Jump to a section

Launching a startup in the vibrant UK scene requires more than just a brilliant idea and dedication. Securing funding is the most important, but also most difficult part, of starting a new business. To make it more complex: the funding options available in the UK are as diverse as the startups themselves. Whether you're exploring the bustling tech hubs of London, the thriving innovation centres in Manchester, or the emerging startup scenes in Edinburgh, understanding the types of startup capital available in the UK is difficult.

This guide will cover the different types of startup financing available and where you need to look for it, so you can give your business the best start.

What is startup capital?

Startup capital is the money you need to fund your startup. It’s often used to cover common early-stage expenses, including product development, hiring employees, or investing in marketing.

How do startups get funding?

Different startups will have different funding needs; some will only need hundreds of pounds, some will need hundreds of thousands of pounds. However, startups have the advantage of exploring multiple avenues to secure funding, thanks to the diverse landscape of funding options available. By leveraging these diverse funding options, startups can tailor their funding strategy, tap into various resources, and increase their chances of securing the right capital to fuel their growth.

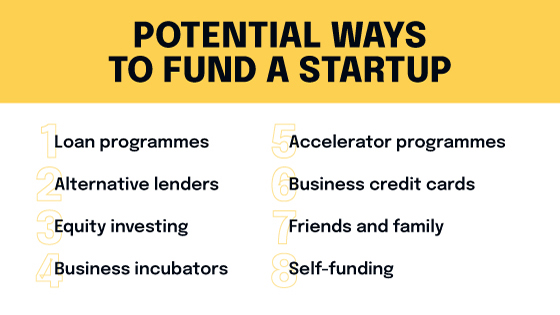

Types of business funding

There are various types of startup funding available, each with its own unique characteristics and requirements. Understanding the different options can help you make informed decisions and choose the most suitable funding approach for your specific needs. From traditional sources such as loans and grants, to newer alternatives like venture capital and crowdfunding, exploring the range allows you to access the financial resources necessary to fuel your startup’s growth and success.

Loan programmes

Loan programmes can vary depending on the lender and the purpose of the loan. They may be designed to serve specific sectors or demographics, such as small businesses, students, or homebuyers. Loan programmes can also be tailored to address particular needs, such as startup funding, education financing, or housing loans. Below are some loan programmes that could be used to get startup funding:

Personal loan

Some personal loans can be used for startup financing. However, it is essential to verify that the lender does not impose any restrictions on using a personal loan for business purposes before applying.

To understand this, carefully review the loan's terms and conditions in advance to understand what you can use it for. If you still have doubts, directly ask the lender, "Can a personal loan be used for a business?" instead of concealing your true intentions.

If lenders discover that a loan was used for a prohibited purpose, they have the right to demand immediate repayment of the borrowed amount and any accrued interest.

Business loan

Business loans provide financial support to businesses by offering a sum of money that needs to be repaid over a specified period.

It’s a common misconception that startups cannot apply for business loans. In fact, you could apply for a business loan to secure the necessary capital for initial operations, growth, or expansion plans. However, it's important to note that lenders may have specific requirements and criteria for startups, such as a solid business plan, collateral, or personal guarantees, as they often consider the startup's risk profile.

There are a few types of business loans you could use to finance your startup:

- Unsecured business loans: Unsecured business loans are a type of startup financing that doesn't require collateral for security. This makes them helpful if your start up needs money but doesn't have assets to use as a guarantee. Unsecured loans are easier and quicker to obtain, and they offer flexible repayment terms.

However, there are some downsides to unsecured loans. They usually come in smaller amounts, typically no more than £25,000. Additionally, if your business is not generating revenue yet, the lender may ask for a personal guarantee, which means they can go after your personal assets if your company fails to repay the loan. - Short-term business loans: You can borrow up to £1 million using short-term business loans, but it needs to be repaid within 12 months. There are different types of short-term business loans available, such as asset financing and invoicing, depending on what your startup requires.

