Jump to a section

As a business owner, it's important to be aware of the risk of scams. Scammers are constantly looking for new ways to target businesses, and they are becoming increasingly sophisticated. While it's impossible to completely eliminate the risk of being scammed, there are several things you can do to protect your business.

What is scamming?

Scamming is when someone tries to deceive you, in order to take your money or personal information. There are a variety of ways that scammers can operate, but some common methods include phishing, impersonating a government official, or promising a free gift in exchange for your contact information.

Popular business scamming methods

Sometimes it can feel like there's a new story every day about someone being scammed out of their hard-earned money. Businesses large and small are targets for scammers, who often use sophisticated methods to trick their victims. Here are just a few of the most popular business scamming methods.

Online phishing attacks

Phishing is a type of scam where the attacker sends an email that looks like it's from a legitimate company, in an attempt to get the victim to share personal or financial information. This information can then be used to steal the victim's identity or access their bank account.

Ransomware attacks

Ransomware is malware (malicious software) which prevents you from accessing your computer or data by encrypting your files. The attacker then threatens to publish the data unless the victim pays a ransom fee to them, usually with a deadline.

Fake invoices and cheques

This is a type of business email scam in which the perpetrator attempts to trick the victim into paying for goods or services that don't exist. The scammer usually sends an email with a fake invoice or bill, often for a large amount of money, and includes instructions on how to pay.

The payment is usually requested via wire transfer. Once the victim sends the money, it's almost impossible to get it back. This type of fraud is becoming more and more common, so it's important to be aware of the danger. If you receive an unexpected invoice or bill via email, always contact the sender to confirm its authenticity before sending any money.

Unordered supplies

Unordered supplies fraud is a type of fraud in which an individual orders supplies, such as office supplies or computer equipment, from a company and then refuses to pay for them. This type of fraud can be difficult to detect because the individual may use a legitimate credit card or shipping information.

Unordered supplies fraud can be costly for businesses, as they will be responsible for the cost of the merchandise as well as any shipping and handling charges. To prevent this type of fraud, businesses should verify all orders before they are shipped and require a signature for all deliveries. Additionally, businesses should keep track of their inventory and reconcile it with their records on a regular basis.

Advertising scams

Advertising scams are false or misleading advertisements that aim to take advantage of consumers. They come in many different forms, from false promises of free products to fake reviews and testimonials.

In some cases, scammers will even create entire websites and social media accounts dedicated to promoting their fraudulent products. Whatever their form, advertising scams are designed to trick people into buying something that they wouldn’t otherwise.

Utility company and government agency imposters

This is where someone pretends to be from a utility company or government agency in order to try to trick you into giving them money or personal information. Utility company imposters will typically try to say that you owe money for unpaid bills, and they may threaten to cut off your service if you don't pay.

Government agency imposters, on the other hand, may claim that you need to pay a fine or fee in order to avoid being arrested. They may also try to get you to give them personal information like your bank account information.

How to protect small business from scams

As a small business owner, you are vulnerable to scams that can cost you time and money. By taking these precautions, you can help protect your small business from being taken advantage of.

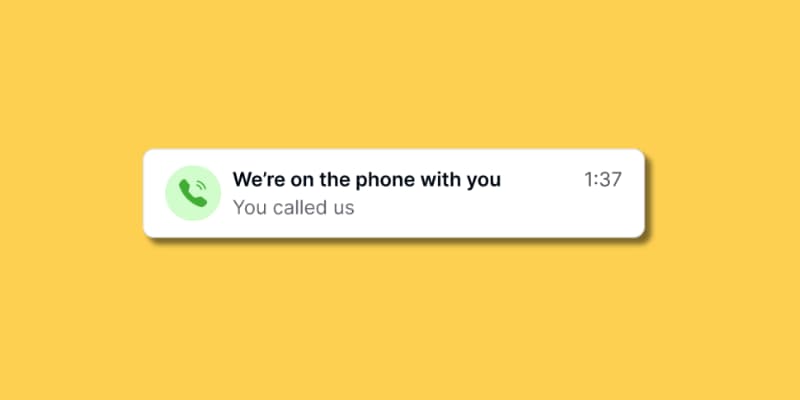

For calls claiming to be from Capital on Tap, you can quickly verify the caller by opening your Capital on Tap mobile app:

- You should see a banner indicating an active call is in progress if it's really us calling

- If no banner appears, go to App Settings > Security and check your "Active Call Status"

- If there is no active call listed, hang up immediately - it is a fraudulent caller”

Be wary of what information you provide over the phone

With so much of our lives taking place online, we often need to input our financial details into various websites and apps. However, this information can be easily accessed by scammers if it falls into the wrong hands.

One way to protect yourself is to be cautious about who you give your account information to over the phone. If you receive a call from someone claiming to be from your bank or another institution, do not give out any sensitive information unless you are certain that the call is legitimate.

You can verify the caller's identity by asking for their name and calling back the organisation's customer service line to confirm that they are who they say they are.

Our Capital on Tap customer support team will never ask you for:

- Your full card number

- CVV (the number on the back of your card)

- One-time passcode sent by SMS

- Your account password

Don’t share your account information

Your account information helps to keep your account safe and secure. Make sure to choose strong passwords for your accounts and be wary not to share them with anyone.

Keep your card details private and if your card is lost or stolen, alert your bank or credit card company straight away.

Protect your bank accounts

It's no secret that scammers are constantly looking for ways to steal people's money. One of the most popular methods is to target people's bank accounts. One way to protect yourself from this type of scam is to keep your personal and business accounts separate. That way, if your business account is ever compromised, your personal finances will remain safe.

Additionally, you should make sure to use different passwords for each of your accounts. That way, even if a hacker does manage to get access to one of your accounts, they won't be able to automatically gain access to your other accounts as well. By taking these simple precautions, you can help keep your bank accounts safe from scams.

Do employee background checks

This will help you to verify their identity and ensure that they don't have a history of criminal activity. Background checks can also help you to avoid hiring someone who is likely to engage in fraudulent activities. For example, if an applicant has a history of financial crimes, you may want to reconsider hiring them.

Safeguard your computer systems

Make sure you have anti-virus and anti-spyware software installed, as well as keeping your operating system and browser up to date. Hackers often exploit known vulnerabilities in outdated software to gain access to computers, so it is important to install security updates as soon as they are released.

Securely destroy all confidential and sensitive business information

It’s common knowledge that confidential and sensitive information must be handled with care. Whether it's customer data, financial records, or proprietary information, a single data breach can cause serious damage to both your reputation and your bottom line.

That's why it's so important to take steps to securely destroy all confidential and sensitive business information. There are a number of methods you can use to do this, from shredding documents to wiping digital devices. But no matter which method you choose, it's important to make sure that the information is completely unreadable before being disposed of.

Otherwise, you could be putting your business at risk of a costly scam.

Don’t transfer funds or make payments on behalf of others

This includes family members, friends, and even businesses. It can be very difficult to get your money back if the recipient turns out to be a scammer. If you are ever asked to do this, it's best to just say no.

Also, be sure to keep an eye out for red flags that may indicate a scam, such as unexpected requests for money, pressure to act quickly, or promises of easy money.

We’ll never ask you to make a transfer or payment using your Capital on Tap card. If you have suspicions about a transaction, it’s best to pause, sense check the request and only proceed if you’re happy it’s legitimate. If something doesn't feel right, it's probably best to just walk away.

Check your account regularly

By checking your account regularly, you can catch any suspicious activity before it gets out of hand. Keep an eye out for unusual charges, unexpected withdrawals, or strange patterns of behaviour. If you see anything that looks suspicious, don't hesitate to contact your bank or credit card company. They'll be able to help you figure out what's going on and how to protect yourself.

By logging into your Capital on Tap account online or in the app, it’s easy to check your statements and spend activity. You can also enable spend alerts which notify you each time your card is used.

If you’re unsure about a transaction and can’t link it to a purchase you’ve made after searching the merchant online or comparing the dates and amounts to your recent purchases, call us on 0208 962 7401.

