Trusted by over 200,000 businesses

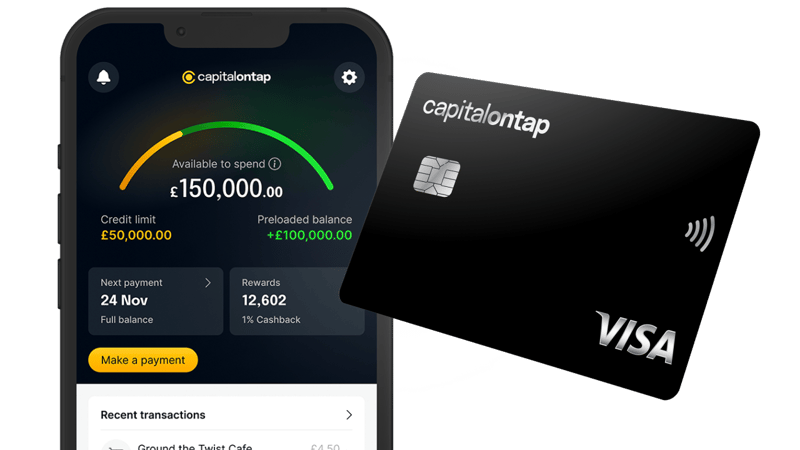

Boost your spending power beyond your credit limit

Our groundbreaking Preloading feature lets you use your own funds together with your credit limit.

- Get greater flexibility in managing cash flow

- Take advantage of 1% cashback on all card spending

- Preload as much or as little as you need, whenever you need it