Jump to a section

Millions of people rely on credit cards to manage their finances, whether this is for their personal spending or business expenses. Yet how we use them - and how we feel about them - varies significantly. Credit cards still seem to be accompanied by a sense of caution, uncertainty and stigma, but why are people choosing to - or not to - utilise credit cards? And how does this differ between consumers and business owners?

To uncover the truth about how credit is being used across the UK, we surveyed over 250 UK business owners and 1,000 British consumers to find out how people are using credit and why, or why not, and how credit habits differ between business owners and consumers.

Inside business owners’ credit card behaviour

While business credit cards offer clear advantages, more than a third (36%) of business owners have never owned one, and a further 11% say they’ve used one in the past but have since stopped. Despite this hesitance to utilise business credit, 78% of business owners hold a personal credit card, suggesting that some may be relying on personal credit to support their business needs.

Many small business owners start out using their personal credit card for company expenses, especially in the early stages. But as a business grows, so does the need for financial separation, strategic cash flow management, and the unique benefits that business credit cards can offer.

Among business owners who do use a business credit card, the value is clear. The vast majority (80%) cite cash flow management as their primary reason, highlighting its usefulness during quieter periods. By comparison, only 34% use their personal credit card for this purpose.

Interestingly, newer businesses, particularly those between one and two years old, are the least likely to use personal credit for business cash flow. This may point to a shift in awareness, with emerging business owners more tuned into the advantages of separating personal and professional spending.

How small business owners use their credit cards

How business owners use their credit cards - whether business or personal - provides valuable insight into the realities of day-to-day operations and how financial habits evolve with growth. In particular, examining where credit is most often spent reveals key priorities and pressures across different types and sizes of businesses.

|

Category of spending |

Average monthly spend on credit card |

|

Employee-related expenses (e.g., payroll, perks) |

£1,903 |

|

Raw materials |

£1,708 |

|

Professional services (legal, accounting, consulting) |

£1,429 |

|

Marketing/advertising costs |

£1,368 |

|

Equipment or machinery |

£1,361 |

|

Inventory purchases |

£1,309 |

|

Shipping and packaging supplies |

£1,306 |

|

Client and staff entertainment |

£1,282 |

|

Travel and accommodation |

£1,263 |

|

Payment processing fees |

£1,246 |

|

Utilities and bills |

£1,230 |

|

Furniture and office decor |

£1,172 |

|

Office supplies |

£1,011 |

|

Subscriptions or software tools |

£962 |

When it comes to spending, the biggest chunk of credit card transactions goes towards employee-related expenses, including payroll and staff perks. On average, business owners spend around £1,902.90 per month on this category. Raw materials also see significant investment, with an average monthly spend of £1,707.50, followed by professional services such as legal, accounting, and consultancy, which account for £1,429.40 each month.

Businesses that have been operating for over a decade tend to lean even more heavily into professional services, spending an average of £2,076.70 per month in this area. Meanwhile, smaller businesses with fewer than five employees are more likely to allocate their credit spend toward equipment and machinery, averaging £520.70 each month.

Business owners also appear to be selective about which expenses go on which card. Business credit cards are most likely to be used for marketing, advertising, and staff or client entertainment (68%) - areas seen as essential for growth and reputation building. In contrast, 22% continue to use their personal cards for day-to-day operational costs like utilities and bills - likely just a habitual decision.

