Jump to a section

APR stands for Annual Percentage Rate. APR is a measure of how much borrowing a sum of money will cost you over a year, given as a percentage of the money borrowed.

When you borrow money, the APR tells you how much it will cost you each year. It considers the interest rate set by the lender and additional fees they may charge, like application fees or closing costs. By looking at the APR, you can compare different borrowing options and see which one is cheaper overall.

The higher the percentage, the higher the cost of borrowing, so the more expensive it’ll be to borrow.

The lower the percentage, the lower the cost of borrowing, so the cheaper it’ll be to borrow.

However, APR doesn't consider how interest compounds, or grows, over time, so it's a simplistic measure. It gives you a good starting point to compare different loans or investments, but keep in mind that the actual costs may be slightly different.

Decoding APR: unveiling the annual percentage rate

Although the APR does take into account interest and all standard fees, including annual and application fees, APR doesn’t include late fees, cash withdrawal fees and other extra charges. This means that the cost of borrowing may be higher than indicated by the APR.

Differentiating APR from interest rates: understanding the distinction

APR is different from interest.

The interest rate is the amount you would be charged over a year for borrowing an amount. The APR includes any additional fees you’ll be expected to pay as part of your lending agreement.

Example:

Let's calculate how utilising the entire credit limit of £1,200 with the intention to repay in full after 2 years, an interest rate of 18.9% and an annual fee of £150 results in a 31.4% APR.

Interest Charges: To calculate the total interest charges, we multiply the credit limit (£1200) by the interest rate (18.9%) and the length of loan term in years (2): Interest Charges = (£1200 * 18.9% * 2) = £453.60

Fees: The annual fee is £150.

Now, we add the interest charges and the annual fee to calculate the total cost of borrowing:

Total Cost of Borrowing = Interest Charges + (Annual Fee * Length of loan term)

Total Cost of Borrowing = £453.60 + (£150 * 2) = £753.60

APR: Now, we need to express the total cost of borrowing (£753.60) as a percentage of the amount spent (£1200), divide by the number of days in the loan term and multiply by 100 to calculate the APR.

APR = ((Total cost of borrowing / Amount Spent) * Number of days in loan term) x 100

APR = (£753.60 / £1,200) / 730) * 365) * 100

APR = 0.314 * 100

APR = 31.4%

Therefore, if the entire credit limit of £1200 is spent on the first day and is outstanding for 2 years, the APR would be approximately 31.4%.

What does typical or representative APR mean?

Representative or typical APR is the rate that is offered to at least 51% of customers who apply successfully for the credit card or loan. This means it’s the rate that most people will receive, but it’s not guaranteed for everyone.

The final cost of borrowing will depend on factors such as the actual interest rate you are offered, how you utilise the credit card or loan, and the amount you repay on a monthly basis.

