Jump to a section

When you’re running your own business, every decision counts. Among these decisions is the selection between a business debit card and a credit card, and your choice can significantly impact your financial strategy.

This guide is your compass in navigating the complexities of business payments. We'll cut through the jargon to help you make sure you have the right information to make a practical decision that aligns perfectly with your business needs.

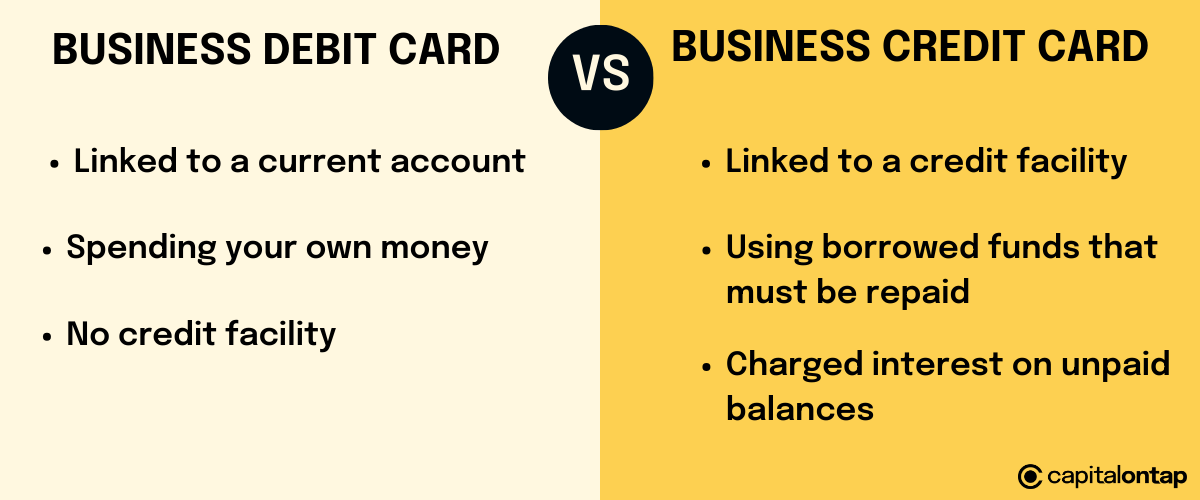

What’s the difference between credit cards and debit cards?

Key features of credit and debit cards

- Debit cards take money directly from your bank account when used. Credit cards allow you to borrow money that you repay later.

- You can only spend money in your account with a debit card, unless you have an overdraft. With credit cards, you can spend up to your set limit and pay later.

- Debit card payments are stopped when your account is empty. You can keep using a credit card until you hit your limit, but you may owe interest on what you borrow.

Debit card

A debit card is like a direct link to your bank account. When you use it, you're usually spending your own money, and the purchase amount is instantly deducted from your bank account. To do this, you need to make sure you have enough money in your account or have an agreed-upon overdraft limit.

An overdraft facility grants you the ability to use funds from your current account, even if it means your account balance will dip into a negative balance. This means you can spend more than what's currently in your account, but it often comes with an associated fee and interest on the amount you overdraw.

So, with a debit card, you’re making withdrawals or purchases with your own money from the balance in your account, and you may be charged interest or fees if you go into an unarranged overdraft.

Credit card

A credit card, such as a Capital on Tap Business Credit Card, isn't linked to your current account or debit card. It's a credit facility that enables you to buy things immediately, up to a pre-arranged limit, and pay for them later. When you use your credit card, you're essentially borrowing money from the credit card company, which you'll need to pay back later. Credit cards have a maximum borrowing limit, indicating the highest amount you can use with the card at once.

You can pay back the credit you’ve borrowed either in full at the end of your billing period, or choose to make a minimum repayment. If you choose to only make the minimum repayment, you'll have to pay interest on the remaining balance. If you pay off your credit card balance in full at the end of your billing period, you won’t pay any interest.

