Jump to a section

If you lose your business credit card or it gets stolen, someone could use it to spend a lot of money. Similarly, employees who abuse their business credit cards for non-business purposes can rack up a big bill. Luckily, your business credit card will often come with some form of protection to help you recover any losses due to fraud, stolen or misuse of credit cards.

How Capital on Tap protects your business

Having robust protection measures in place is non-negotiable for small business owners. Let's take a closer look at how we keep your business credit card safe and sound.

Card purchase protection

With your Capital on Tap Business Credit Card, you're covered if:

-

An item doesn't show up, but you've paid for it.

-

The item arrives damaged, and the company won't sort it out.

-

Your purchase is not what you expected, or it doesn't work right.

-

The company goes bust before delivering what you paid for.

-

An event you planned gets cancelled after you've already paid for travel and accommodation.

Just contact our 24/7 Customer Service Team to let them know, and we’ll investigate this for you with the merchant.

Visa's Zero Liability Policy

Capital on Tap is a Visa scheme participant, meaning you’re protected by Visa’s Zero Liability Policy — a guarantee that you won’t be held responsible for unauthorised or fraudulent payments made with your account or account information, online or offline. You can learn more about this policy, including its exceptions, on the Visa Zero Liability Policy page.

Dispute card transactions

If you spot a charge on your card that you didn't make, contact our 24/7 Customer Service Team via phone, email or online chat.

We'll look into it and temporarily credit your account for the disputed amount to keep you financially secure during the investigation. If your dispute is successful, we’ll also waive any interest and finance charges accrued as a result.

Fraud protection

Nobody likes dealing with fraud. But if it happens, our fraud protection kicks in. The first time you raise a fraudulent transaction to us, we’ll refund that transaction and you won't be held responsible for any fraudulent charges. We’ll also refund you if any honest mistakes happen that lead to fraud on your account.

Now, just so we're clear, there are some cases where our refund guarantee doesn't apply. If you're involved in the fraud, we can't repay the losses. But for everything else, we're here to help keep your money safe.

We’ll do all we can to help you, but make sure you’re doing all you can to protect yourself! Check out our blog on protecting your business from credit card fraud to learn more.

Freeze cards instantly

If your card is lost or stolen, freeze it instantly using our mobile app or online portal. Get a new physical card within 3 business days and, in the meantime, keep the ball rolling with a virtual card.

Data protection

Your privacy matters. Check out our Privacy Policy to see how we keep your data secure at all times.

Spend limits and alerts

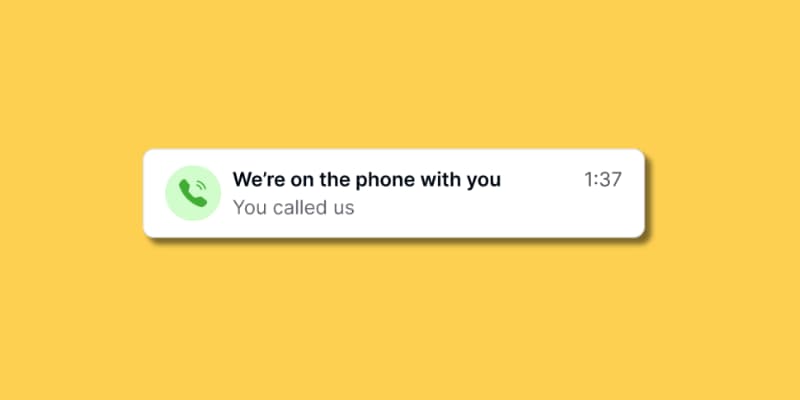

We make it easy to keep an eye on your transactions. Receive real-time notifications tailored to your chosen spend threshold to keep you informed anytime, anywhere.

Set personalised spending limits for transactions and total spend for you and your employees.

Virtual cards

Maximise your business’ financial security with virtual cards. Create virtual cards instantly with your Capital on Tap account, making urgent payments hassle-free, even before your physical card arrives.

Each virtual card you create has its own custom card number, expiration date, and security code that can be created or deleted easily and at any time. So, if you make a purchase with your virtual card but something doesn’t feel quite right, simply cancel your card and generate a new one instantly. You won’t have to worry about your card information getting in the hands of the wrong people, and won’t suffer a delay in access to your funds.

The bottom line

From card purchase protection and Visa's Zero Liability Policy to 24/7 dispute resolution and fraud protection, your Capital on Tap Business Credit Card has got you covered. Freeze lost or stolen cards instantly, and utilise virtual cards for added flexibility and security. Our commitment to data protection, spend limits, and real-time alerts ensures your peace of mind. Trust Capital on Tap to keep your business credit cards safe, allowing you to focus on your business' success.