|

Spending category |

Business credit card |

Personal credit card |

Both |

|

Utilities and bills |

42% |

22% |

32% |

|

Furniture and office decor |

55% |

14% |

29% |

|

Office supplies |

60% |

14% |

25% |

|

Shipping and packaging supplies |

61% |

14% |

24% |

|

Professional services (legal, accounting, consulting) |

64% |

11% |

23% |

|

Travel and accommodation |

56% |

19% |

22% |

|

Subscriptions or software tools |

55% |

17% |

22% |

|

Payment processing fees |

64% |

8% |

21% |

|

Client and staff entertainment |

68% |

11% |

21% |

|

Employee-related expenses (e.g., payroll, perks) |

65% |

11% |

19% |

|

Equipment or machinery |

62% |

16% |

19% |

|

Raw materials |

61% |

17% |

18% |

|

Marketing/advertising costs |

68% |

14% |

18% |

|

Inventory purchases |

62% |

21% |

15% |

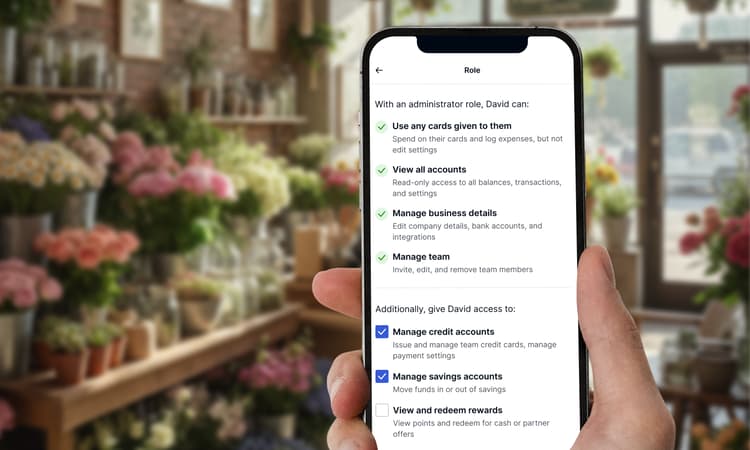

Alex Miles, Chief Operating Officer at Capital on Tap, comments: “When starting out, it's common to set up utilities and recurring bills on a personal credit card - especially before becoming eligible for business credit - and then never revisit this setup. The reality is, to build business credit, you need to actively use it. The more expenses you can channel through a business credit card, the better your opportunity to strengthen your business credit profile. It also helps maintain a clear divide between personal and business finances, reducing confusion and potential risk. Plus, business credit cards typically offer higher limits than personal cards, meaning you’re less likely to hit a ceiling as your business grows.”

How credit card use differs by industry

While many businesses across the UK are embracing credit cards as a practical tool for managing their finances, our survey reveals that attitudes and usage both differ significantly across industries.

Leading the way in adopting business credit cards are building and construction firms, with nearly two-thirds (65%) of owners in this sector reporting that they own one. This industry also shows the biggest differences in terms of repayment - only 35% of businesses pay their balance in full each month, and 12% admit to leaving payments outstanding for six months or more, higher than in any other sector.

In contrast, just 23% of personal care business owners (such as nail and hair salons) and 35% of those in arts and crafts currently use a business credit card, showing the lowest engagement with credit. Adding to this, only one in ten personal care business owners say that they would consider using one in the future, again indicating widespread reluctance. That said, those who do engage with credit in the personal care industry find high credit limits particularly appealing, with 50% identifying this as the card’s most valuable feature.

Consumer credit card habits

Almost three-quarters of Brits own a personal credit card, with 41% using it as part of their everyday spending. However, when comparing credit card spending habits between business owners and consumers, consumers typically spend far less each month.

|

Category of spending |

Average monthly spend on credit card |

|

Holidays/travel |

£389.20 |

|

Rent or utilities |

£318.20 |

|

Insurance |

£244.70 |

|

Education or training (e.g. online courses, school fees) |

£239.20 |

|

Home improvement or furniture |

£237.10 |

|

Groceries |

£233.40 |

|

Charitable donations |

£196.80 |

|

Pet care (e.g. vet bills, food, insurance) |

£181.60 |

|

Health and fitness (e.g. gym membership, medical expenses) |

£178.90 |

|

Online shopping (e.g. clothing, electronics) |

£157.80 |

|

Transport |

£154.00 |

|

Gifts and celebrations (e.g. birthdays, holidays) |

£153.30 |

|

Subscriptions (e.g. streaming services, digital tools) |

£151.40 |

|

Other things |

£148.00 |

|

Dining out or entertainment |

£135.00 |

When it comes to what the general population are using their credit cards for, travel and holidays top the list. The average person spends £389.20 per month on getaways, adding up to nearly £4,700 a year, likely a way for people to spread the cost of these luxuries.

What’s perhaps more surprising is that essential costs like rent and utility bills also feature heavily, with average credit card spending reaching more than £550 on them combined, placing them within the top three spending categories. However, rather than a sign of financial strain, this may reflect a strategic approach to spending. By putting recurring expenses on their credit cards, many individuals are making the most of rewards programmes - earning cashback, points, or other perks on payments they would be making anyway.

Alex adds, “Many people assume credit cards should only be used for emergencies or occasional luxury spending, but that mindset can limit their true potential. When used strategically, a credit card can help build your credit score, smooth out cash flow, and reward you for everyday purchases. Ultimately, credit should be viewed as a financial tool, not a last resort.”

Generational differences in credit usage

Age seems to play a significant role in shaping our relationship with credit. While 53% of Brits have maxed out their credit card at some point, that figure increases to 78% among 18-24-year-olds. In contrast, just 31% of over-65s can say the same. Younger consumers are not only more likely to hit their limits, but also more likely to miss payments.

|

Age group |

% who have missed credit card payments in the past |

% who have maxed out their credit card at some point |

|

18-24 |

36% |

78% |

|

25-34 |

34% |

69% |

|

35-44 |

28% |

68% |

|

45-54 |

20% |

55% |

|

55-64 |

20% |

40% |

|

65 or over |

6% |

31% |

These contrasts reveal a generational shift in attitudes toward debt. Older consumers treat credit with caution and discipline, while younger users may see it as a flexible financial tool, but one that carries higher risk if not carefully managed.

