Jump to a section

Most small businesses qualify for a small business credit card, meaning owners can enjoy elevated rewards schemes and cashback perks on business spending, simplified bookkeeping with separated personal and business expenses, and issue employee cards. However, determining whether your business will qualify can be confusing, especially if you're a new business owner.

In this blog post, we'll guide you through the steps to help you understand if you're eligible for a small business credit card. We'll also provide you with useful tips to increase your chances of approval. So, whether you're an established business or just starting, we've got you covered.

Who can qualify for a small business credit card?

Your business doesn’t need to have employees, a huge turnover, or a formal business structure to qualify for a small business credit card.

If your business is active and registered as a legal entity, such as a private limited company or sole trader, it is likely to meet the requirements.

Whilst the requirements to qualify for a business credit card will vary depending on the card provider, there are 4 common business types that will generally be approved for a business credit card:

Limited company

A limited company is a type of business structure in which the company is a separate legal entity from its owners. Shareholders have limited liability for the business’ debts as they are liable only for the amount of share capital that they have subscribed to.

There are two kinds of limited companies: private limited companies and public limited companies.

Corporation

A corporation is a legal entity that is owned by shareholders but is distinct from its owners. It’s a body of persons authorised by law to act as one person, required to pay Corporation Tax in the UK. A corporation has rights and liabilities that are separate from the individuals who form the corporation. An example of a corporation is Apple Inc., which is owned by shareholders and has a board of directors that manages the business operations.

Partnership

A partnership is a business structure in which two or more individuals own and run a business together, sharing profits and liabilities. Unlike corporations, a partnership is not taxed separately on its profits or losses.

Sole trader

A sole trader owns and runs a business as a single person, with no legal distinction between the business and themselves. An example of a sole trader is a self-employed freelancer or consultant who operates their business on their own.

Unfortunately, sole traders are unable to apply for a Capital on Tap Business Credit Card at the moment.

Even if your business is one of these 4 structures, it must also be deemed an ‘acceptable' type of business; many credit card providers will not provide credit to ‘high-risk’ business types such as arms manufacturers, gambling merchants, or online pharmacies.

Business ownership also impacts credit card qualification as you can only apply for a business credit card if you own the business, or are a majority shareholder in the business. If you do not have ownership you may not qualify for a business credit card.

For some business credit cards, it is a requirement to provide a personal guarantee. This means that you, as the director, will be financially responsible for any unpaid bills or abandoned balances on the business credit account.

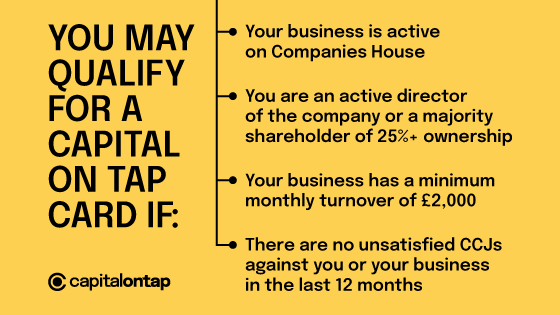

You may qualify for a Capital on Tap Business Credit Card if:

- Your business is active on Companies House

- You are an active director of the company or a majority shareholder of 25%+ ownership

- Your business has a minimum monthly turnover of £2,000

- There are no unsatisfied CCJs against you or your business in the last 12 months

How to qualify for a small business credit card

While applying for a business credit card is straightforward and doesn't require a lot of time and effort, it's crucial to understand how you can qualify for a small business credit card.

To qualify for a small business credit card, you’ll need to provide some information about yourself, such as your name and birthdate, home address, and email address.

You'll also need info relevant to your business, such as your business’ legal and trading names, monthly turnover, and business address.

But, what else can you do to increase your chances of being approved for a small business credit card?

Check your personal credit score

Some lenders require a personal guarantee when you apply for a business credit card, which means you will be held personally liable for any debt payable on the card if your business itself cannot pay.

Therefore, many lenders review your personal credit history to ensure that you are a trustworthy borrower before approving a business credit card application. By checking your credit score and history, lenders look for evidence that you will use your business credit card responsibly and avoid financial risks.

If you have a low personal credit score, it could result in higher interest rates or even rejection of your business credit card application. Therefore, before applying for a business credit card, it's wise to check your personal credit score and history to ensure that it's accurate and reflects positively on you. If you find any errors or discrepancies, it's crucial to dispute them promptly to avoid any negative impact on your creditworthiness.

Make your business profitable

Lenders want to see that your business has a positive cash flow and is capable of repaying any credit card debt. So, if your business is not profitable, it may be challenging to obtain a business credit card, or you may receive unfavourable terms and conditions.

Therefore, it's crucial to ensure that your business has a solid financial foundation before applying for a business credit card. By doing so, you'll increase your chances of approval and have access to credit that can help your business grow.

Compare business credit cards to find the best option for you

Not all business credit cards are created equal, and they may offer different benefits, interest rates, fees, and rewards programs.

By comparing different options, you can find a business credit card that aligns with your business goals and financial situation. Moreover, you can save money on interest and fees and take advantage of rewards programs that benefit your business. Therefore, it's essential to research and compare various business credit cards to find the best option for your business before applying.

The Capital on Tap Business Credit Card has unlimited 1% cashback and credit limits up to £250,000.

Ready to apply for your business credit card? Apply and get a decision in less than 2 minutes.