Short-term loans are useful if you need to make an important purchase quickly or when you're facing immediate financial difficulties. However, it's important to know that these loans often have higher interest rates, usually between 5% and 10%. Additionally, they are typically unsecured, meaning you may need to provide a personal guarantee as a form of collateral. - Convertible loans: Convertible loans are a type of short-term debt that can be converted into ownership shares (or ‘equity’) at a later date. They provide an opportunity for lenders to finance high-risk startups with the potential for future profitable ownership.

Conversion usually occurs when the loan recipient successfully raises a certain amount of equity funding, known as a "trigger." Convertible loans are a quicker and more accessible funding option compared to equity fundraising, and they typically do not require interest payments. However, when a convertible loan matures, it takes priority over other forms of debt. - Startup Loan: The government-backed Start Up Loan is an unsecured personal loan of between £500 and £25,000 with a repayment term of up to 5 years, at a fixed interest rate of 6%. As well as the startup capital, successful applicants get business guidance, including business plan support and mentoring.

Applying for a Start Up Loan is free, and in contrast to many other sources, the Start Up Loan typically accepts riskier applicants.

Small business grants

A small-business grant is not the same as a small business loan. Small business grants are non-repayable. As a result, these grants are highly sought after, and typically more challenging to obtain compared to business or startup loans.

Moreover, small business grants are often tailored to particular sectors or geographic locations. Therefore, conducting thorough research is essential to identify the grant that best aligns with your business. One effective method to find small business grants you’re eligible for is by using the UK Government's business funding search tool.

Alternative lenders

An alternative lender is a financial institution or individual that provides loans to businesses or individuals outside of traditional banking channels, such as online lenders, peer-to-peer platforms, and crowdfunding websites.

Peer to peer lending

Peer-to-peer lending, also known as P2P lending, is a type of lending that connects individual borrowers directly with individual lenders, without the involvement of traditional financial institutions such as banks. It is a form of crowdfunding, where individuals or businesses can lend money to other individuals or small businesses through an online platform.

In P2P lending, borrowers apply for loans through an online platform, which then assesses their creditworthiness and assigns a risk grade. The loans are then posted on the platform, and individual lenders can choose to invest in them by contributing small amounts of money. The loans are typically paid back over a fixed period, with interest, and the platform takes a fee for facilitating the transaction.

P2P lending is often seen as an alternative to traditional bank lending, as it can offer borrowers access to credit at a lower cost, and can provide lenders with a potentially higher return on their investment than traditional savings accounts. As P2P funding is typically unsecured, it is easier to be accepted for than traditional lending options, however you’ll often pay a fee to the platform and interest rates can be high.

Crowdfunding

Crowdfunding's popularity has surged in recent years, offering a refreshing alternative for startup capital, with its user-friendly platforms, online communities, and inspiring success stories.

Crowdfunding allows multiple people to invest small amounts of money into your startup, typically through an online platform, such as Crowdcube.

There are two main types of crowdfunding:

- Reward-based crowdfunding: Contributors receive a non-financial reward, such as an exclusive discount, merchandise or free product/service, in exchange for their contribution. For example, if someone contributed funding to a bar or pub, they may receive a free drink upon opening.

- Equity crowdfunding: Equity crowdfunding works in a similar way except, instead of product or service-related perks, contributors receive a small share in your business.

If you're hitting a brick wall trying to secure funds from traditional sources, crowdfunding could be your saviour. Just remember, though, that it's a battlefield out there in the world of crowd-sourced finance, where competition is fierce.

Standing out from the competition in order to raise money this way can be time consuming and expensive. Even if you do this well, there’s no guarantee that you’ll meet your target amount, and will still have to source funds from elsewhere.

So, it might be helpful to think of crowdfunding as a piece of your funding puzzle which complements the other funding sources we've discussed in this guide.

Equity investing

In the context of startups, equity investing refers to the purchase of ownership shares in a company that’s still in the early stages of development. Investors who provide equity funding to startups are often looking for high-growth potential.

