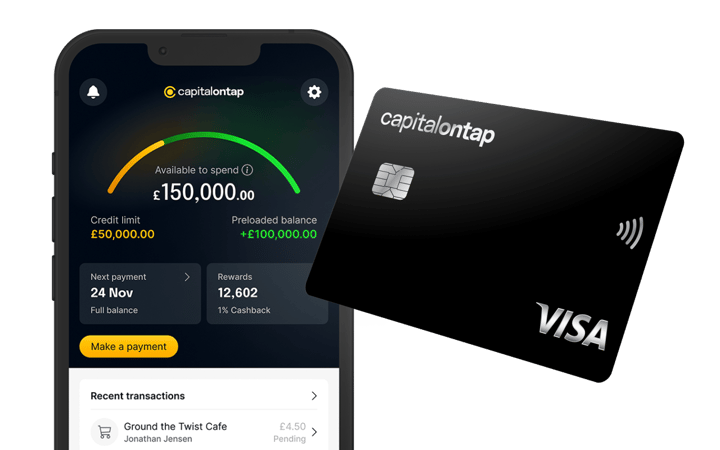

Unified Financial Hub: A seamless integration that allows customers to view their credit, spend management, and savings in one centralised dashboard, with the ability to pay down credit balances directly from their savings.

“This milestone is more than just a number; it represents the evolution of Capital on Tap into a comprehensive financial ecosystem,” added Brychcy. “We started with credit to help businesses grow; we’ve now added savings to help them stay resilient. Our vision for 2026 is to continue building the 'operating system' for SME finance, removing the friction and fees that have held small businesses back for decades.”

Business owners can open a Capital on Tap Instant Savings account, powered by ClearBank, by visiting capitalontap.com/en/business-savings-account/.

About Capital on Tap

Capital on Tap makes it easy for small businesses to manage their business spending, access funding, and earn rewards. Since 2012, over 200,000 small businesses have spent more than £10 billion on their Capital on Tap Business Credit Cards across the UK and US. Recognized for its consistent innovation, the company ranked #1 in the Fintech, Financial Services & Insurance category in the Financial Times' inaugural Europe's Long-Term Growth Champions 2025 list.

Press/Media Contact

Name: Kamilla Fernandes-Pickett

Email: kamilla.fernandes@capitalontap.com

Website: https://www.capitalontap.com/en/