Redeem your rewards your way

Business Rewards Credit Cards

Running a business is hard work — your card should work hard too. Make every purchase more rewarding with the Capital on Tap Business Credit Card.

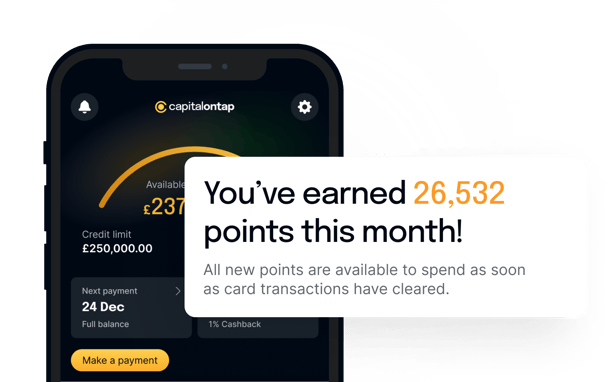

- 1% cashback on all card spend

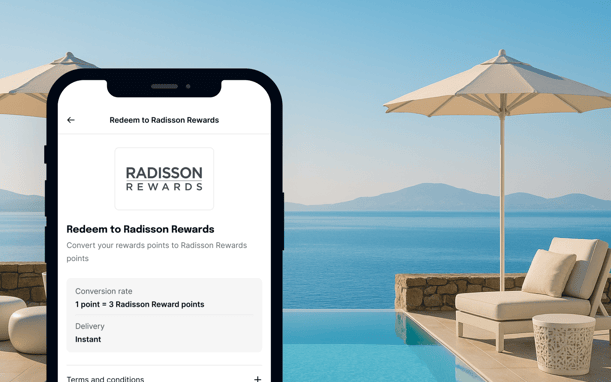

- Multiple reward redemption options

- Convert points to Avios for free