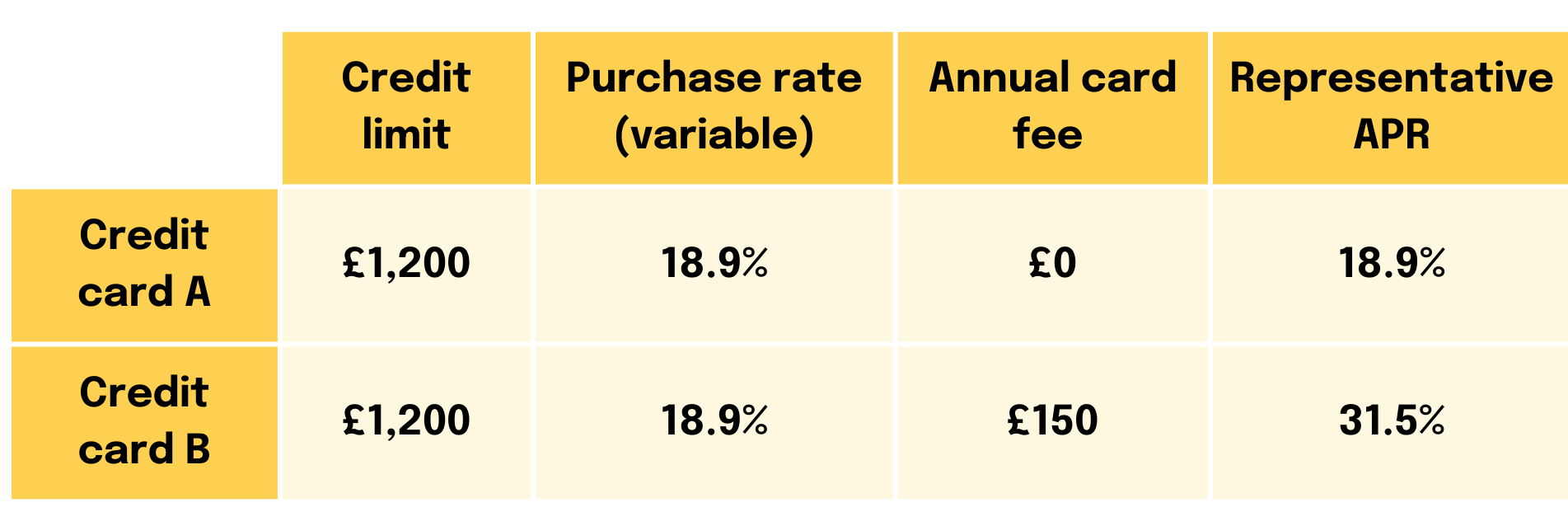

This means the APR may not directly reflect the exact cost of a credit card or loan to you, but can be used as a way to compare different products. For example, it can be used here to compare credit card A and credit card B:

Here, APR can be used to quickly identify that credit card A (18.9% representative APR) should be cheaper than credit card B (31.5% APR).

However, APR doesn’t take into account the potential benefits that could be earnt using either card. So, whilst credit card A should be cheaper, you may earn more rewards, such as Avios points or cashback, using credit card B, making it the more worthwhile choice.

That’s why it’s important to do thorough research before taking out any credit card or loan.

Defining APR: What small business owners need to know

Now you understand what APR is, what else do you need to know?

- Shop around: APR enables you to compare loans from various lenders. By considering the APR, you can make more informed decisions about which loan may be the most cost-effective for your business.

- Repayment: While APR reflects the annual cost of a loan, it's essential to consider how your business intends to repay the loan. Understanding your repayment capabilities, such as monthly instalments or lump sum payments, will impact the actual total cost of the loan over time.

- Complete picture: Although APR provides a standardised metric for comparing loans, it's essential to consider other factors as well. Evaluate the loan term, flexibility, repayment terms, customer support, and other terms and conditions offered by different lenders. APR is a useful starting point, but it shouldn't be the sole criterion in your decision-making.

Calculating APR: A step-by-step guide for clarity

Calculating APR can be a bit complex, as it involves considering the interest rate, loan term, and any additional fees or charges associated with the loan. The exact calculation may vary depending on the specific terms and compounding frequency. In addition, you won’t be required to calculate the APR of a lending product as it will always be provided by the lender. However, here is a simplified overview of the general process:

- Gather loan information: Collect all the necessary details about the loan, including the loan amount, interest rate, loan term, and any additional fees or charges.

- Determine the payment period: Identify the frequency at which payments are made (e.g. monthly, quarterly, annually).

- Calculate the periodic interest rate: Divide the annual interest rate by the number of payment periods in a year. For example, if the annual interest rate is 6% and payments are made monthly, the periodic interest rate would be 6% divided by 12 (months), which is 0.5%.

- Calculate the periodic payment amount: If you have access to a loan calculator or spreadsheet software, you can use formulas to calculate the periodic payment amount. Otherwise, you can use financial formulas like the amortisation formula to determine the payment amount based on the loan amount, interest rate, and loan term.

- Account for additional fees: If there are any upfront fees, closing costs, or other charges associated with the loan, add them to the total cost of the loan.

- Determine the total repaid amount: Multiply the periodic payment amount by the total number of payment periods over the loan term. This gives you the total amount repaid, including both principal and interest.

- Calculate APR: Using the loan amount, total repaid amount, loan term, and additional fees, apply the APR formula. This formula involves solving for the interest rate that equates the total repaid amount with the loan amount. This process may require iterative calculations or the use of financial software.

- Express APR as a percentage: Once you've calculated the APR, convert it into a percentage to represent the annualised cost of the loan.

Note that this simplified explanation may not cover all scenarios or factors that can affect APR calculations. For accurate and specific calculations, it is advisable to consult with a financial professional or use specialised loan calculators and software.

What is APR on a credit card?

APR on business or personal credit cards is exactly the same as we’ve already looked at; APR gives you an estimate of how much borrowing money on a credit card will cost.

Choosing wisely: selecting the right card for your business

A good credit card APR is one that's below the national average credit card rate, which is around 21% as of the first quarter of 2023 in the UK.

The Capital on Tap Business Credit Card rates are as low as 14.40% APR (variable).