Consider using a mobile wallet

Digital wallets offer an extra layer of security through fingerprint authentication or facial recognition. It also means your card details are not stored or shared with merchants. In addition, most digital wallets offer built-in fraud protection features, such as encryption and transaction activity monitoring.

You can add your Capital on Tap physical or virtual card to your digital wallet at any time.

Educate your employees about fraud and scamming

Employees are often the first line of defence against fraudsters, and they can be instrumental in spotting and reporting suspicious activity. Furthermore, employees who are aware of the risks of fraud and scams are less likely to become victims themselves. In the event that an employee does fall victim to a scam, they will be more likely to report it to you quickly, allowing you to take swift action to mitigate any damage.

Sign up to the government’s PROOF scheme

Companies House sees between 50-100 incidents of corporate identity theft every month, where a scammer has infiltrated by changing the details of the company’s directors and registered office.

The protected online filing scheme (PROOF) is a free service that can protect your business from unauthorised changes to your records. It works by preventing the filing of certain paper forms, including:

- Changes to your registered office address

- Changes to your officers (appointments, resignations, or personal details)

- Changes to your company name by special resolution

Get insurance

A scam can cost a business thousands, and in some cases, the loss may be even greater. In addition to the financial costs, a scam can also damage a business's reputation and leave it vulnerable to legal action. Business insurance can help to reimburse a business for any losses incurred as a result of a scam, as well as cover the costs of legal defence. While no amount of money can make up for the damage caused by a scam, having insurance can help to minimise the financial impact.

How to spot scammers

Here are a few red flags to watch out for if you think someone might be trying to scam your business:

- They're asking for personal information or financial details right away.

- They're pressuring you to make a decision quickly.

- They're offering a "too good to be true" deal.

- They're using high-pressure tactics or threats.

- They're being evasive or vague when you ask questions.

- They refuse to provide references or give you any way to verify their claims.

- Something just doesn't feel right - trust your gut!

If you see any of these warning signs, it's best to step away and do some more research before proceeding. It's better to be safe than sorry when it comes to protecting your business from scammers.

What to do when a company scams you

Contact your financial institutions

Contact your bank or credit card company immediately and let them know what happened. They will be able to freeze any affected accounts and may be able to cancel any unauthorised transactions. They might also be able to offer help and advice on how you can protect your account in the future.

Many companies, including Capital on Tap, offer the ability to freeze cards by logging into your account, meaning you can act quickly if you’re concerned.

Report to the authorities

This can help to track down the scammer and prevent others from becoming victims.

Action Fraud is the national fraud and cyber crime reporting centre for the police. If your details have been used without your consent, or you suspect fraudulent activity, report it to Action Fraud or call 0300 123 2040. If you can’t hear or speak on the phone, you can type what you want to say using Relay UK: 18001 then 0300 123 2050.

If you receive a suspicious email, forward it to report@phishing.gov.uk. and then delete it. Do not try to view any attachments contained in the email.

If you’re a Capital on Tap customer

If you think you’ve been scammed, contact us immediately by calling 020 8962 7401.

You can also freeze your own card and any of your company cardholders, by simply logging into your account and heading to the ‘Cards’ page.

Frequently Asked Questions

What’s 2 factor authentication (2FA)?

2FA is a security feature designed to keep your account and devices secure. You will often have to complete 2FA when logging into an account or device, after entering your password. A code will be sent to your device that you’ll be asked to enter to confirm your identity.

It’s a good idea to have 2FA enabled for your phone and email accounts - this makes it harder for fraudsters to gain access to your devices and accounts. Do not share these codes with anyone. They can be used to access your accounts and make transactions.

Received a one-time passcode but haven’t used your account?

This could be somebody trying to gain access to your account without your consent. Please contact us immediately on 020 8962 7401 and freeze your card in your account. Do not share this passcode with anyone, even if they claim to be from Capital on Tap.

How to track down a scammer?

The safest course of action is to report it to the relevant authorities mentioned earlier. They will be better equipped to track the scammer down and prevent others from falling victim.