Trusted by over 200,000 businesses

The credit card built for small businesses

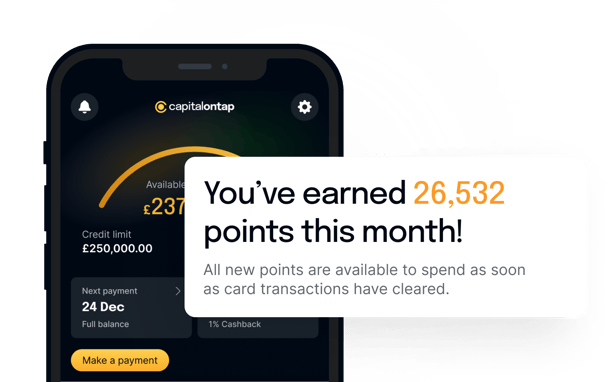

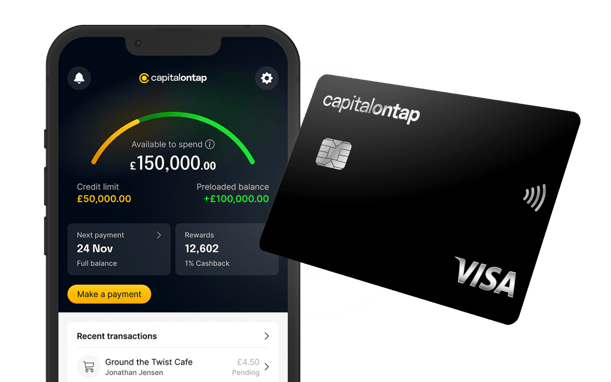

Get unlimited 1% cashback on all card spending. Redeem for cash, Avios, gift cards, or against your balance. Apply and get a decision in 2 minutes.

- Go further with credit limits up to £250,000

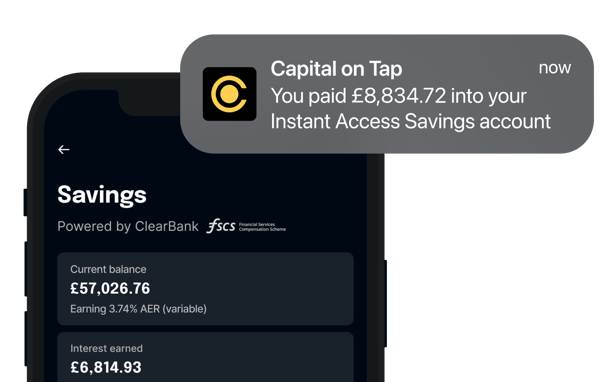

- 3.74% AER* (variable) Instant Savings**

- No annual, FX, or ATM fees