There are different types of credit cards, including:

- Business credit cards: Specifically designed for business users, not to be used for personal purchases

- Personal credit cards: Designed for personal use

- 0% purchase credit cards: Help spread the cost of items interest-free for a set period

- Balance transfer credit cards: Let you move your balance to another card to save money

- Credit builder cards: Often aimed at those in need of help to build their credit score

Understanding business debit cards

Business debit cards are designed specifically for businesses. These cards are linked to a business' current account, providing a convenient way to manage expenses, make purchases, and access funds.

Business debit cards: pros and cons

Pros

- Avoiding debt: With a business debit card, you can only spend what's in your account, so you never accumulate debt, giving you complete control over your spending.

- Eligibility: Business debit cards are easier for many businesses to get because they have fewer requirements than business credit cards.

Cons

- No access to credit debt: In urgent situations, you might have restrictions because you can only use the money you have in your account.

- Lack of rewards: Usually, you don't get cashback or rewards with business debit cards.

Exploring business credit cards

Business credit cards provide a distinct financial tool for businesses, offering access to a revolving line of credit. This feature allows businesses to make purchases, manage expenses, and build credit.

Business credit cards: pros and cons

Pros

- Cashback and rewards: For businesses with tight margins, uncapped cashback and credit card rewards could make a huge difference to their bottom line.

- Expense tracking: Some credit cards come with integrated expense tracking and management solutions to streamline your business bookkeeping.

- Build credit: Using a business credit card allows you to build your business credit score if you use it responsibly.

- Protection: You get liability protection against fraudulent or unauthorised transactions made using your credit card.

Cons

- Qualifying: Not all businesses will qualify for a business credit card.

- Interest charges: Interest rates on unpaid balances can impact your bottom line.

Business debit card vs credit card: Comparing key factors

Now that you know the pros and cons of using debit and credit cards for your business expenses, you can decide which is better for you. But remember, you don't have to pick just one – you can actually have both a business credit card and a business debit card if that suits your needs!

Spending limits and debt

Business debit cards limit your spending to what you have in your bank account, ensuring financial responsibility.

However, business credit cards offer a spending limit that can be advantageous when you need extra flexibility for larger expenses or emergencies. Just remember to use them wisely to avoid unnecessary financial constraints for your business.

Cash flow management and expense tracking

Business debit cards help track cash flow since transactions instantly appear in your bank account.

However, many business credit cards offer additional benefits with their detailed expense tracking tools, plug-ins for your favourite accounting software, and the ability to issue additional cards to your employees making them a valuable asset for effective financial management and expense reimbursement.

Credit building

When it comes to building credit, business debit cards and credit cards have different effects.

Business debit cards don't help build business credit, but they can keep your banking relationship positive. They show that you manage your finances responsibly.

On the other hand, business credit cards can be essential for establishing and improving your business credit. Using them responsibly and paying on time can build a strong credit history, which can be valuable for getting loans or better deals from suppliers in the future.

Rewards

Business debit cards usually do not offer any reward programs. They're designed primarily for simple transactions linked to your bank account without any additional perks.

On the other hand, business credit cards often come with various rewards and benefits, such as cashback on purchases, travel perks, and discounts. This makes them an appealing choice for businesses looking to gain more from their everyday spending.

Eligibility

Business debit cards are usually easier to obtain because they are linked to a bank account, not a credit account. This lower risk for financial institutions makes them more accessible.

Business credit cards, on the other hand, may have stricter approval requirements, but they offer a broader range of benefits, making them a valuable addition for those who qualify. So, having a business credit card can be a good choice for individuals seeking more rewards and advantages, albeit with potentially stricter approval criteria.

When is it better to use a business credit card?

- Larger purchases: When your business needs to make substantial purchases or investments, a business credit card can provide the necessary flexibility. The predefined credit limit allows you to manage significant expenses without depleting your cash reserves. If your business credit card offers rewards, you could also earn points or cashback on this purchase.

- International transactions: If your business conducts international transactions or frequently deals with foreign currencies, many business credit cards offer favourable currency conversion rates which can be a significant advantage, especially if it does not charge foreign transaction fees.