How consumer and business credit card habits differ

While the distinction between personal and business credit cards may seem obvious - one funds personal spending, the other business expenses - there are some more subtle differences. Our survey looked further into these nuances, highlighting how both groups value benefits and the main factors preventing them from embracing credit.

Maximising perks and benefits

While business owners primarily use their business credit cards to manage their cash flow, and consumers tend to use them to spread costs, these are far from the only benefits.

When it comes to maximising perks, business owners seem to be a step ahead. Almost two-thirds of business owners (63%) using business credit cards cite perks and rewards as a key reason for doing so, compared to just 50% of consumers. This gap could suggest a lack of awareness or understanding of these benefits among consumers who may be unknowingly missing out.

For business owners, cashback on purchases tops the list as the most appealing benefit, with 49% saying it's the most attractive advantage, followed by point-based rewards (35%), and travel perks (22%). Travel credit cards, in particular, offer extra incentives such as access to premium airport lounges, accelerated flight points, and complimentary travel insurance can be especially valuable for frequent flyers.

However, it is important to remember that these rewards are only beneficial when they’re paired with responsible spending habits. Alex adds, “Both business and personal credit cards come with unique benefits - the smartest credit card users treat those expenses as an opportunity to unlock rewards. However, rewards should never be the reason to spend more than you can afford. The most savvy credit card users treat points and cashback as a bonus, not a goal.”

It’s easy to get swept up in the excitement of earning rewards, but discipline is key. Use your credit card for purchases you were already planning to make - then pay the balance off in full. That’s how you maximise value without creating risk.

Why are some Brits choosing not to use credit cards at all?

Despite their widespread use and clear advantages, credit cards still come with a sense of hesitation, both among consumers and business owners. Over half of consumers (54%) say that they actively avoid using credit cards, and 46% of business owners don't have a business credit card. But what exactly is holding them back?

|

Barriers to credit card use |

% of business owners who say this is a barrier |

% of consumers who say this is a barrier |

|

High interest rates or fees |

34% |

31% |

|

Worried about overspending |

27% |

36% |

|

Concern about accruing or accumulating debt |

27% |

33% |

|

Prefer paying upfront using cash, bank transfers, or savings |

21% |

31% |

For business owners, the top concern around credit card use is high interest rates and fees, cited by 34%. While 31% of consumers also worry about this, it is not their primary concern, suggesting that business owners may be more focused on the long-term implications of credit, especially when managing larger or recurring expenses.

The primary concern of consumers, by contrast, is a fear of overspending. Over a third (36%) identify this as their main concern, compared to just 27% of business owners. Fear of accumulating debt is also shared across both groups - 33% of consumers and 27% of business owners.

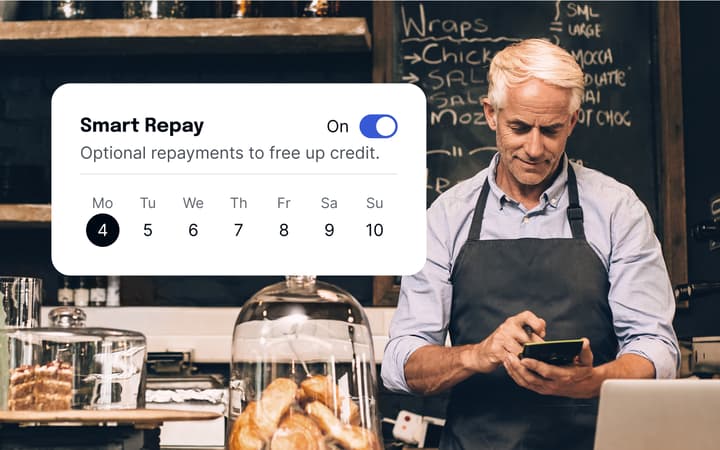

However, Alex explains that the idea that credit cards mean taking on debt is one of the biggest credit myths: “If you clear your balance in full each month, you won't pay interest. Instead, you gain access to short-term cash flow flexibility during lower-income periods or for unexpected expenses.

“The key is to spend within your means. If you’re new to using credit, consider setting a lower credit limit to help manage spending. It’s also wise to integrate your card into your monthly budget and set up a direct debit to automatically repay your balance on time. That way, you stay in control without the stress.”

A preference for paying upfront also plays a role in consumer hesitation. Almost a third (31%) of consumers avoid credit for this reason. Business owners are less tied to this idea, though, with only 21% saying they avoid credit because of a preference to pay up front.

While many consumers remain cautious, many business owners are beginning to embrace the benefits that credit can bring. By understanding how credit truly works and how to use it responsibly, both groups can make more informed decisions and utilise credit as a powerful financial tool.

Sources and methodology

All data regarding the use of credit in business and business credit cards was taken from a survey of 256 UK business owners. The survey was conducted in May 2025.

All data regarding consumer credit usage was taken from a survey of 1009 British consumers. The survey was conducted in May 2025.