Jump to a section

Running a business is a juggling act, and nothing disrupts your rhythm more than waiting for payments to clear. When you've hit your credit limit, those waiting periods can pause essential spending and bring your cash flow to a standstill.

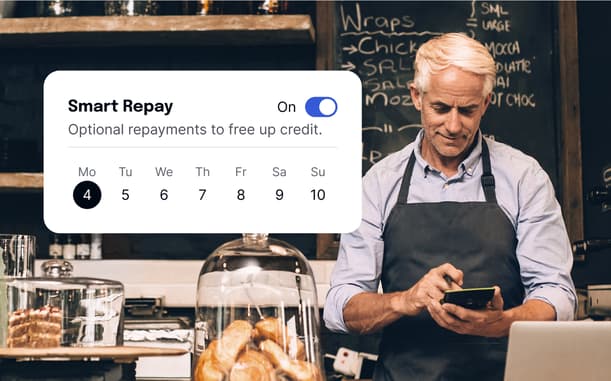

At Capital on Tap, we’re committed to making it easier to run your business, which is why we’re excited to announce Smart Repay. This new intelligent feature uses Open Banking to give you more speed and flexibility with two new repayment schedules: daily or weekly. Say goodbye to frustrating payment delays and hello to instant control.

The problem with slow payment clearance

For any small business owner, cash flow is king. So, when you make a repayment on your credit card, you expect your spending limit to be available again promptly. However, traditional payment systems like Direct Debit can be slow.

Many businesses experience delays of around four working days for a payment to clear. If you’re a weekly repayer, these waiting periods can add up to 16 working days a month where your funds are effectively frozen, creating significant cash flow disruptions. This delay can be more than just an inconvenience; it can prevent you from paying for crucial services, purchasing stock, or funding a new opportunity, ultimately costing you potential revenue.

How Smart Repay helps your business thrive

Smart Repay is our solution to the delays that can hold your business back. By using Open Banking technology, it allows us to transfer money from your account to ours instantly and effortlessly. Here’s how it helps:

-

Instant payments, instant access: With Smart Repay, your payments are transferred to us instantly. This means your available credit is updated right away, helping you to avoid the four-day clearance delays you might have experienced with Direct Debits. This instant settlement eliminates long lead times and lets you get back to business without interruption.

-

More control and flexibility: Smart Repay offers two new flexible repayment schedules: weekly or daily. Having these dedicated options gives you more control to manage your business's cash flow effectively, reducing the risk of over or underpayments.

-

Earn extra cashback: Pro customers who select the Daily Repay schedule receive an increased cashback rate of 1.25% (a 25% boost) on every pound spent, helping you maximise the rewards you earn on your everyday business spending. Please note: To qualify for the 1.25% rate, your full balance must be cleared daily. If an automated payment fails for any reason or you don’t sweep your full balance, simply make a manual repayment in full that day to ensure you still receive your boosted cashback.

-

Fewer disruptions: The instant nature of Smart Repay helps to prevent payment clashes and late-stage failures, ensuring a much smoother payment experience for your business.

How to switch to Smart Repay

Getting started with Smart Repay is simple.

Please note: To use Smart Repay, your nominated business bank account must be compatible with Open Banking. This is because the Open Banking technology it uses is not yet available at all UK banks. We also take into account your bank’s payment limits into consideration. If your bank isn't set up for Open Banking, you can still pay your balance via our standard Smart Repay via weekly Direct Debit

Current list of known compatible banks: Barclays, HSBC, Lloyds, Royal Bank of Scotland, Santander, Bank of Scotland, Danske Bank, and Monzo. This list is accurate as of December 2025. We strive to update this list promptly whenever a new compatible bank is added.

Steps to set up

-

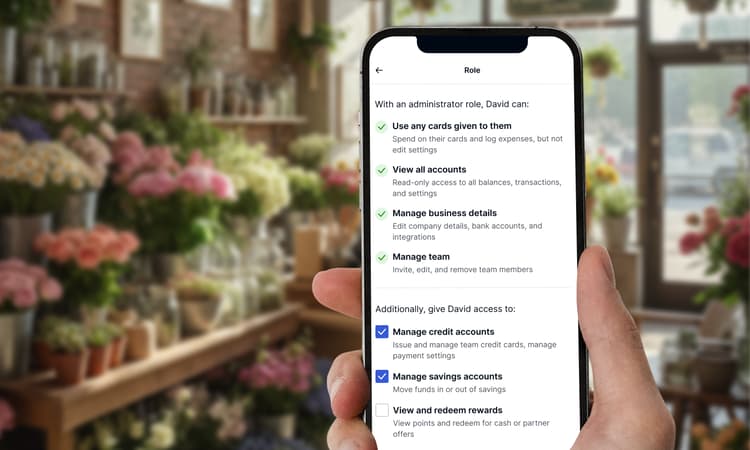

Log in: Access your Capital on Tap account online or via the mobile app.

-

Select 'Smart Repay': Navigate to the payments section and choose ‘Smart Repay' to begin.

-

Choose your schedule: Choose between the two available schedules: 'Weekly Repay' or 'Daily Repay'.

-

Confirm with your bank: You will be guided through a secure process to link your bank account. Following the on-screen steps, you will be transferred to your bank's app or online portal to authorise the new payment consent.

-

You're all set: Once you confirm, you’ll be redirected back to the Capital on Tap app. Your Smart Repay schedule is now active.

With more efficient and flexible repayment options, you get back valuable time and greater control over your finances. Switching to Smart Repay means you can manage your business's cash flow more effectively, without having to worry about frustrating issues like payment clearance delays.

Ready to leave payment delays behind? Making the switch to Smart Repay puts you in control of your cash flow. Check our FAQs if you have any questions about Smart Repay.

To find out more about how our business credit card can help you manage your finances, see how you can improve your business cash flow. You can also learn more about the benefits of our Capital on Tap Business Credit Card and how it’s designed for small business owners like you.