Startups typically use equity funding to finance operations, research and development, and other business activities that require significant capital investment.

Angel investor

An angel investor invests in startups or small businesses, usually in exchange for equity ownership or convertible debt. Angel investors are typically high net worth individuals with a strong entrepreneurial background, who are willing to take risks on early-stage ventures with the potential for high returns.

As angel investors are often successful in business themselves, it can be a valuable opportunity for mentorship and support as well as funding.

Additionally, angel investors often invest smaller amounts than venture capitalists, which can make them more accessible to early-stage startups.

However, working with an angel investor can also have drawbacks. For example, angel investors may want a significant degree of control or influence over the direction of the business, which could limit your autonomy.

Angel investors may not always have the same long-term vision for the business as the founder, and may prioritise short-term gains over the company's long-term success.

Venture capital

Venture capital firms collect large sums of money from a combination of wealthy individuals and financial institutions, and invest this into start-ups with high growth potential.

Venture capitalists typically invest larger amounts of money than angel investors, and often take a more active role in the management and decision-making of the company. They often typically require a significant ownership stake in the company, and may also require a seat on the board of directors.

Because of this, many venture capitalists are very particular about the types of startups they add to their portfolio. So, before pitching your startup idea to a venture capitalist, do some research into their previous investments, including what kind of industries and business-types they focus on. Platforms such as FindVC and Crunchbase are a good place to start your research.

Business incubator and accelerator programmes

Business incubators and accelerator programmes are both designed to support and nurture startups, but they have different approaches and objectives.

What is a business incubator?

A business incubator is like a nurturing environment for startups in their early stages. It provides various resources such as office space, mentoring, networking opportunities, and business support. The goal of incubators is to help startups establish a strong foundation, refine their business ideas, and develop their products or services. Incubators focus on long-term growth and sustainability, assisting startups until they become self-sufficient and ready to enter the market.

What is a business accelerator programme?

Accelerator programs, on the other hand, are designed to accelerate the growth of startups that already have a viable business model. These programmes are more intense and have a specific timeframe, usually a few months to a year. Accelerators offer structured guidance, mentorship, and access to industry experts and investors. Their aim is to rapidly propel startups forward, helping them refine strategies, scale operations, and attract funding. The focus of accelerators is on achieving significant growth and market traction within a short period.

In simpler terms, incubators provide long-term support and resources to early-stage startups, helping them grow steadily, while accelerators offer a shorter and intense programme to fast-track the growth and success of startups that have already shown potential.

Business credit cards

Business credit cards are designed specifically for businesses to manage their expenses, streamline financial operations, and build credit. Similar to personal credit cards, business credit cards provide a line of credit that allows businesses to make purchases, cover operational costs, and track expenses conveniently.

However, qualifying for a business credit card usually requires meeting certain eligibility criteria. Many lenders will require the business to have a minimum annual or monthly turnover to demonstrate financial stability. Typically, this turnover requirement ranges from £1,000 to £2,000 per month or £12,000 to £24,000 per year. Unfortunately, these criteria can make it challenging for startups to utilise business credit cards as a source of financing for initial capital.

Despite the difficulty for startups, established businesses with consistent revenue can benefit greatly from business credit cards. They offer several advantages such as providing a flexible and easily accessible source of capital, enabling separate tracking of business expenses, simplifying record-keeping and expense reconciliation, and often offering rewards programmes that provide additional benefits like cashback, travel points, or discounts on specific business-related purchases.

Friends and family

If you haven’t previously owned a business, or you have a few failed attempts behind you, it might be difficult to obtain funding from the more traditional sources above.

If you find yourself in this situation, friends and family could be a good option to secure some startup financing.

People you know personally are likely to be more flexible and forgiving than traditional lenders, and are unlikely to do extensive background or credit checks.

However, there’s always the risk relationships will be strained or damaged when borrowing money from close associates if, for example, you can’t pay them back when you expected to, or if your venture fails and you can’t pay them back at all.

