Trusted by over 200,000 businesses

Convert points to Avios

Earn unlimited rewards on every purchase and convert to Avios at no extra cost.

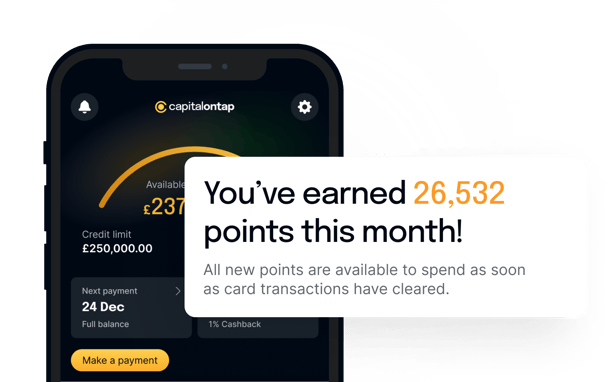

- Earn points for every pound spent

- No annual fee to earn rewards

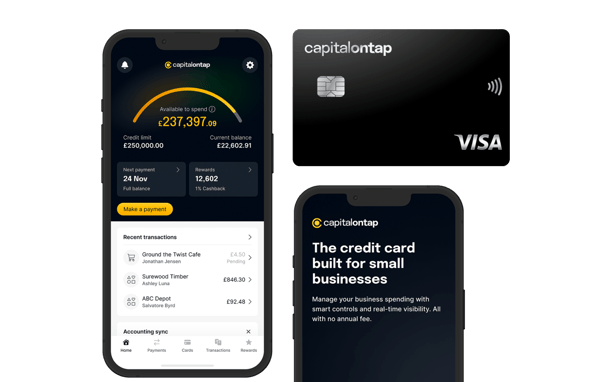

- Unlimited, free company cards

Earn unlimited rewards on every purchase and convert to Avios at no extra cost.

Come for the rewards, stay for the all-in-one spend solution. Change your plan at any time.

£0/year

No annual fee

£299/year

Billed annually

Everything from Free, plus:

A business credit card with air miles turns your company's everyday spending into travel rewards. Every purchase earns points that can be converted to Avios for flights, upgrades, and travel perks. With Capital on Tap, earn points for every pound spent, which you can convert to Avios, cashback, gift cards, or travel rewards.

Collecting Avios is key for any business owner looking to make the most of their spending. With a business travel credit card that earns air miles, you can turn everyday operational costs into rewards. It's a great opportunity to use those supply purchases, marketing budgets, and overhead expenses to fund corporate travel, or even treat yourself to a well-deserved holiday.

Business credit cards with air miles allow businesses to earn rewards in the form of air miles for their spending. They usually work like this:

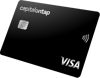

Every purchase on your business credit card earns rewards points. With Capital on Tap, you'll earn points that can be converted to Avios, turning your business spending into travel opportunities.

Boost your rewards quickly with new member offers. Sign up to Capital on Tap’s Pro credit card and earn 10,000 bonus points when you spend £5,000 on your card in your first 3 months - all convertible to Avios for your travel rewards!

The points or air miles earned can be redeemed for flights, hotel stays, upgrades, and other travel expenses. Some cards, like Capital on Tap’s, also offer redemption options like gift cards or cashback. Plus, points are instantly redeemable as soon as you spend.

Unlike most business air miles credit cards that charge annual fees, Capital on Tap lets you earn and convert points to Avios at no extra cost on our Free tier.

Flying isn't the only way to earn Avios - your Capital on Tap Business Credit Card turns everyday business expenses into rewards points that can be converted directly to Avios for travel.

Take your business further with our Pro welcome offer. Earn 10,000 bonus points when you spend £5,000 on your card in your first 3 months. As a Pro cardholder, these bonus points convert to a full 10,000 Avios—or you can opt for £100 cashback.

Use your Avios to fly further - book flights, hotels and more for your next trip using the best small business credit card for travel.

You can redeem your rewards points against your balance, for cash, gift cards, or convert to Avios via the Rewards page in your Capital on Tap app or online portal, you just need your British Airways Club account details to hand!

Turn your business spending into rewarding experiences. Enjoy spending your Avios on:

Read our customer storiesWe used our Avios to pay for 7 employees’ flights to Vegas. After converting our cashback to Avios we only had to pay £75 for each flight ! Using our points brought the cost right down so we could justify the trip.

Avios is the British Airways Club's rewards currency. You collect Avios when you book flights, hotel stays, car hire, and more. You also earn points you can convert to Avios on certain business credit cards with travel rewards, including the Capital on Tap Business Credit Cards. Avios can then be spent on travel rewards.

Avios is the rewards currency used by British Airways’ Club. You can spend Avios on travel-related benefits like flights, upgrades, car hire, and more.

With Capital on Tap, you first earn reward points whenever you make purchases on your business credit card. You can then convert these reward points into Avios. The number of Avios you receive for your points varies depending on your Capital on Tap card plan and the current conversion rates applicable to your account.

Once you have Avios, their value can differ based on how you choose to redeem them. For example, the Avios needed for a flight will depend on the destination, travel class, date of travel, and availability. You can explore flight options and check Avios requirements on British Airways’ Reward Flight Finder. Avios can also be used for other rewards like hotels, car hire, experiences, and more.

The Avios you collect with your business credit card for travel will stay valid as long as you collect, spend, purchase, or share at least one Avios every 36 months. If no action is taken in 3 years, your Avios will expire and be removed.

Checking your Avios is easy. Simply log in to your account with a British Executive Club account or one of their partners - Iberia Plus, Aer Lingus AerClub or Vueling Club. Your up-to-date Avios balance will be right there.

You can spend Avios to fly with British Airways, Iberia, American Airlines and any airlines within the oneworld alliance®, as well as other partners. These airlines can therefore be booked by using converted points collected by spending with the Capital on Tap Business Credit Cards.

The easiest way to check if you can spend your Avios on personal travel is to review your credit card’s terms and conditions.

Businesses can use Avios converted from the Capital on Tap Business Credit Cards to book discounted travel for employees or meetings/events.

Different credit card providers will have different Avios sign-up bonuses. With the Capital on Tap Pro plan, you’ll earn 10,000 bonus points you can convert to 10,000 Avios or £100 cashback when you spend £5,000 on your card in your first 3 months. This is applicable only to customers who have not previously received a sign-up bonus.

No, with Capital on Tap, there is no minimum monthly or annual spending requirement to convert rewards points to Avios.