- Purchase protection: When you're looking for extra purchase protection, a business credit card can be invaluable. Many credit cards offer benefits like extended warranties, purchase insurance, and fraud protection, which can safeguard your business against unforeseen issues with purchased items.

When is it better to use a business debit card?

- Budget control: If your priority is to maintain strict control over your business' spending and avoid accumulating debt, a business debit card is ideal. It restricts your spending to the funds available in your linked bank account, preventing overspending.

- ATM withdrawals: Business debit cards provide easy access to cash through ATMs, making them convenient for businesses that require frequent cash transactions or need to pay vendors or employees in cash.

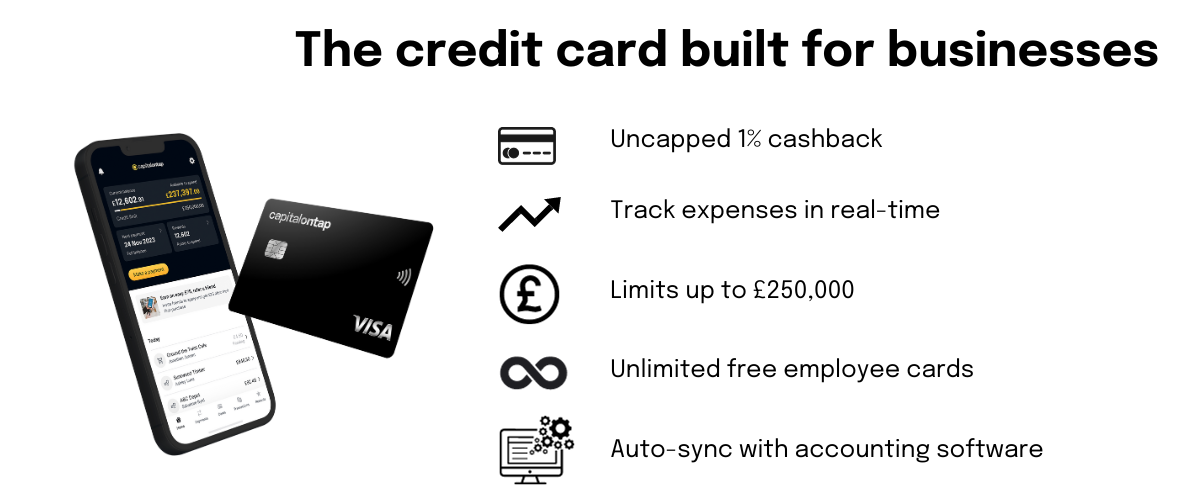

Why choose a Capital on Tap Business Credit Card?

Capital on Tap is the credit card built for small businesses. To sustain your cash flow, borrow our line of credit for up to £250,000 to spend and repay either weekly or at the end of your monthly billing cycle.

We provide both physical and virtual cards to you and your employees to fuel your employees’ and teams’ expenses. You can create unlimited employee cards and assign them to different employees. Each cardholder can also have up to 5 virtual cards dedicated to specific projects, subscriptions or suppliers, all with no annual fee.

Learn more about the 200,000 customers who have made the smart choice by opting for the Capital on Tap Business Credit Card to enhance their business operations.

The bottom line

Business credit cards have clear advantages, but whether they’re right for you depends on how you manage your business budget and money. If you have enough cash and can pay off the card each month or afford interest costs, go for it - reap the rewards business credit cards can offer on your everyday business spending. But if you might spend too much or carry an unmanageable balance, think twice.

If you want to boost your credit and could use some assistance with your cash flow, a credit card is a strong solution. But if you prefer to use your own cash and don't care about rewards, stick with a debit card.

Having both a business credit card and a debit card gives you options. You can use a credit card for regular payments, which ensures your bills are covered without draining your bank account, and it also helps you track your spending easily. Additionally, if you're carrying a balance on your business credit card, you can use your debit card for everyday expenses to avoid extra interest charges.

Ready to reap the rewards of a business credit card? Apply for a Capital on Tap Business Credit Card today without impacting your credit score.

This does not constitute financial advice. If you wish to understand the suitability of a credit or debit card for your business, contact your financial advisor or accountant.