Jump to a section

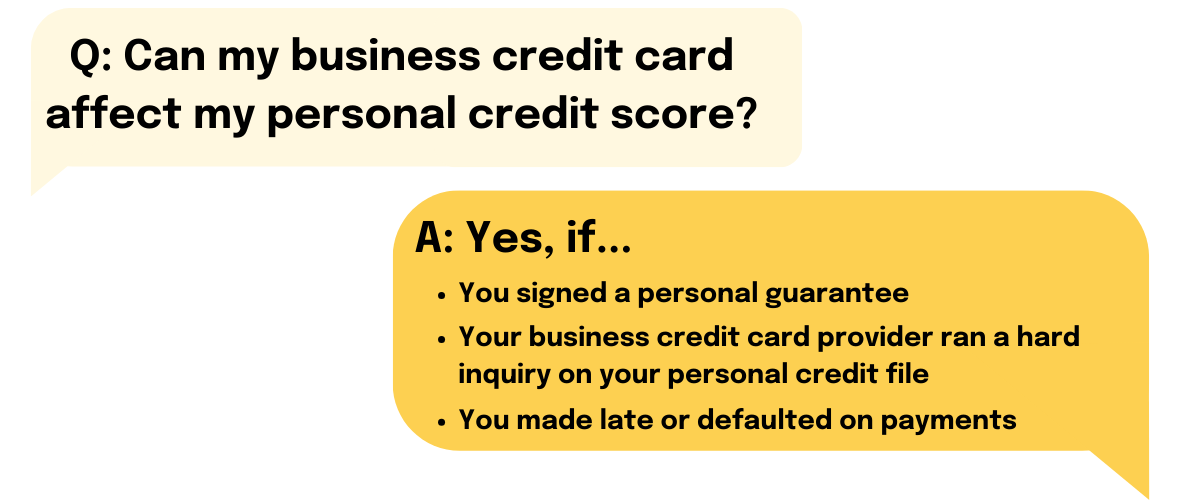

As a small business owner, you work hard to keep your personal and business finances separate. But how does applying for a business credit card affect your personal credit score?

The answer depends on the business credit card you choose and how you use it. The key is choosing the right card for you, and using it wisely. With some research and responsible habits, a business credit card can provide financing without hurting your personal credit. So let’s get started.

Key takeaways

- Business credit scores are separate from personal credit scores, but a business card can still impact your personal score

- Paying late or defaulting on a business card with a personal guarantee can hurt your personal credit score

- To protect your personal score, pay bills on time, only spend what you can pay back, and only use your business credit card for business purposes

- With responsible use, a business card provides financing without damaging your personal credit profile

Is business credit separate from personal credit?

There are two types of credit: personal and business. Personal credit is your score as an individual. It's based on things like paying your bills on time, the amount of loans or credit cards you have, and your current unpaid debt. A good personal credit score can help you get approved for loans, credit cards, and other things in your personal life, like a mortgage for a house.

Business credit is different. It's the score and rating for a company, not a person. A good business credit score can help your company get approved for business loans and credit cards.

The main thing to understand is that your business and personal credit files are separate. But, applying for and how you use a business credit card can have a big impact on your personal credit score.

Does business credit affect personal credit?

If you’re going to take out or use a business credit card and you’re unsure if it will affect your personal credit score, you need to understand the answers to these key questions:

-

Will a business credit card provider check my personal credit file?

-

Does my business credit card have a personal guarantee?

-

Have I defaulted or made late payments?

1. Will a business credit card provider check my personal credit file?

When you apply for a business credit card, the provider will check your business credit file. This is called a credit inquiry. A credit inquiry lets the provider see how you handle money - kind of like a report card for how you pay bills and use credit cards. When you want a loan or get a new credit card, the company will do a credit inquiry to help them decide if they should give you the loan or credit card.

Some providers will also run an inquiry on your personal credit file - especially if a personal guarantee is attached to the card.

There are two main types of credit inquiries:

- Soft search: Soft inquiries don't affect your credit score at all. Sometimes, companies will do a soft inquiry as a background check or to see if you might qualify for one of their credit cards or loans.