Self-funding

If you’re not sure about traditional funding sources and you’re not keen on borrowing money from friends and family, another option is to fund your startup yourself, or ‘bootstrap’ your startup.

Bootstrapping means using personal funds, such as savings, personal loans, or personal credit cards.

To bootstrap your business, you need to have a solid understanding of your financials and budgeting. It's important to track your expenses and revenue carefully, and to prioritise spending on essential items.

The benefits of bootstrapping include maintaining control over your business and avoiding taking on debt or outside investors. It can be a slow process, but it can also help you build a strong foundation for your business.

How to fund a startup

By following these key steps, you can navigate the funding landscape effectively:

1. Estimate how much you need

The first step is to determine the amount of funding your startup requires. While the exact amount will vary based on your business model, industry, and growth plans, there are several key factors to consider when estimating your funding requirements:

- Startup costs: Identify the initial expenses necessary to get your business off the ground. This includes costs such as market research, product development, equipment, office space, legal fees, licences, and permits.

- Operating expenses: Calculate your ongoing operating costs, including rent and bills, salaries, marketing and advertising, inventory, insurance, and any other expenses necessary to sustain your business for the first few months or years.

- Working capital: Determine the amount of working capital needed to cover day-to-day expenses and maintain sufficient cash flow until your business becomes profitable. This includes considerations such as inventory replenishment, payroll, supplier payments, and other short-term financial obligations.

- Growth and expansion: If your startup has big growth plans, consider the funds you’ll need to scale operations, launch new products or services, enter new markets, or expand your team. Estimate the costs associated with marketing campaigns, hiring additional staff, research and development, or any other initiatives that contribute to your growth strategy.

- Contingencies: It's wise to include a buffer or contingency fund to account for unexpected expenses or potential market fluctuations. This safety net can help you navigate unforeseen challenges or seize opportunities that arise during the early stages of your startup.

2. Write a business plan

Developing a comprehensive business plan is crucial in attracting potential investors or lenders. It outlines your company's mission, target market, products or services, competitive analysis, and financial projections. A well-structured business plan not only helps you clarify your goals but also demonstrates your startup's potential for success to potential funders.

3. Organise your documents

When you're seeking funding for your startup, it's important to gather and organise essential documents that support your funding applications. These documents play a vital role in demonstrating the financial health and credibility of your startup. Here are the key documents you should include:

- Financial statements

- Tax returns

- Legal agreements

- Licences and permits

- Business plan

By organising and presenting these documents clearly, you demonstrate transparency, professionalism, and preparedness. This not only simplifies the funding process but also increases the confidence of lenders or investors in your startup. It improves your chances of securing the funding you need for your startup to grow and succeed.

4. Choose what type of funding is best for you

The wide variety of options available to you have been listed and discussed above. Consider the various funding options and its advantages and drawbacks, then evaluate them carefully to determine the most suitable fit for your startup.

5. Apply and make sure you can pay it back

Once you've identified the appropriate funding source, submit your applications along with all required documents. Be thorough and transparent in your applications to increase your chances of approval. Additionally, consider the repayment terms and obligations associated with the chosen funding option. Ensure that you have a realistic repayment plan in place to honour your financial commitments.

The bottom line

The UK offers a diverse range of funding options to startups, each with its own unique characteristics and requirements. By understanding the various types of startup financing available, such as loans, grants, crowdfunding, equity investment, and business incubators, you can tailor your funding strategy to meet your specific needs.

Launching a startup in the UK requires perseverance, adaptability, and a thorough understanding of the funding options available. By leveraging the resources and knowledge provided in this guide, you can increase your chances of successfully obtaining the funding you need to bring your brilliant idea to life and propel your business towards long-term success.

This does not constitute financial advice. If you want to understand your startup finance options in detail, you should speak to your financial advisor or accountant.

If you’re looking to grow your small business in a flexible, affordable way, a business credit card from Capital On Tap could be the answer with limits up to £250,000, uncapped 1% cashback on all spend, and £0 in fees.