Fixed vs. variable APR: pros and cons for small businesses

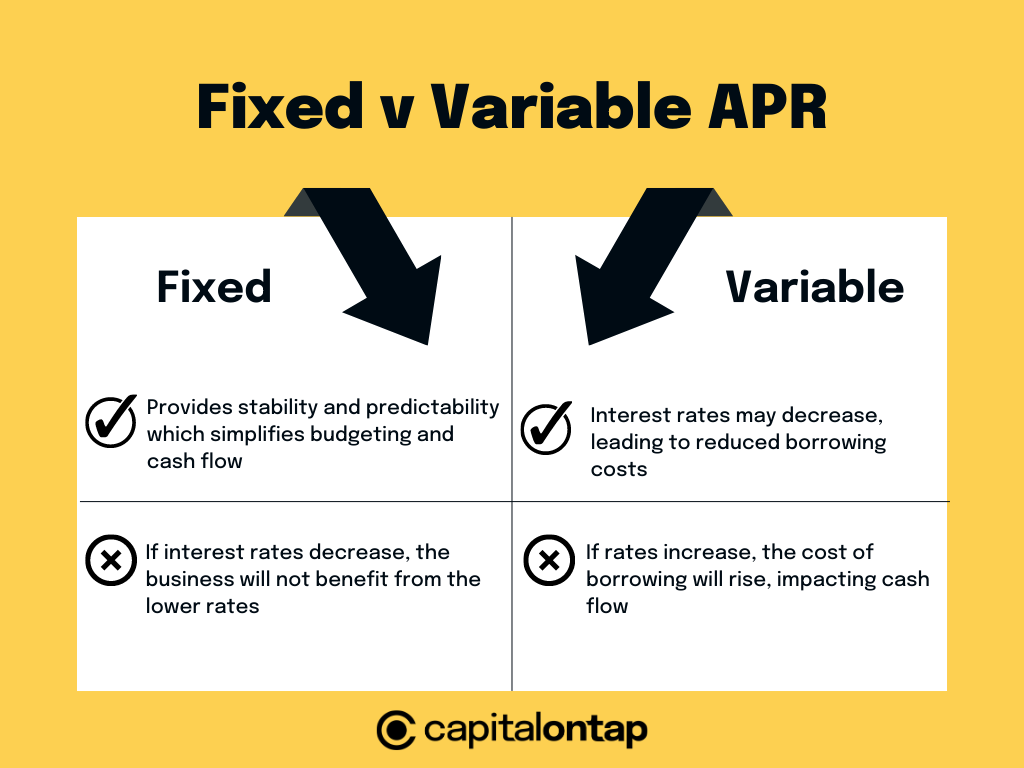

Fixed APR: A fixed APR provides stability and predictability for small businesses. The interest rate remains constant over the life of the loan, allowing businesses to plan their finances accurately.

Pro: This consistency simplifies budgeting and cash flow management since the monthly payments remain the same. Small businesses can rely on a fixed APR to maintain a steady repayment schedule, making it easier to forecast future expenses and allocate resources accordingly.

Con: If interest rates decrease in the market, the business will not benefit from the lower rates and may end up paying more over time.

Variable APR: Variable APRs are tied to market interest rates, such as the prime rate or the LIBOR. These rates fluctuate over time, which means that the APR and monthly payments can also change.

Pro: There is the potential to benefit from lower interest rates if they decrease, resulting in reduced borrowing costs for the business.

Con: Rates can also increase, leading to higher monthly payments and potentially impacting the business's cash flow.

Cost considerations: How APR affects your bottom line

APR can have a significant impact on a small business's bottom line in the following ways:

- Cost of Borrowing: APR determines the total cost of borrowing funds for a small business. A higher APR means higher interest payments and fees, resulting in increased expenses for the business. This can directly reduce profits and impact the overall financial health of the business.

- Loan Repayment: A higher APR leads to larger monthly loan repayment amounts. If a small business has taken on a loan with a high APR, it may face challenges in meeting the repayment obligations, especially if cash flow is limited. This can strain the business's finances and potentially affect its ability to invest in growth initiatives or cover essential operational expenses.

- Competitive Advantage: The APR can impact a small business's ability to compete effectively in the market. If a business has higher borrowing costs due to a higher APR, it may be at a disadvantage compared to competitors with lower borrowing costs. This can affect pricing strategies, profitability, and the overall competitiveness of the business.

Understanding and managing the APR effectively is vital for small businesses to maintain a healthy bottom line and achieve long-term financial success.

The bottom line

APR provides a standardised metric that incorporates interest rates and additional fees, allowing for effective comparison among various loan or credit card offers. By considering APR, you can assess the overall cost of borrowing and make informed decisions. However, it's important to recognize that APR has limitations, as it doesn't account for compounding interest or certain extra charges. Therefore, you should conduct thorough research, considering factors beyond APR alone, such as rewards programs or cashback benefits.

For small businesses, managing APR becomes crucial as it directly impacts the bottom line. Higher APRs result in increased borrowing costs, larger monthly loan repayments, and potential challenges in meeting repayment obligations. It can also affect your business's competitiveness in the market. Therefore, businesses must carefully evaluate borrowing options, compare APRs, and consider factors like repayment capabilities, loan terms, and other terms and conditions offered by lenders.

While APR serves as a valuable starting point, it should not be the sole criterion for decision-making. Striving for an APR below the national average and exploring options like the Capital on Tap Business Credit Card with competitive rates can help businesses optimise their borrowing strategies and maintain financial health.

This does not constitute financial advice. If you want to understand APR in detail, you should speak to your financial advisor or accountant.