- Hard search: Hard inquiries show up on your credit report and may temporarily lower your credit score a little bit. Common hard inquiries are some credit card, loan, or property rental applications.

Not all business credit card providers will do a hard check on your personal credit file.

2. Does my business credit card have a personal guarantee?

If your business credit card has a personal guarantee, it has the potential to impact your personal credit score.

A personal guarantee is a document that asks you to personally promise to pay back a loan or credit card debt if your business can’t. Signing a personal guarantee means the bank or lender can make you use your own money to repay the debt if the business doesn't or can’t repay.

A personal guarantee gives banks, loan and credit card providers confidence to lend money to your business. But it puts your own credit score at risk if the business struggles and you cannot repay the money owed.

3. Have you defaulted or made late payments?

Most business lenders only send information to your personal credit report if something goes wrong. For example, if your business pays its credit card bill late, that could show up on your personal credit report.

This is a problem because late payments hurt your credit score. If your business credit card gets reported late on your personal credit file, it will lower your personal score.

A lower personal credit score can cause other issues. It might be harder to get a loan, rent property, or get your own personal credit card later.

So, if your business credit card provider will perform a hard search on your personal credit file, the business credit card has a personal guarantee, you made late payments, or defaulted on payments, your business credit card will affect your personal credit profile.

How do business credit cards affect your personal credit?

Using a small business credit card can either help or hurt your personal credit score.

Paying your credit card bill on time every month is good for your business credit. Making payments on time shows lenders you are reliable, which can improve both your business and personal credit scores over time, putting you in a better position to apply for any personal credit if it’s needed.

Does a company credit card affect employee credit scores?

When a business gets a credit card, the directors or owners are usually the main account holders. These are the people who sign the personal guarantee promising to pay back any charges on the card.

Let's say the owner of a company gets a business credit card with a personal guarantee. The owner's personal credit reports will show the card's activity.

But what if employees also get cards for the business? Their names are not on the account. So any charges they make are not reported to their personal credit reports. Using a company card does not affect the credit scores of employees - only the main account holders. So, employees don't have to worry that work charges on a company card will help or hurt their personal credit scores.

What types of business credit card activity is reported to the credit bureaus?

Credit bureaus get information about your credit accounts from banks, credit card companies, and other lenders. The credit bureau puts all this information together to make your credit report. They keep track of how you handle credit so lenders can decide whether to give you a new loan or credit card.

How do business credit cards appear on your personal credit report?

When you first apply for a business credit card, it might show up as a ‘hard inquiry’ on your personal credit report. That just means you applied for new credit.

After that, the credit card company usually only reports information to business credit bureaus rather than personal ones. The one big exception is if you make late payments or don't pay your bill. Then, they will report it to the personal credit bureaus too.

How can I protect my personal credit score from a business credit card?

To keep your personal credit score safe when you have a business credit card:

- Pay your bill on time every month. If you pay late, it could hurt your personal credit score. If you set up a Direct Debit, your payments are taken automatically - one less thing to think about!

- Only spend what you can pay back. If you can’t pay back what you owe and you go into debt, this might be reported on your personal credit report.

- Only use the card for business expenses, like office supplies. Don't use it to buy personal things like holidays or clothes. Keep business and personal spending separate.

Following these rules can help protect your personal credit even though you have a business card. Pay on time, don't overspend, and use it just for the business. Then your personal credit score is likely to stay strong.

The bottom line

Running a business is tough, and securing financing can be one of the hardest parts. A business credit card can provide much needed funds, but can put your personal credit at risk.

The good news is that you can apply for and use a business card responsibly, without it negatively impacting your personal score. Do your research to find a card that fits your needs; make payments on time every month; only spend what you can pay back, and use the card only for actual business expenses.

Following these best practices allows you to tap into business credit without harming your personal credit profile. Your business can access the financing it requires while you maintain your good standing to qualify for future personal loans and credit as needed.

This does not constitute financial advice. If you wish to understand the impact of a business credit card on your personal credit file, contact your financial advisor or accountant.